Inflation

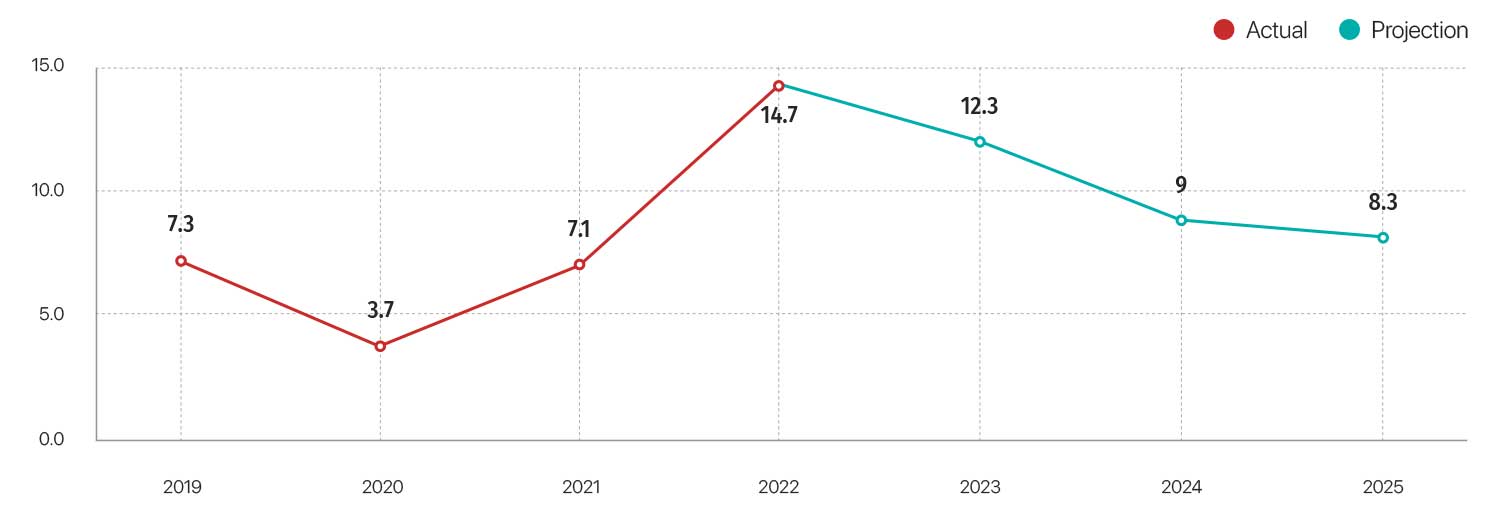

The Bank of Mongolia has been working to stabilize inflation growth in 2021-2023 at around 6% per annum and in the range of +/- 2 percentage points. At the end of 2022, inflation reached 13.2%, well above the central bank’s target. It is likely to remain high over the coming quarters.

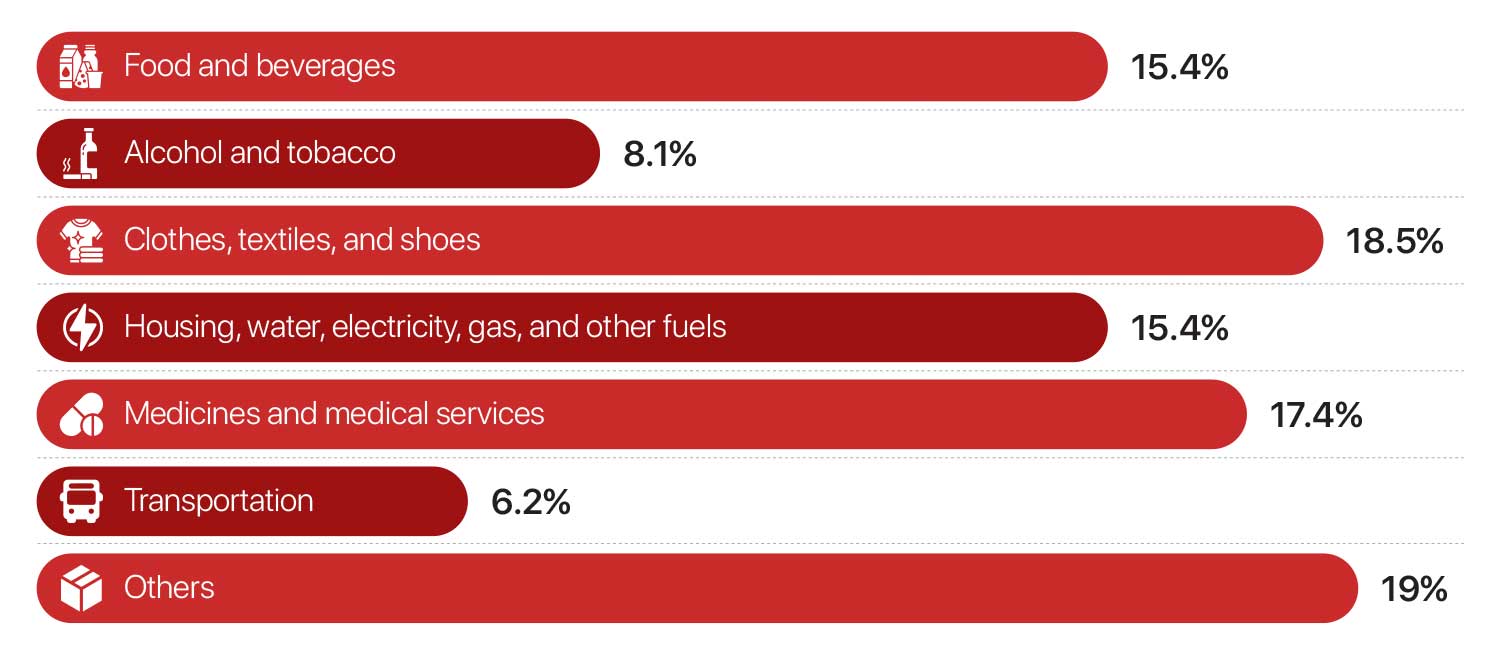

Drivers of consumer price index increase (by sector)

Drivers of consumer price index increase (by sector)

Source: NSO

The largest contributor to inflation has been the increase in the price of imported goods.

Until recently, Mongolia’s inflation was driven by supply-side and global factors, such as high international prices, a decline in domestic meat production, and supply disruptions related to China’s border restrictions and sanctions against Russia, according to the International Monetary Fund.

However, China’s easing of its Covid-Zero policy and opening of its border are positive signs for Mongolia’s economy, which is expected to reduce custom delays and have a positive impact on the price of imported products.

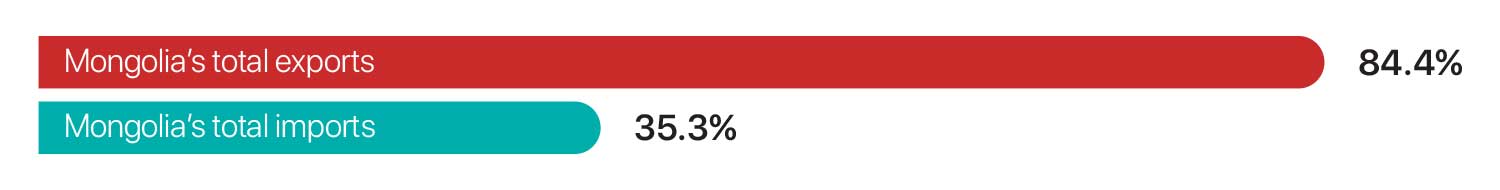

Mongolia-China trade in 2022 (by percentage)

Source: NSO

In addition to the high risk of inflation caused by the increase in prices in the global supply chain, the ongoing conflict in Ukraine and the continued depreciation of Mongolia’s currency, the tugrik (MNT), remain risks.

To stabilize inflation expectations and target levels in the medium term, the Central Bank of Mongolia increased the interest rate to 13 percent in December 2022.

Inflation, annual percentage change

Source: IMF, October 2022

The IMF suggested that to reduce inflation, quasi-fiscal operations should be quickly phased out and the government of Mongolia should support the Bank of Mongolia’s effort to contain inflation.

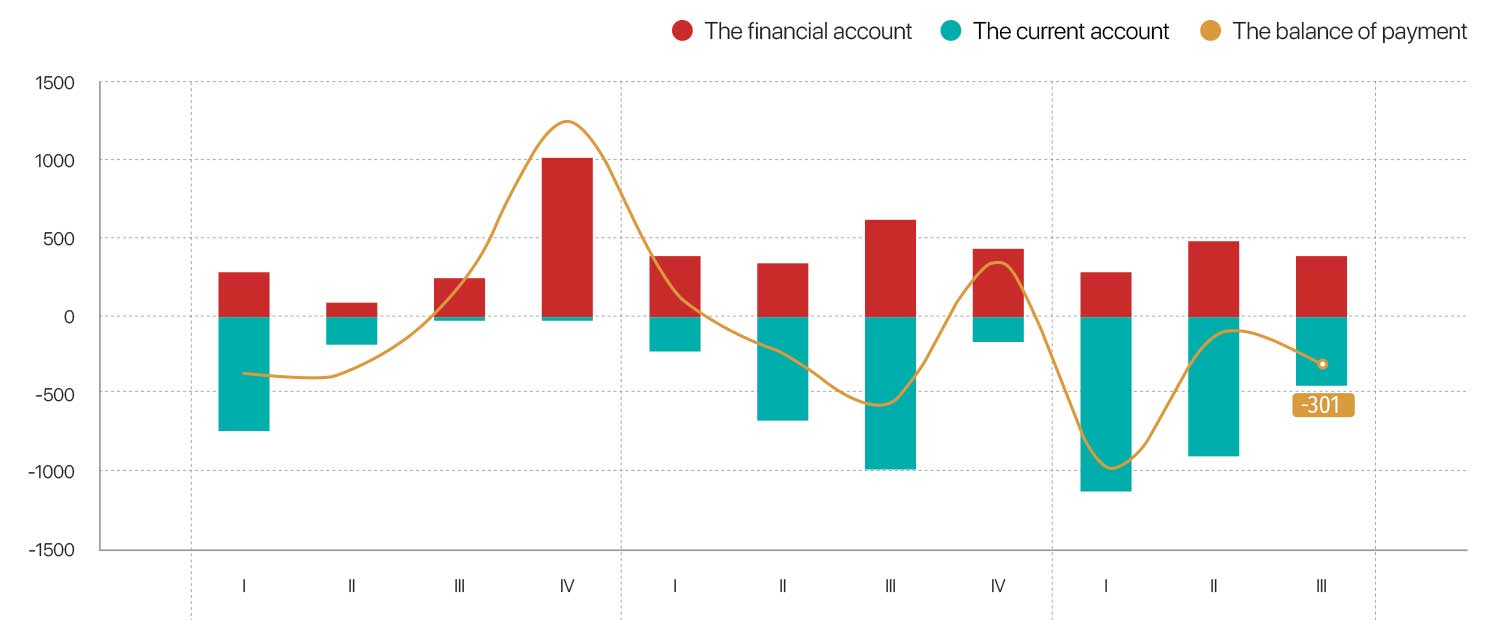

Foreign exchange rate risk

The impact of China’s “Zero Covid” policy on Mongolia’s mining export volume resulted in a slowdown in the first half of 2022 and contributed to a balance of payments deficit due to increased transportation costs, posing a risk to the exchange rate. However, exports increased in the second half of 2022, leading to a positive trade balance.

Despite this improvement, a significant bond repayment was made at the end of 2022, the Ministry of Finance reported a projected balance of payments deficit of $1 billion by the end of the year.

The balance of payment is the method countries use to monitor all international monetary transactions at a specific period.

The balance of payment, USD million

Source: NSO, Ministry of Finance

The foreign exchange reserves shrank in the mid-year due to the Bank of Mongolia’s significant intervention to prevent a sharp decline of the tugrik against the USD. Regardless, the foreign exchange reserves improved towards the end of the year as export revenue started to recover.

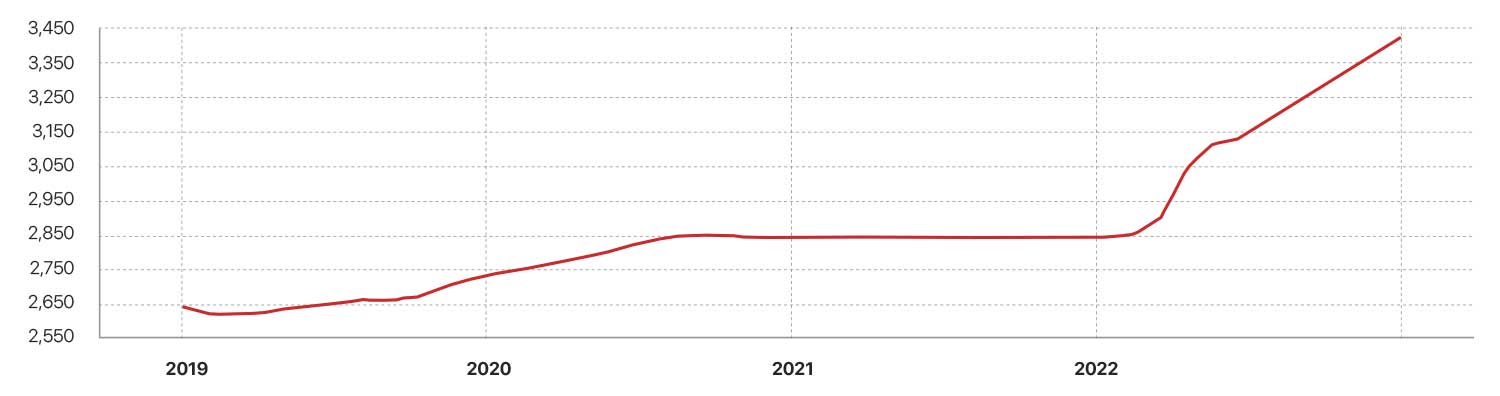

Foreign currency reserve, in US$ million

Source: Mongolbank

Although foreign exchange inflows are improving, the overall risk remains as MNT continues to depreciate against the USD and CNY.

Exchange rate between the US dollar and the Mongolian tugrik

Source: Mongolbank

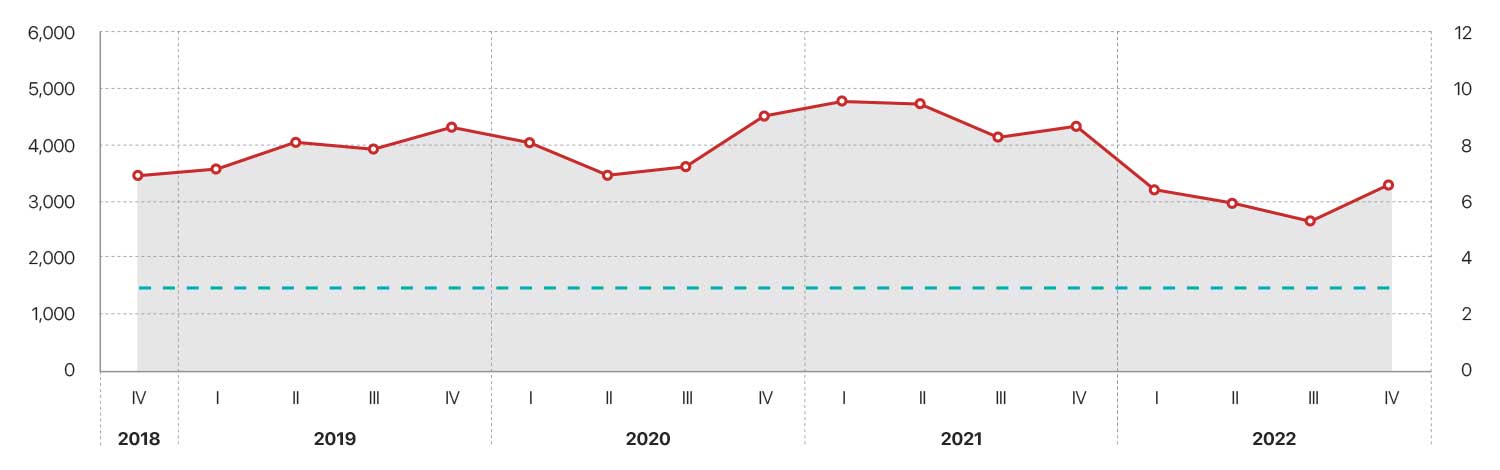

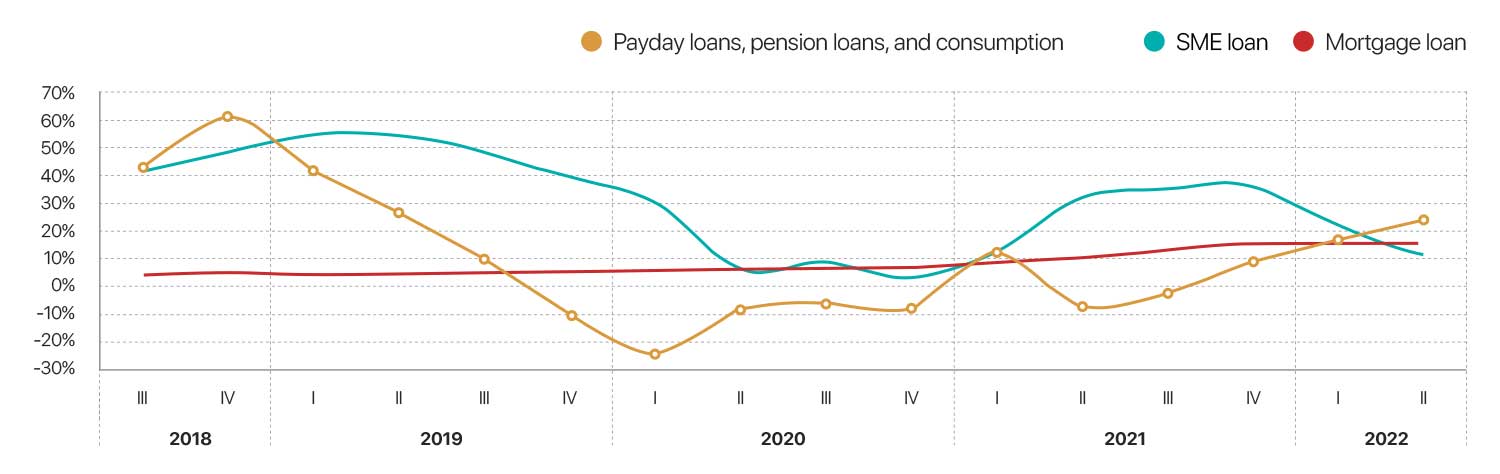

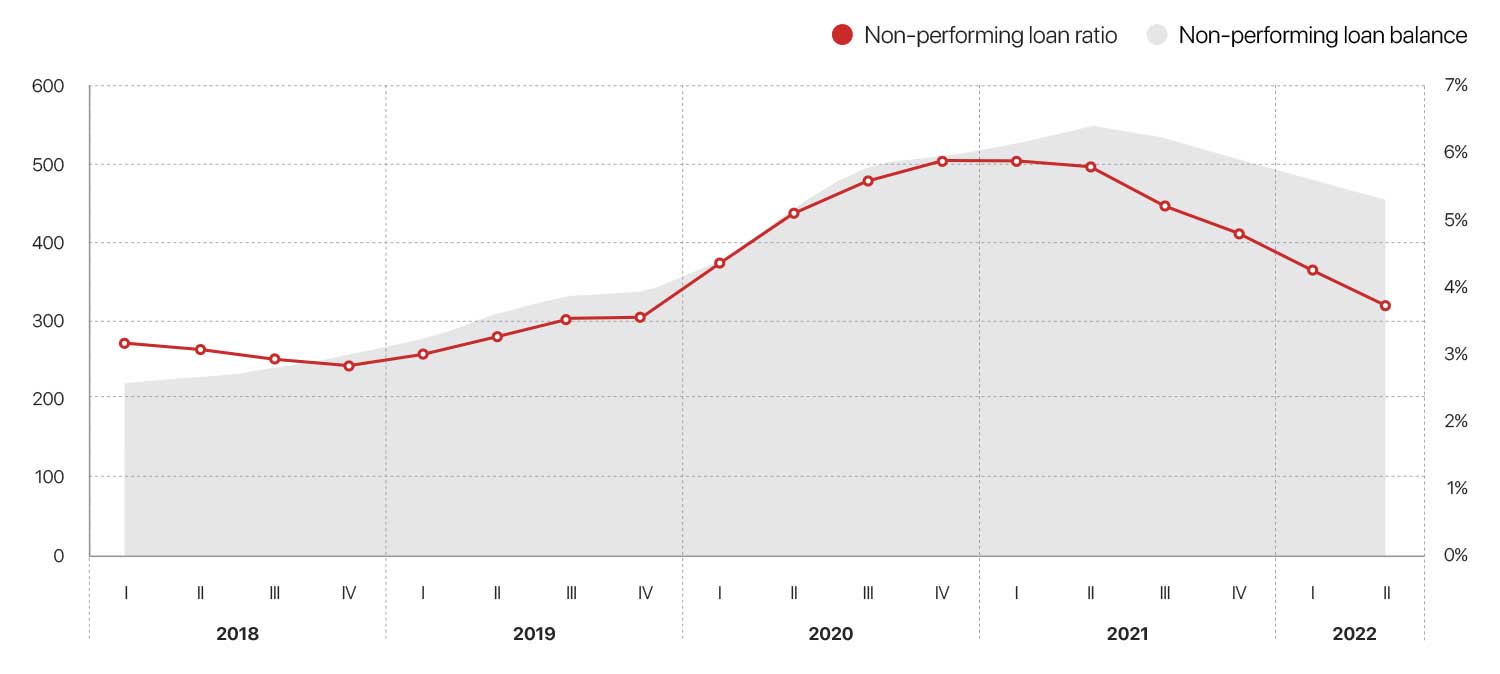

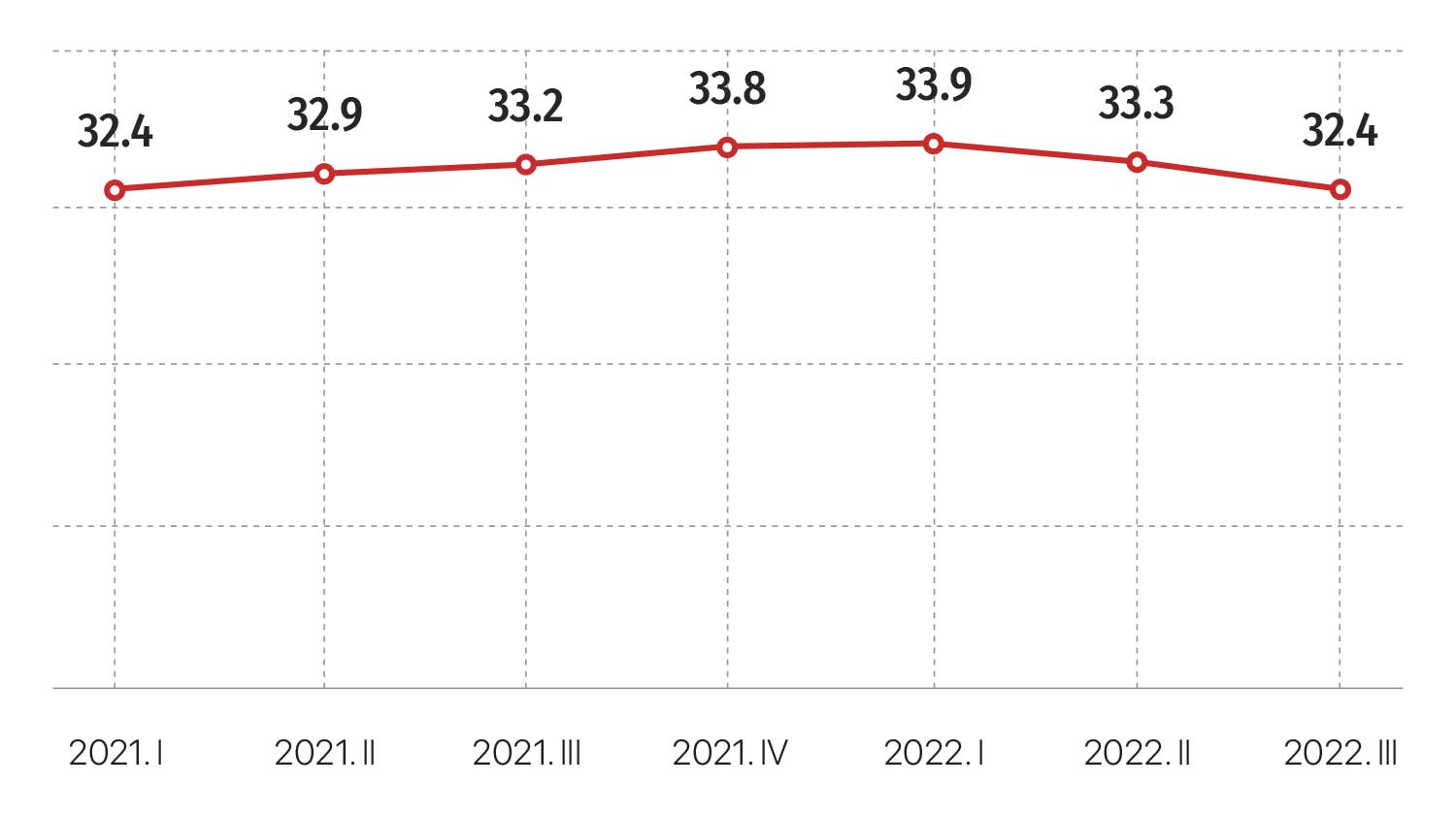

Household debt risk

After the pandemic, Mongolia prioritized economic recovery through policy initiatives, leading to a expansion in bank lending and a sharp increase in consumer and mortgage loans. The Financial Stability Council’s September 2022 report noted that despite the recovery of the labor market and an increase in real household income, the total outstanding consumer loans in the financial sector rose at an even faster rate. The end of pandemic-related incentives for loan repayments and regulations in 2022 may affect loan repayment and credit quality.

Yearly bank personal loan growth

Share of non-performing loans in the total outstanding loans of banks (MNT billion)

Source: Mongolbank

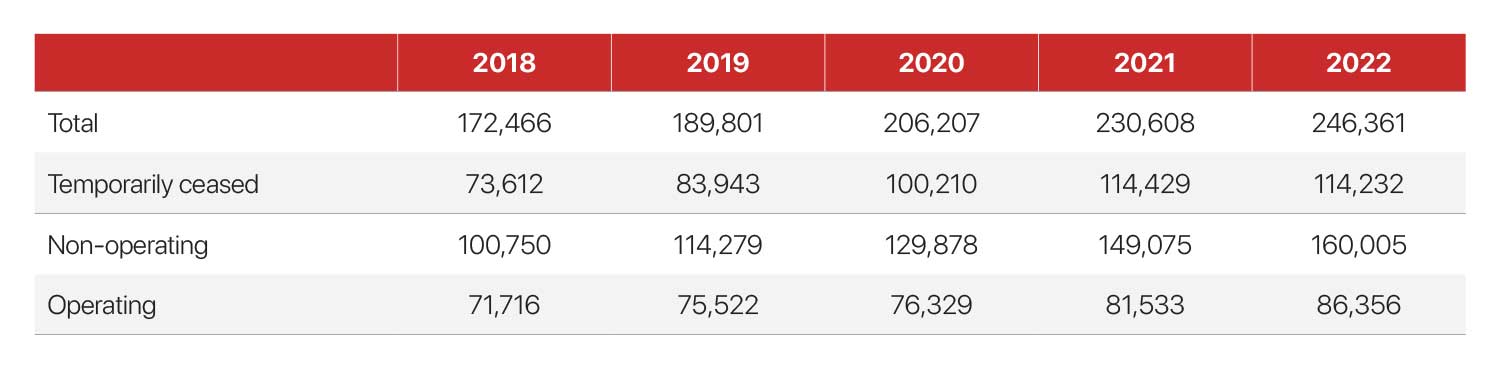

Risks to businesses

To reduce the Covid impact on the economy, the Government of Mongolia is implementing an MNT 10 trillion MNT program to support economic recovery. But due to high inflation, depreciation of the MNT, and instability in the global economy, production costs have increased, and companies’ profitability has decreased.

As a result, the number of businesses closing is outpacing the number of new businesses being established.

Source: NSO

Fiscal deficit

The fiscal balance has improved with the post-pandemic recovery; however, the level of fiscal spending remains high. During the pandemic, most of the increased public spending was allocated to social care and benefits. However, in 2022, the most of it was directed towards budget investments.

Mongolia’s 2022 budget performance

Source: Ministry of Finance

The potential for increased fiscal spending during the 2024 parliamentary elections poses a risk of a larger budget deficit. Regardless, China’s easing of its Covid-zero policy, which allows for smooth customs operations at the border, has reduced the risk of interruptions in the export of mineral products and fiscal revenues.

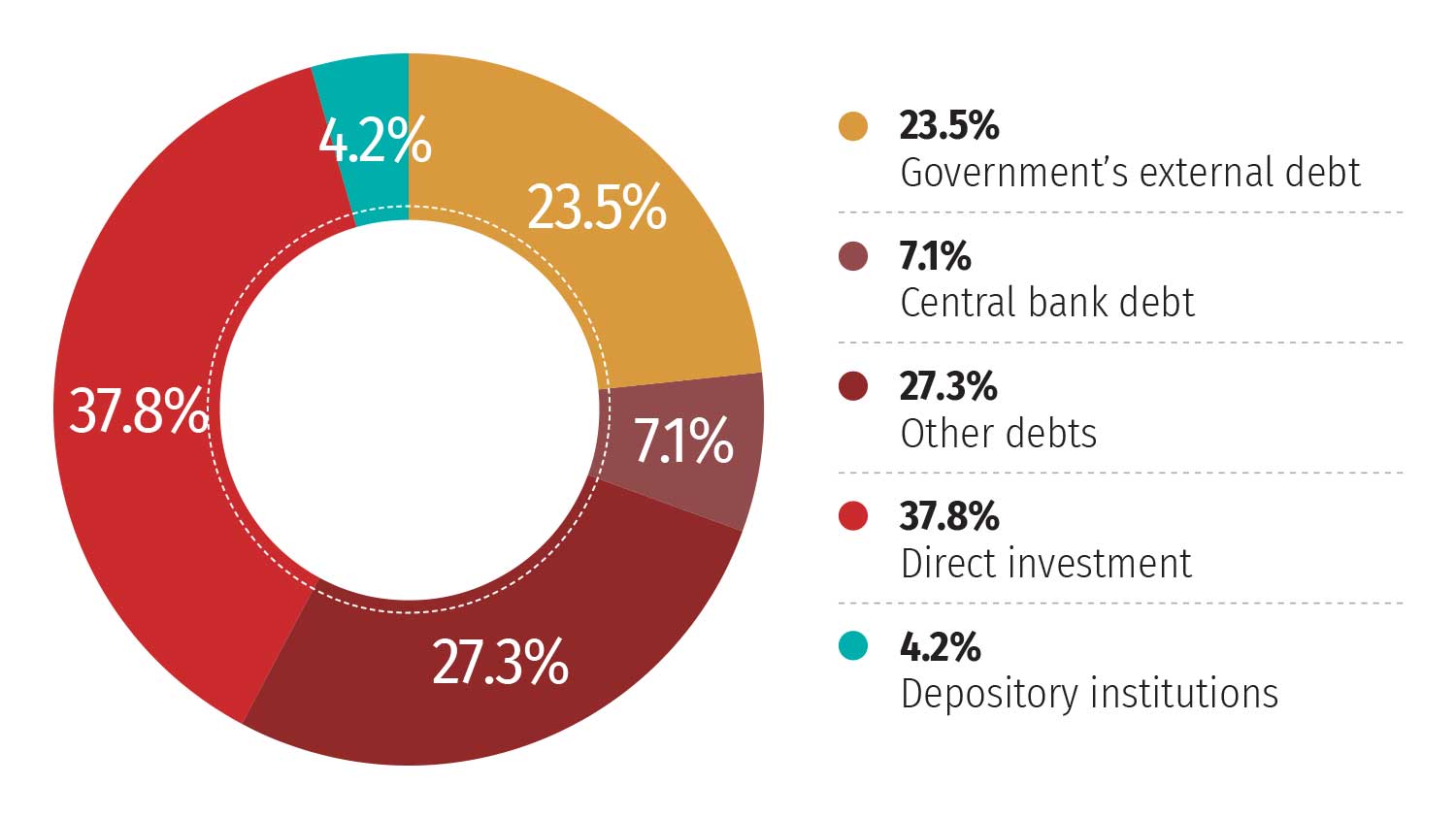

Debt risk

Mongolia’s external debt pressure remains high.

Mongolia’s 2022 budget performance

Source: Ministry of Finance, Development Bank of Mongolia

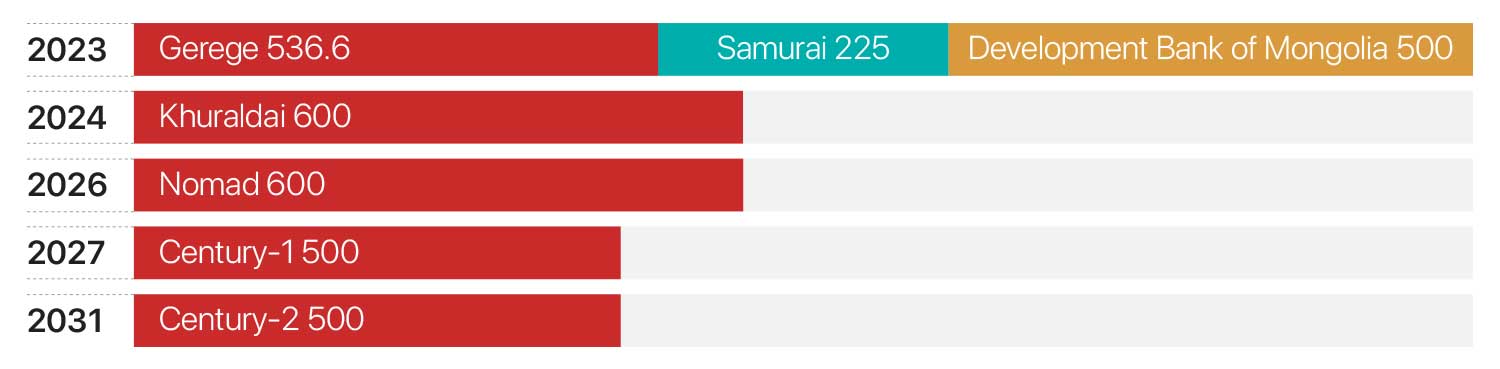

In December 2022, the government paid off the remainder of Chinggis bond in $136 million transactions.

The repayment obligations of sovereign bonds with massive amounts were one of the major risks in the near term. The Financial Stability Council warned in September 2022 that financial conditions in the global environment are tightening, and there is a risk of higher funding costs for refinancing government bonds and loan payments.

Shortly after that in 2023, Mongolia successfully issued a new bond worth $650 million with an interest rate of 8.65%. Although the interest rate is high, the bond subscription amounted to $4 billion, showing higher demand. The Minister of Finance stated that the financing of this bond will be used for the $1.1 billion bond repayment in 2023 and 2024, and the remaining $450 million will be collected from the state budget. Finance Minister Javkhlan Bold concluded that Mongolia was able to avoid a default risk with the issued bond.

Fitch Ratings assigned Mongolia’s US dollar bonds a ‘B’ rating in January 2023. The rating agency sees that one of the good signs of the macroeconomic situation is a resumption of stronger economic growth and expert trends without the emergence of imbalances, and the maintenance of a favorable business environment conducive to robust foreign direct investment inflows.

Mongolia has a large share of external debt in foreign currency and the foreign currency depreciation causes another risk. As specified by the World Bank, foreign currency debt as a share of total debts was high in Mongolia – 88 percent – as of October 2022.