The Mongolian government has initiatives in place to welcome foreign investment and in general, Mongolian law prohibits any discrimination against foreign investors. This is in line with the Mongolian government’s efforts to support economic growth by ratifying a new investment law effective in 2013.

This Investment Law aims to protect the legitimate rights and interests of investors within the territory of Mongolia, to establish common legal guarantees for investors, to support investment, provide a stable tax regime, to determine the powers of the state organizations, and to set the rights and obligations of the investor and regulate other relations concerning investments. This law applies to both foreign and domestic investors. The 2013 Investment Law of Mongolia does not carry any specific requirement for foreign investors to have a Mongolian joint venture partner in country. In other words, businesses may be 100% foreign-owned and operated.

The Mongolian government has initiatives in place to welcome foreign investment and in general, Mongolian law prohibits any discrimination against foreign investors. This is in line with the Mongolian government’s efforts to support economic growth by ratifying a new investment law effective in 2013.

This Investment Law aims to protect the legitimate rights and interests of investors within the territory of Mongolia, to establish common legal guarantees for investors, to support investment, provide a stable tax regime, to determine the powers of the state organizations, and to set the rights and obligations of the investor and regulate other relations concerning investments. This law applies to both foreign and domestic investors. The 2013 Investment Law of Mongolia does not carry any specific requirement for foreign investors to have a Mongolian joint venture partner in country. In other words, businesses may be 100% foreign-owned and operated.

Corporate forms

Mongolian legal business structures reflect those in many other parts of the world and the reader may already be familiar with these. This section provides a recap for those who many may not as familiar, and we emphasize any potential differences that apply specifically to Mongolia if a foreign investor wants to operate in the country.

Mongolian legislation provides for a wide range of legal forms of commercial entities including a limited liability company or LLC, joint-stock company or JSC and joint venture. However, in practice, private businessmen and foreign investors mostly prefer with a limited liability company. Representative office of foreign legal entities is also common.

Limited Liability Company (LLC) with a foreign investment

LLCs are the most commonly used forms of legal entity in Mongolia, established by one or more individuals or legal entities.

According to the Mongolian law, a foreign invested company is defined as “a business entity with an overall equity of $100,000 or more, not less than 25% of which must be owned by (a) foreign investor(s)”.

If two or more investors are about to incorporate a foreign invested LLC in Mongolia, each investor must invest $100,000 or MNT equivalent.

The law may provide for higher share capital requirement for certain fields of activity such as banking and insurance.

Joint-stock companies (JSC)

There are two types of joint-stock company: open and closed.

An open JSC is a company whose capital invested by the shareholders is divided into shares, which are registered at the securities trading organization such as the Mongolian Stock Exchange. The shares are freely traded without regard to pre-emption rights of the shareholders. An open JSC may have an unlimited number of shareholders.

A closed JSC is a company whose capital invested by the shareholders is divided into shares, which are registered at the securities depositing organization, and which are traded in the market in a closed extent outside of the securities trading organization.

Representative office

A representative office of a legal entity does not have the status of a legal entity. It is not entitled to conduct business activity. That is why the representative offices’ activities in Mongolia are practically limited to few activities such as business development, representation of the head office interests, marketing, and research.

Establishing process:

1. Apply for certificate of Representative at GASR

List of required documents: http://burtgel.gov.mn

Online register: http://e-mongolia.mn

2. Obtain the company seal

Obtainable within 2 hours at Seal producing company

Liquidation and bankruptcy

A company can only be voluntarily liquidated if it is solvent, and all debts can be paid. In the event of the voluntarily liquidation, company’s shareholders must issue a resolution and appoint a liquidation committee. The company must notify the Legal Entities Registration Office within 15 days from the date the resolution is approved. The process generally takes at least 12 months or more and requires a final tax inspection.

Investment types

According to the Law on Investment, investments into Mongolia can be made in the following ways:

- Through the establishment of a solely or jointly-owned business entity.

- Through the purchase of Mongolian companies’ shares, bonds, and other types of securities

- Through a merger with a Mongolian company or an acquisition of a Mongolian company by a foreign company.

- Through a franchise or financial leasing agreement.

- And by other forms acceptable, which are not prohibited by law.

Establishment of a solely-owned or jointly-owned business entity:

Please refer to the section that describes the corporate forms that may be set up in Mongolia.

The purchase of shares, bonds, and other types of securities in Mongolian companies.

According to the Company Law of Mongolia, one third or higher common shares of a company is considered a controlling stake.

If a controlling stake is purchased through a stock exchange, the buyer “shall initiate a bidding process to request other shareholders and shall notify the Financial Regulatory Commission for a decision” as required under the Securities Law.

Unless the law states otherwise, shareholders of a joint-stock company have the right to trade their shares, regardless of the opinions of other shareholders.

As for LLCs, the rights for shareholders to trade their shares is limited to a certain degree and the decisions of other shareholders shall be mandatory before selling the stakes to a third party.

Mergers & Acquisition

There are two types of corporate mergers, as specified in Mongolian Company Law: “acquisition” and “merger”.

In terms of process, the Company Law of Mongolia makes no distinction between mergers and acquisition (M&A). The decision on M&A has to be approved by the votes of simple majority of shareholders with voting rights to be effective.

At the same time, the term “acquisition” carries more significance in the acquiring company has the right to obtain the special rights, licenses, and the previous operations of the acquiring company. Therefore, an acquisition can be viewed as a common time and cost-saving method when an overseas company is considering the establishment of a new company.

Financial Leasing:

Mongolia’s Financial Leasing Law came into effect in 2006 and some minor amendments in this law were made in 2018.

The financial leasing sector is not regulated by any state entity. According to the current legislative environment, only banks, as well as savings and credit cooperatives are able to engage in financial leasing activities. However, this activity is not tightly regulated and special licensing is not required to engage in financial leasing activities.

An ad hoc approach has been taken to the financial leasing sector due to the sector’s unregulated state. However, according to the latest study completed by XacLeasing LLC in 2016, the domestic leasing sector was estimated to be MNT 410.9b ($119.3m) (in what year), which is about 60% larger than the MNT256b ($74.3m) of the savings and credit cooperative sector in 2020.

Franchising

Article 29 of the Civil Code of Mongolia approved in 2002 includes regulations on franchising agreements. However, the law does not specify much about franchising agreements as only a few provisions regulate these agreements.

The number of private entities providing products and services using foreign trademarks and trade names in the Mongolian market has been steadily growing in recent years. MCS HOLDINGS was the first to operate franchising operations in Mongolia by winning a COCA COLA franchise in 2001. Since then, franchising businesses have been growing rapidly in the food and retail sectors across the country.

“Premium Group” of Mongolia obtained the franchising rights of South Korea’s largest retail network “CU” in 2018. Since then, the company opened more than 140 franchises in Mongolia within three years.

Required permits & registration for foreign investors

The Law on Investment provides discrimination-free equal rights to both local and foreign investors. There are a small number of specific regulations related to foreign investors and legal entities. These include:

As stated on the Law on Investment:

1. A foreign investor is defined as “a business entity with an overall equity of $100,000 or more, not less than 25% of which must be owned by (a) foreign investor(s)”.

In the same way that applies to Mongolian investors, foreign investors must be registered at the General Authority for State Registration Registering. Applicants receive the required materials electronically and must submit a completed form via email. The General Authority for State Registration reviews the application form and confirms it within two days.

Materials required for registration

After obtaining permission from the General Authority for State Registration, the company must then be registered at with the local tax authority. When considering employing people, another registration is required at the State Social Insurance General Office.

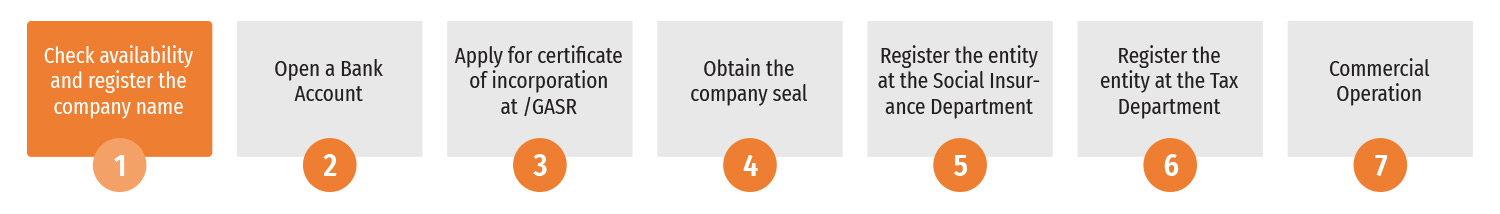

Incorporating a company in Mongolia: key steps

Below are key steps of incorporation a new company in Mongolia:

The World Bank’s “Doing Business in Mongolia” report highlighted that the business registration process in Mongolia is adequately straightforward for overseas investors. In other words, the business registration process is “easy and convenient.”

Please read the “Setting Up a Business in Mongolia” section for further information on starting a business in Mongolia.

2. A foreign government-owned legal entity holding 33% or more of the total shares issued by the legal entities of Mongolia deal with any business in the following sectors must obtain permission from the state central administrative body in charge of investment affairs:

“A foreign state-owned legal entity” means a legal entity in which 50% or more of shares are directly and/or indirectly owned by a foreign country’s government.

3. Unlike Mongolian investors, overseas nationals and entities do not have the right to possess a plot of land and only Mongolian citizens are granted land ownership rights. However, foreign investors may obtain use rights for the underlying land, these rights last for five years with a one-time, five-year renewal. The government imposes no such restriction on its nationals. Also, overseas nationals with permission to use land are not allowed to use the land itself commercially, to sell it, or to trade it to a third party. Foreign countries and international organizations are allowed to rent or use a plot of land with a concession agreement, in which case a Parliamentary decision would be required and the Mongolian Government should explicitly lay out the land’s boundary and terms of use.