Mongolia’s economic growth is fueled by mining, yet equitable revenue distribution remains a significant challenge.

Mongolia’s mining sector plays a dominant role in the economy, yet it has struggled to ensure equitable distribution of resource wealth. While rapid mining development has fueled high economic growth, the World Bank classifies Mongolia as a country with relatively low poverty levels, low-income inequality, and strong economic expansion.

However, concerns remain over over-reliance on mining revenues and ineffective allocation of wealth. According to the World Bank, despite Mongolia’s rapid economic growth, the gap between rich and poor remains a key risk, alongside the potential for deepening inequality due to the country’s dependence on the mining industry.

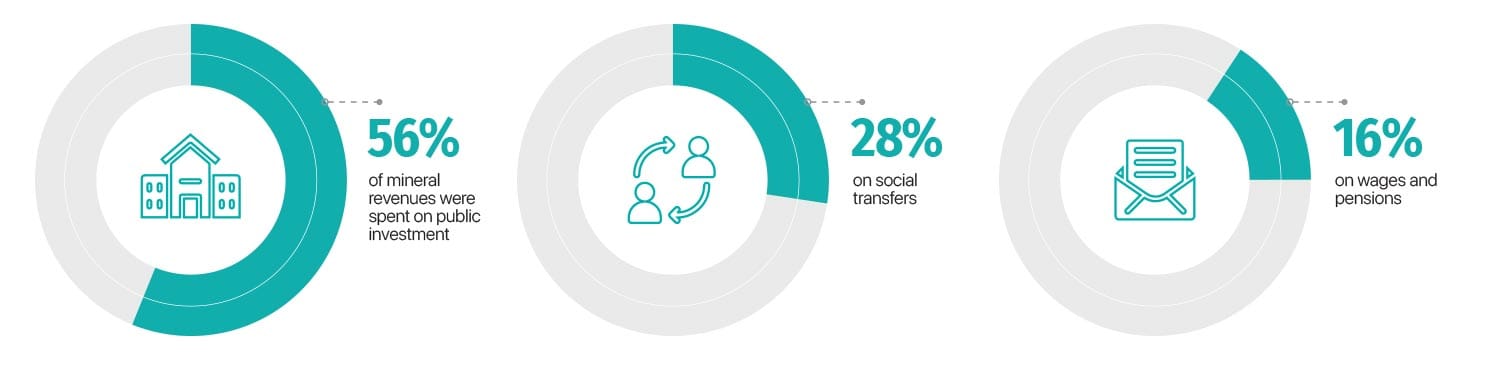

Over the past 20 years, 99 cents of every dollar generated from Mongolia’s mineral wealth has been spent, while only 1 cent has been saved through the Stabilization Fund and Future Heritage Fund. Systematic savings from mining revenues only began in 2011, highlighting the challenges of long-term wealth preservation and fiscal sustainability.

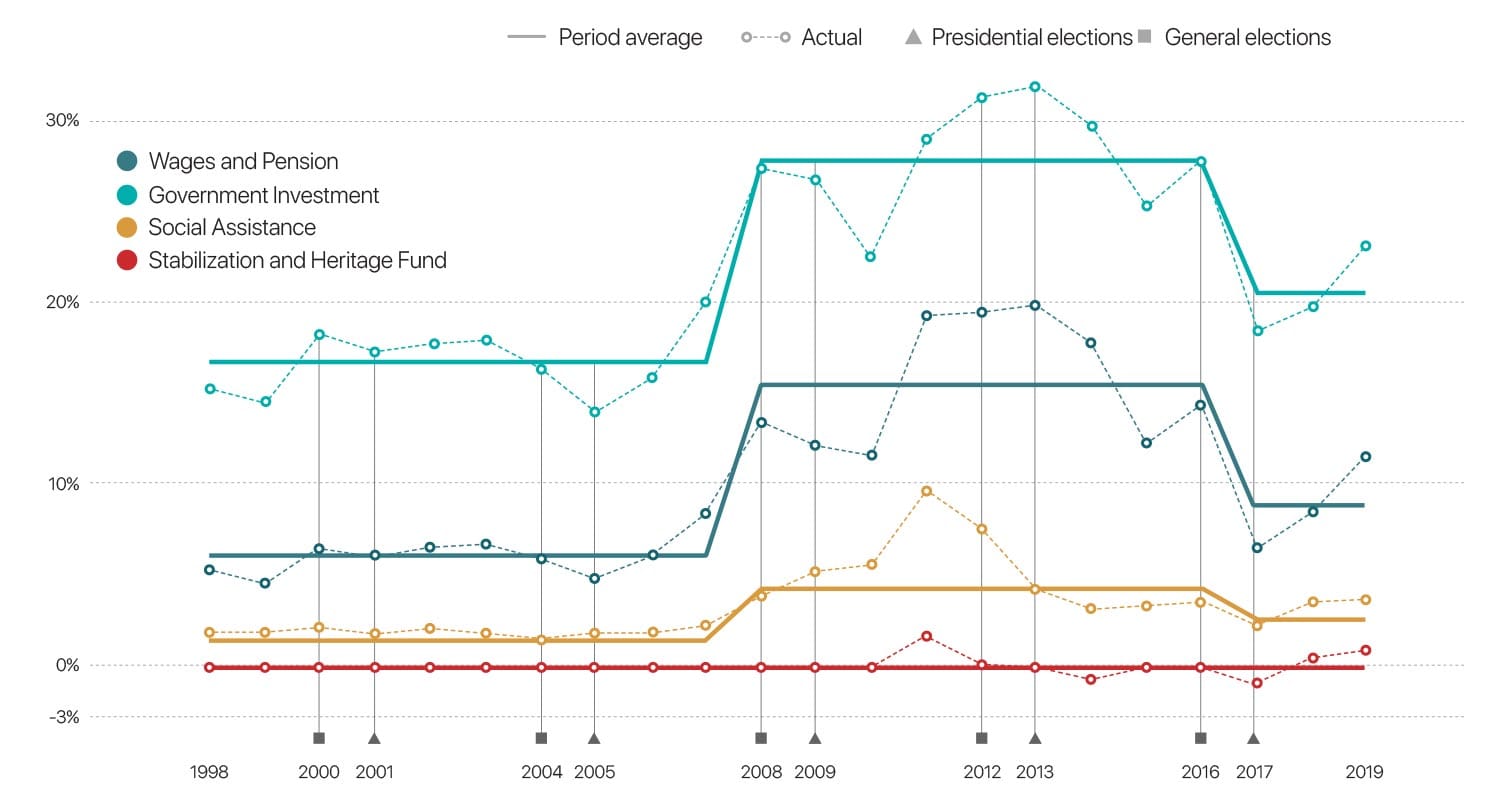

Explained by Political Convenience

Source: The World Bank

How mineral revenues were allocated (as % of GDP)

The use of mineral revenue was mostly determined by political convenience, not economic merit.

Source: World Bank, 2020

National Wealth Fund of Mongolia

In April 2024, Mongolia’s Parliament passed the National Wealth Fund Law, establishing a structured framework for managing revenues from the country’s natural resources. The fund consists of three specialized funds, each serving a distinct purpose: Future Heritage Fund, Accumulation Fund, and Development Fund. These funds are designed to accumulate, invest, and distribute national wealth derived from Mongolia’s mineral resources.

Three Key Components of Mongolia’s National Wealth Fund:

- 1. Future Heritage Fund – A savings fund focused on accumulating resource wealth for future generations. The fund’s assets will be invested in global financial instruments to grow in value over time.

- 2. Accumulation Fund – A newly introduced mechanism designed to distribute resource revenues directly to Mongolian citizens. The funds will be used to support healthcare, education, and housing. Every citizen will have a personal accumulation account.

- 3. Development Fund – A fund dedicated to financing large-scale development projects that drive Mongolia’s economic growth.

Following international sovereign wealth fund models, Mongolia has structured its National Wealth Fund into these three distinct categories to ensure clear and effective resource management. While the Future Heritage Fund and Development Fund have already been active, the Accumulation Fund introduces a new concept aimed at direct citizen benefit.

Under this policy, dividends from up to 34% of the government’s share in strategic mineral deposits will be distributed to individuals through the Accumulation Fund.

Amendments to the Minerals Law & Resource Ownership

The Accumulation Fund will be financed through dividends from the state’s 34% ownership share in mining companies operating in Mongolia. In addition, key amendments to the Minerals Law have been introduced to strengthen the government’s stake in strategic mineral assets:

- If a strategic deposit (including associated secondary deposits) was discovered through state-funded exploration, the government is entitled to up to 50% ownership free of charge when partnering with private entities for development.

- If a strategic deposit was discovered through private investment, the government is entitled to up to 34% ownership free of charge.

This new National Wealth Fund framework represents a transformational shift in Mongolia’s natural resource governance, aiming to balance long-term savings, economic development, and direct financial benefits for citizens.