1. Highlights

The gold industry provides a considerable contribution to Mongolia’s foreign exchange reserves and significantly weighs on export revenues; thus, it is considered an industry of high economic importance for Mongolia. The central bank of Mongolia, with an aim to support gold miners, implemented the “Gold” financing program three times since 1992, dispensing crucial support for the sector.

Since 1992, the gold production and mining in Mongolia has increased 26 times and the gold purchase by the central bank grew 10 times in the last decade. Gold industry accounted for 10% of mining production and 24% of Mongolia’s total export revenue in 2020. However, as of 2021, the sector accounted for 11% of export revenue, and 13% of foreign exchange reserves.

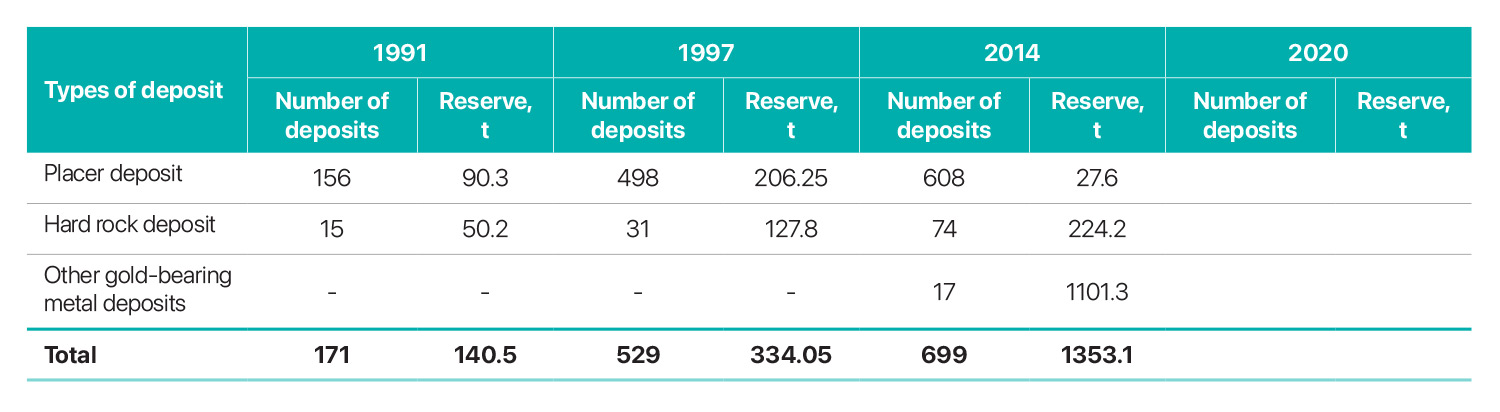

2. Reserve

Mongolia’s residual gold reserve, including placer deposits, hard rock deposits, and other gold-bearing metal deposits, amounted to 1,587 tonnes as of 2018.

Registered gold reserves

There are numerous placer deposits registered in Mongolia. But the share of placer deposits in the total discovered reserves of gold is relatively small. On top of that, exploration activities drastically reduced since the enactment of a “The Law with the Long Name” that prohibited gold mining activities near rivers and ponds. As a result, mining activities in placer deposits have continually shrunk. In terms of location, numerous placer deposits of gold were registered in the central region provinces, including Tuv, Selenge, Bayankhongor, and Darkhan-Uul.

In order to increase the overall production of gold, the Government of Mongolia is strongly supporting the deployment of advanced technologies in major deposits for average capacity instead of utilizing low-yield small mines.

The number of registered hard rock deposits in Mongolia is the highest in Selenge, Tuv, and Umnugovi provinces. From the major mines, Boroo and Gatsuurt deposits are already depleted.

Major hard rock gold deposits

GOLD DEPOSITS IN MONGOLIA

Other gold-bearing metal deposits include copper, lead, and zinc deposits. The majority of the country’s discovered resources of gold are incorporated in these deposits. By far, the biggest one in terms of size is Oyu Tolgoi. The copper-gold deposit of Oyu Tolgoi alone has a total of 1,028 tonnes of gold resources. In addition, 810 tonnes of additional gold reserves, which can be used in certain circumstances, have been registered at the Oyu Tolgoi deposit.

In 2020, most of the newly registered hard rock gold deposits were in Zavkhan, Umnugovi, and Bayankhongor provinces, whereas most of the placer gold deposits were located in Tuv, Selenge, Khentii, and Bayankhongor aimags. Among these, several major gold deposits were registered in 2020, including:

Placer gold mining licenses account for the majority of valid licenses, while hard rock deposits account for about 90% of total gold reserves. In recent years, the number of hard rock gold minig projects, including the Altan Tsagaan Ovoo, Bayankhundii and Tsagaan Tsakhiur, operated by foreign invested companies have been increasing thanks to FDI inflow.

3. License & Exploration

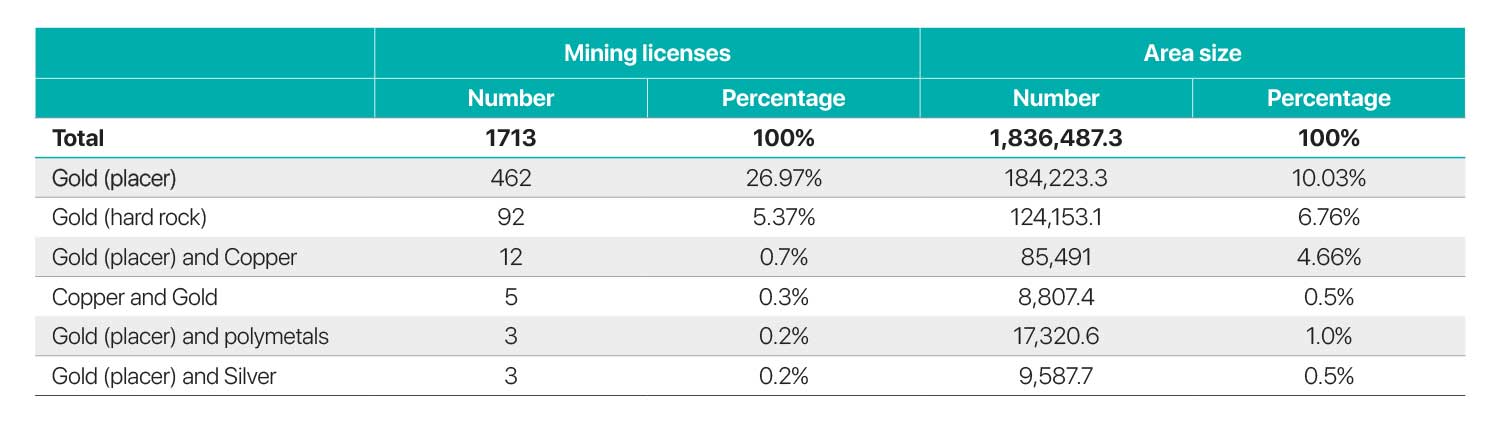

Gold mining license:

Throughout Mongolia, there are 462 valid mining licenses for placer mines and 92 for hard rock deposits of gold. In addition, licenses for gold-bearing metal deposits remain valid. In terms of quantity, placer gold accounts for the largest share of all mining licenses, accounting for 26%.

The number of valid mining licenses and effective area as of 2022

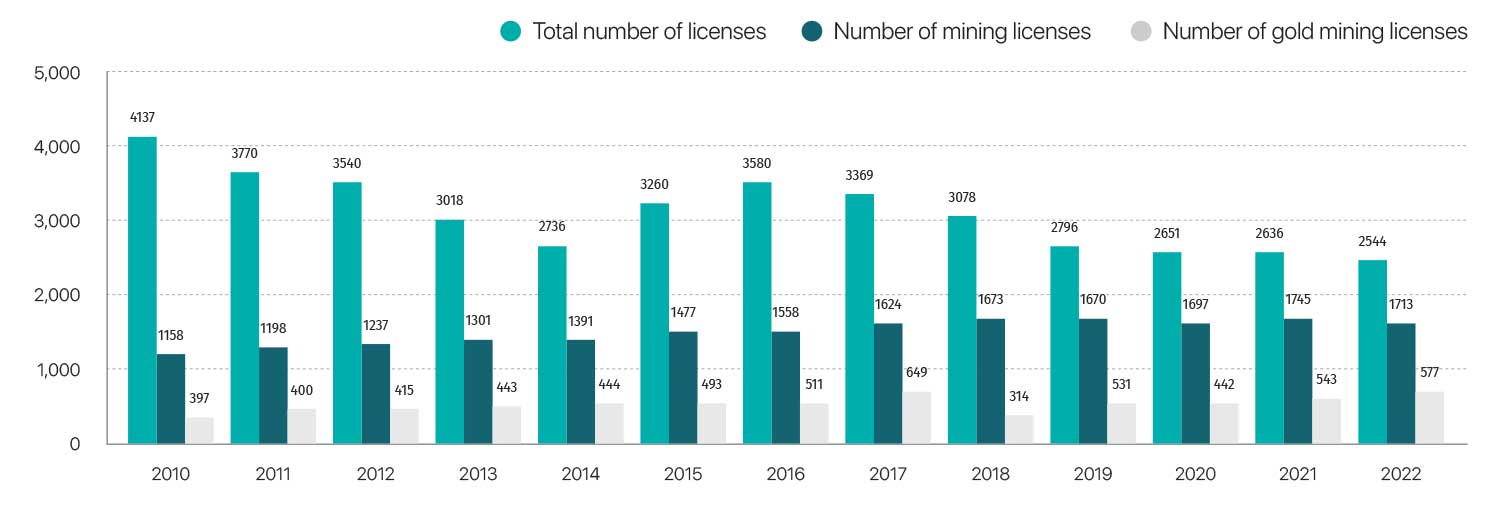

NUMBER OF GOLD MINING LICENSES

Gold exploration

The number of mineral exploration licenses has been declining, especially since 2018. This is due to the prohibition of request or application-based process of exploration licenses. Today, exploration licenses are only granted by way of tender organised by the Government agency. All licenses to be issued in competitive bidding causes a huge delay in the process and provides lack of transparency, leading to a reduction in the number of new licenses. The 159 exploration licenses have been issued within two and a half years since 2019, which is relatively low, therefore, the government is paying attention to adjusting.

Furthermore, Covid-19 has caused a global investment fall which had a drastic impact on foreign direct investment in the mineral exploration sector in Mongolia.

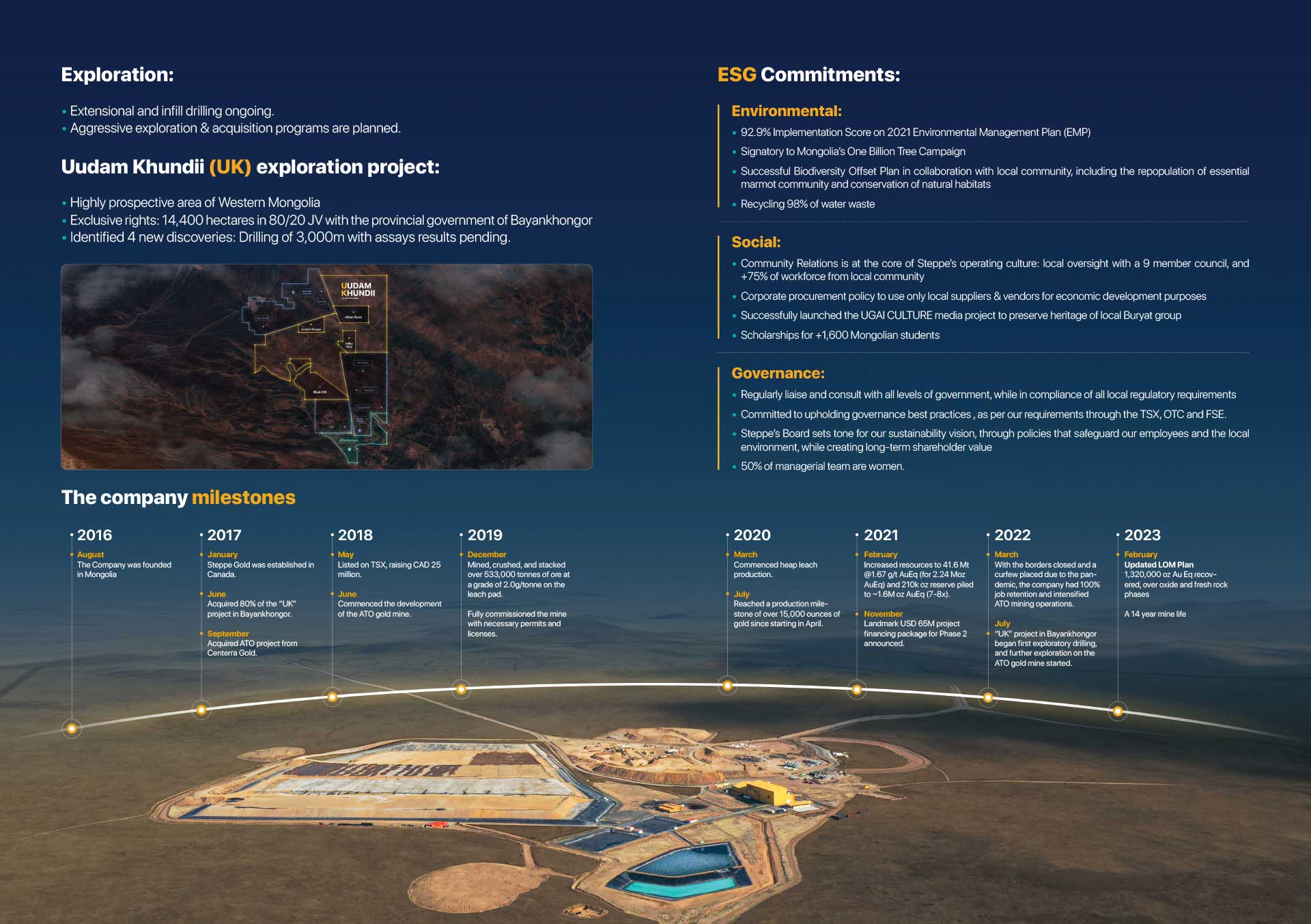

In terms of geological study in Mongolia, the southwestern

region of the country belongs to the Central Asian Orogenic Belt which includes the largest known economic gold accumulations after South Africa. The zone includes several known major gold deposits, including Oyu Tolgoi, Kharmagtai, Bayankhundii, Altan Nar, and Uudam Khundii. However, the number of geological surveys is fairly limited in the zone.

Within the frames of the “Gold 2” program, a geological study of gold “BUM Alt 2019” is being carried out in the west and southwest regions, covering almost a third of Mongolia’s territory. Successful completion of the survey will allow for a shorter and low-cost exploration of deposits and reserves.

Provinces under the geological study are Bayan-Ulgii, Uvs, Khovd, Zavkhan, Govi-Altai, Bayankhongor, Uvurkhangai, Arkhangai, Khuvsgul, Bulgan, Dundgovi, and Umnugovi.

Source: The National Geological Office of Mongolia

The existing major gold mines are mainly discovered as a result of many years of exploration and geological study. For example, the Altan Tsagaan Ovoo project of Steppe Gold in Dornod Province, was first discovered 18 years ago. Erdene Resource Development carried out exploration in the areas of the Bayankhundii gold mine for 16 years. Tsagaan Tsakhir hard rock gold mine of Naran Mandal LLC was also discovered by an exploration conducted between 1950 and 1960.

4. Production & Export

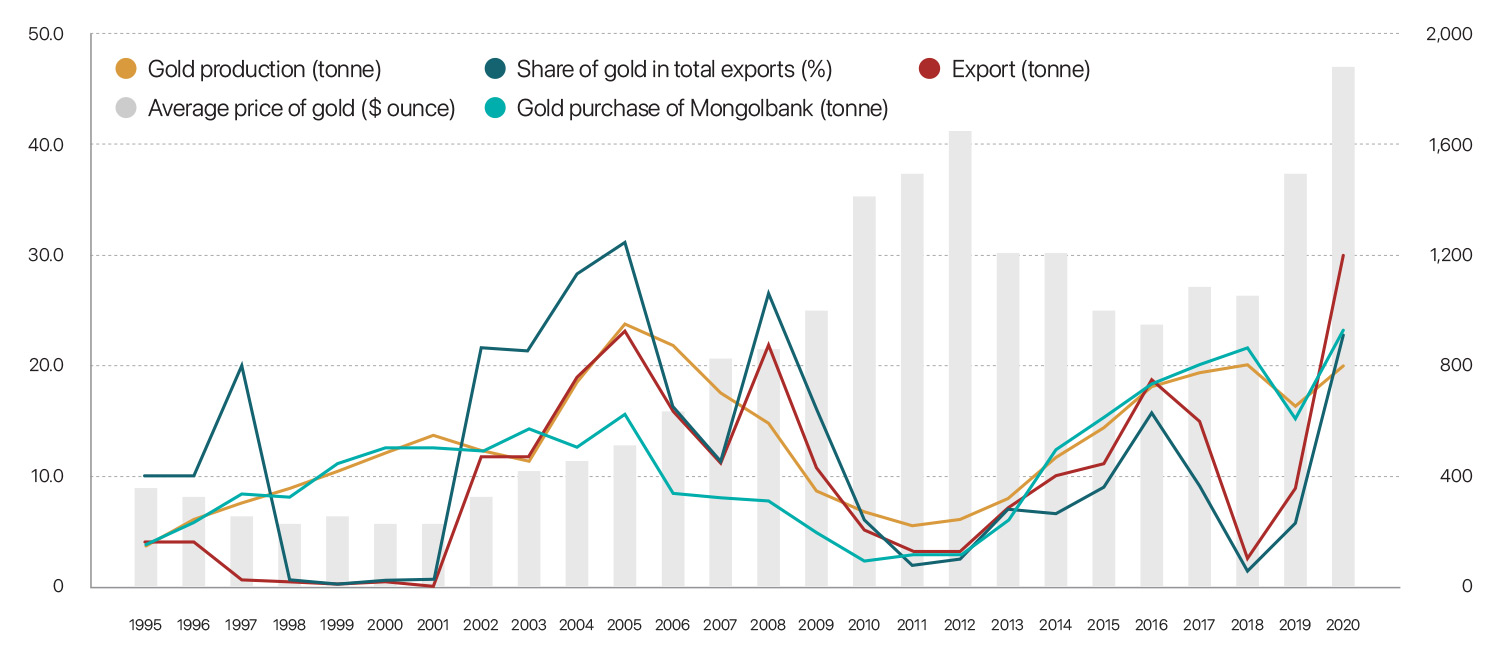

Gold exploration

In Mongolia, there are several major gold mines in Tuv, Selenge, and Umnugovi provinces. Also depending on the locations of placer mines, gold production is mostly centered in Selenge, Tuv, Uvurkhangai, Bulgan, and Bayankhongor provinces.

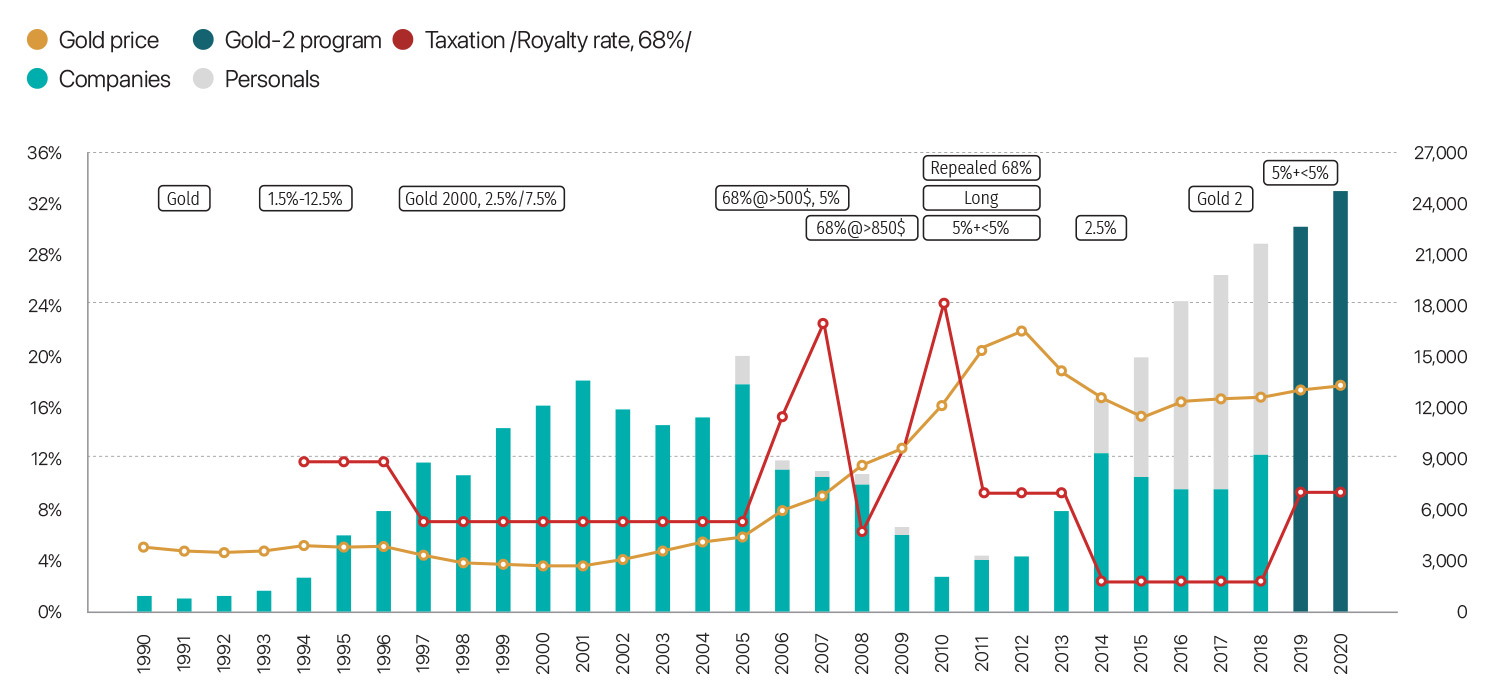

Mongolia’s gold production shrank in 2007-2013 when the price of gold was high in the global market. The overall output, which was 17.5 tonnes in 2007, fell to a third of this amount in 2011 to 5.7 tonnes. This peculiar drop in production amid high prices was because of the unfavorable legal environment created by an enactment of a particular law in Mongolia, which also caused shrinkage in explorations.

Gold production then started to pick up in 2012-2013. Since the beginning of 2011, the Mongolian government has been paying special attention to create a favourable legal environment, especially in the gold sector. Also, the royalty rate, which was 10 percent, was lowered to 2.5 percent to incentivize miners to sell their gold to the central bank. These were significant supports that boosted gold output and the central bank’s gold purchase.

Plus, the “Gold-2” program implemented in 2017 offered soft loans to gold miners and as a result, gold production started to pick up.

Gold production, export and central bank’s gold purchase in Mongolia

Source: NSO of Mongolia, Customs Office of Mongolia, Mongolbank, World gold council

Gold purchase by the Bank of Mongolia

As stated in the Law on Minerals, gold mined within the territory of Mongolia must be sold to either the Bank of Mongolia or its partnering commercial banks. The central bank purchases gold at global market rates. The new gold testing laboratories in Darkhan-Uul and Bayankhongor provinces were also established which have improved the transparency of gold trades and increased turnover. Plus, the improved tax environment and the impact of “Gold” financing programs to support gold miners has made a positive impact on the gold sector.

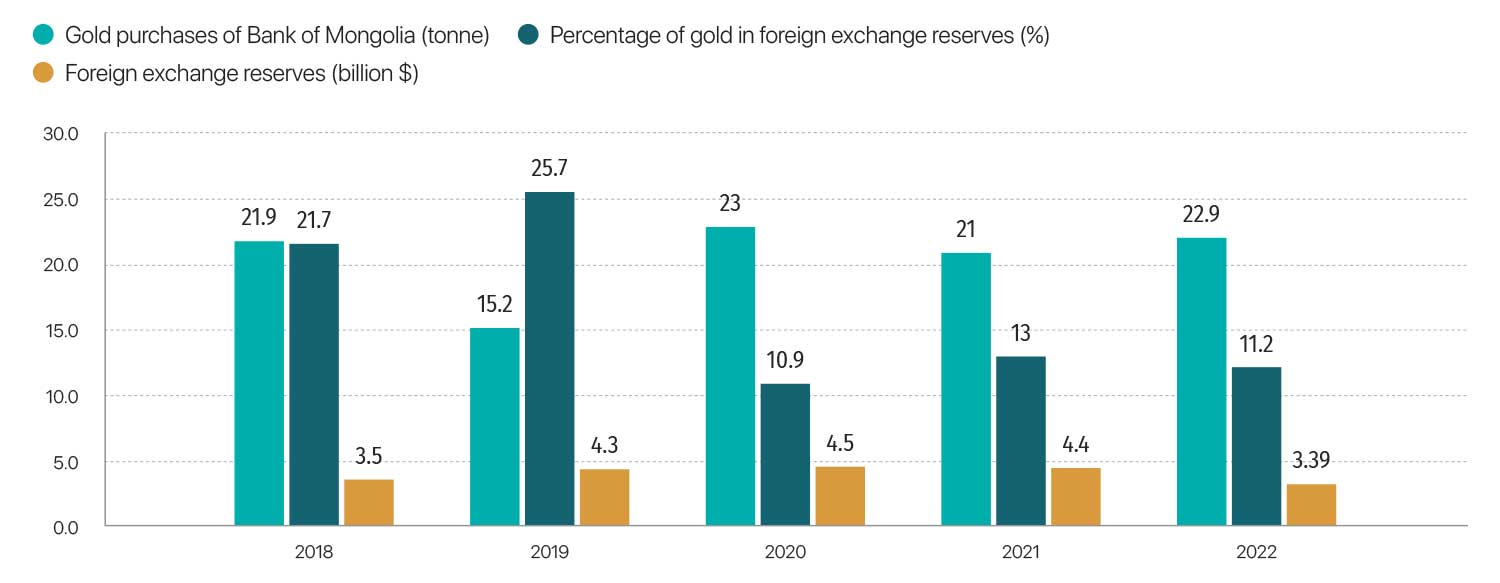

In the last 5 years, about 100 tonnes of gold was purchased by the Bank of Mongolia, bolstering foreign exchange reserves by $3.7 billion. The annual gold purchase of the Bank of Mongolia reached its historic high of 23 tonnes in 2020, which is 23 times higher than the total amount of 1990.

Mongolbank’s gold purchase, revenue from gold, FX reserves, and share of gold in FX reserves

Central bank’s gold purchase, gold price and legislative changes

- 1991: “Gold” program first launched

- 1994: Royalty rate is set at 1.5-12.5% in accordance with Minerals Law of Mongolia

- 1997: “Gold 2000” program launched

- 1997: Revised Mineral Law of Mongolia set royalty rate of hard rock mining at 2.5% and placer gold mining at 7.5%

- 2006: Revised Mineral Law of Mongolia set royalty rates at 5%

- 2006: Legalized tax rates of up to 68% in case price reaches $850 per ounce in accordance with Special Product Price Increase Tax Law

- 2008: Legalized tax rates of up to 68% in case price reaches $850 per ounce in accordance with Special Product Price Increase Tax Law

- 2009: Parliament passed the Law on the Prohibition of Minerals Exploration and Mining in Headwaters of Rivers, Protected Water Basins Zones and Forested Areas (the Long-named law)

- 2010: Revised Mineral Law of Mongolia legalized additional royalty rate of 5 % in case of price increase above $900 per ounce

- 2011: Repealed Special Product Price Increase Law (68%)

- 2014-2019: Royalty rates were kept at 2.5% in accordance with revised Mineral Law of Mongolia

- 2017: “Gold 2” program started

- 2019: Royalty rates increased to 5%, additional royalty set to 0%.

Gold Exports

Mongolian gold is exported in two types of forms as pure gold and gold concentrate.

Mongolian gold export increased till 2008, and then dramatically dropped because of lower gold output as well as changes in policy and regulations in the sector. Even though the world gold price increased by 80% between 2008 and 2012, revenue of the gold export was significantly lower. The gold exports have rebounded since 2011 due to favorable changes in regulations and improvements in the world gold market.

According to the Economic Research Institute (ERI), Canada was the major destination of Mongolian gold during the period between 2010 and 2013. This is related to the fact that the Centerra Gold bakced Boroo Gold LLC sends its production directly to refineries in Canada.

Mongolia’s pure gold export reached its peak in 2020 alongside the spread of Covid-19 pandemic, exceeding 30 tonnes for the first time, and as a result, revenue from gold exports reached $1.7 billion. In terms of physical amount, exports increased by 28 percent compared to 2005 while the revenue jumped 439%.

Mongolia exports the majority of its gold to two countries. In 2022, 92 percent was exported to Switzerland, and 8 percent to South Korea. The share of gold earnings in total exports accounted for 9 percent in the same year.

Oyu Tolgoi is the main exporter of gold concentrate whose main destination is China. It is indeed one of the largest copper-gold mine projects in the world and the company’s gold sale in concentrates was 270,500 ounces in 2022.

5. Legal environment, policy framework, and regulatory agencies

Legal environment related to the gold industry

Mongolian government carried out several policy measures in the gold sector since 1990.

“Gold-1” financing program: Thanks to the investment attracted within the frames of “Gold-1” in 1992-2000, the annual gold output was increased from 0.7 tonne to 11.0 tonnes and several placer mines became operational, accumulating a significant amount of tax revenue and contribution to the sector development. In the beginning of 1990s, gold miners used to not take enough rehabilitation measures. In 1995-1997, certain actions, including environmental assessments and technical rehabilitation, were carried out by gold mining private entities.

In the early 1990s after the fall of the Soviet regime, the country faced the challenge of creating economic opportunities for its rural population and urban unemployed. It led to an increase in the number of artisanal miners which were later estimated to be around 100,000 full time and part time artisanal and small-scale miners in Mongolia. They became more widespread in gold placer mines in Sharyn Gol, Zaamar and Bayankhongor. The artisanal miners generally used mercury and occasionally cyanide for gold extraction without understanding the risks for their own health and the natural environment.

“Gold-2000” program: The development of the gold industry reached a new level in 2000-2010 and the annual output at the national level hit 24.1 tonnes, of which over 40 percent were mined from hard rock deposits. However, gold mining operations significantly declined later in the decade due to the enactment of “Windfall Tax on Some Products”. The purpose of this law was to impose a tax on the additional income generated from increased prices of some minerals, including gold.

“Gold-2 program”: The program was approved in 2017 to support the foreign exchange reserves of the Bank of Mongolia, and as a result the bank purchased 18.6 tonnes of precious metal in 2016, 20 tonnes in 2017, 21.9 tonnes in 2018, 15.2 tonnes in 2019, and a historic amount of 23.6 tonnes in 2020, amassing about $900 million to the foreign exchange reserves.

“State policy on mineral resources sector”: The policy framework was approved by the Mongolian Parliament in 2014 and serves as the basis for developing the gold industry, and related laws and regulations.

2014 amendments to the Law on Minerals had a positive impact on the gold purchase of the Bank of Mongolia. The approval of the Law on Repealing the Law on Windfall Tax on Some Products in 2011 and the 2014 amendments to the Law on Minerals, which reduced the royalty on gold from 10 percent to 2.5 percent, helped create transparency on gold trades and had a positive impact on gold purchase and exports. The Law on Minerals was amended once again in 2019 to set the royalty on gold up to 5 percent. The increase in tax did not reduce overall turnover.

Furthermore, 30 percent of revenue from royalties and 50 percent of fee income from exploration and mining licenses are now allocated to the local budget. This was an important step in promoting cooperation between gold miners and the local community.

Regulative agencies in the gold industry

The Ministry of Mining and Heavy Industry is the central body of the state in charge of policymaking, monitoring, and coordination of stakeholders in the mining sector.

The Mineral Resource and Petroleum Authority of Mongolia is an implementing agency under the Ministry of Mining and Heavy Industry. The agency develops mining policies, provides support on policy enforcement, collects information and data regarding gold mining activities, implements policy guidance, and offers licensing services.

Mongolbank – the Bank of Mongolia or the central bank manages the purchase, sale, storage, and refining of gold in accordance with the Treasury Law. Private entities and artisanal miners engaged in gold mining activities, as well as third-party intermediaries, are obliged to sell their gold to the central bank or its partnering commercial banks as specified in the Treasury Law. The purchasing price of the Bank of Mongolia shall be referenced from the London Metal Exchange.

Moreover, the Bank of Mongolia has the right to store gold on its own or in other foreign correspondent banks. It is also the only legal entity with the right to export gold in Mongolia.

The Bank of Mongolia makes gold payments based on the results of the analysis of gold and silver content in molten gold in the Precious Metals Laboratory of the Probation Inspection Agency and deducts 5 percent royalty under the seller’s identification and transfers it to the General Department of Taxation.

With an aim to boost the implementation of the Gold-2 program, the Bank of Mongolia is providing long-term down payments and financing to gold mining companies that can be repaid in gold. The financing is offered in two forms. First, a short-term working capital financing of up to 6 months. Second, an investment financing of up to 24 months.

Agency for Standardization and Metrology – The Assay Office is responsible for the identification, quality control, registration, and monitoring of gold samples.

6. The opportunity of developing a gold refinery

The gold mined and processed in Mongolia has an average grade of 90 percent, which needs to be purified to 99.99 percent to be sold on the international market.

The country has been refining its gold in other countries, such as Russia, the United Kingdom, and Japan. As the production of gold increases and several new hard rock and placer mine projects are becoming operational, the government views that a domestic gold refinery is needed.

About 2 percent of gold is either lost or goes to waste when refining in other countries and the estimation of other metal contents, such as silver and platinum, gets complicated according to the “Gold 2025 Program Baseline Study Report” published in 2015. Furthermore, transportation, insurance, and protection costs and duration of refining gold are higher abroad and highly complex.

It is impossible to export, pledge, and trade gold that is not purified under the world standard of pure gold in a refinery guaranteed by the London Metal Exchange’s certification.

Regardless, the country had a plan of building its own gold refinery for some time. Several meetings were held with a Swiss gold refinery Argor-Heraeus SA in 2019 to study the business operations of accredited refineries of the London Bullion Market Association. Also, a state-owned enterprise Erdenes Alt Resource obtained a patent for gold refining technology from a gold refinery in Kazakhstan. However, the refinery project is not on board at present.