As stated in the Labor Law, employees may be employed in the following ways:

An employment contract shall specify the employee’s duties, working conditions and time. The employee and employer must enter into a contract, and if the contract is not signed after 10 days of employment, the employer shall be held legally liable as defined under the Labor Law.

- Internship

- Trial run period

- Seasonal employment

- Temporary employment

- Full-time employee or employment contract made for an indefinite period

- Replacement of a retained employee who is on temporary leave of absence

- Part-time employment

- Telecommuting

- Contractual labor agreement

Recruiting from overseas

In addition to being governed by the Labor Law, foreign recruitment shall be governed by the “Law on sending the labor force abroad and hiring the labor force and specialists from abroad”, as well as the “Law on the legal status of foreign citizens.”

The process of obtaining a work permit for overseas nationals takes about four weeks before entering the territory of Mongolia and another two weeks after entering the country.

Overseas nationals shall receive a single-entry working visa from the Embassy of Mongolia in the designated country upon entry into Mongolia.

For stays in Mongolia of more than 30 days, or for the purposes of obtaining double entry or multiple-entry visas for work or study, an official approval from the Immigration Agency of Mongolia is required. A representative in Mongolia may make the request for approval on your behalf. Visas are valid for entry within 90 days upon the date of issue and the duration of stay commences on the date of arrival into Mongolia.

Registration at the Immigration Office is mandatory within 21 days of entering Mongolia. Failure to register within this time will lead to a penalty of MNT1m ($290.40).

Foreign investors and people of managerial positions of a foreign-invested company are also required to apply for a work permit, a B visa, or a C visa issued to foreigners arriving for work. After entry into Mongolia, they will have to obtain a long-term, multiple-entry permit.

A work permit shall be effective for one year, starting with the date of arrival and can be extended once the employer’s request and reasons for extension are reviewed for approval.

The salary floor for foreign recruits shall be set as twice as high as the minimum wage of the country (currently c. $319.4) for employment and income-generating work and services. If a mining license holder employs more than the appropriate ratio of foreign and local employees, it also has to pay a monthly fee equal to ten times the minimum wage (currently c $1,596.9).

Individual (not corporate) shareholders or the registered Executive Director of a foreign-invested company are not required to hold work permits for the purposes of working in Mongolia. These categories of employees qualify for an Investor’s Card from the State Registration Office and the accompanying В-type visa and a long-term residency permit. Holders of a B visa are not required to pay the workplace fee.

The Government of Mongolia sets a quota on the number of foreign employees. Depending on the industry and the number of employees, the quota is between 10-70% of total employees. For instance, a private entity with a total of 5 to 20 employees is allowed to have 1 foreign employee regardless of its operations. On the other hand, entities established under a government-level agreement, or who carry out training under an international program with foreign investment are entitled to have a foreign workforce equal to 70% of the total number of employees. When it comes to industry-specific requirements, 10-50% of employees in the mining and extraction sector are allowed to be foreign. For instance, a company with over 201 employees extracting oil and gas are allowed to have foreign employees equal to 50% its total workforce.

Typical employment standards in Mongolia

Hours of employment

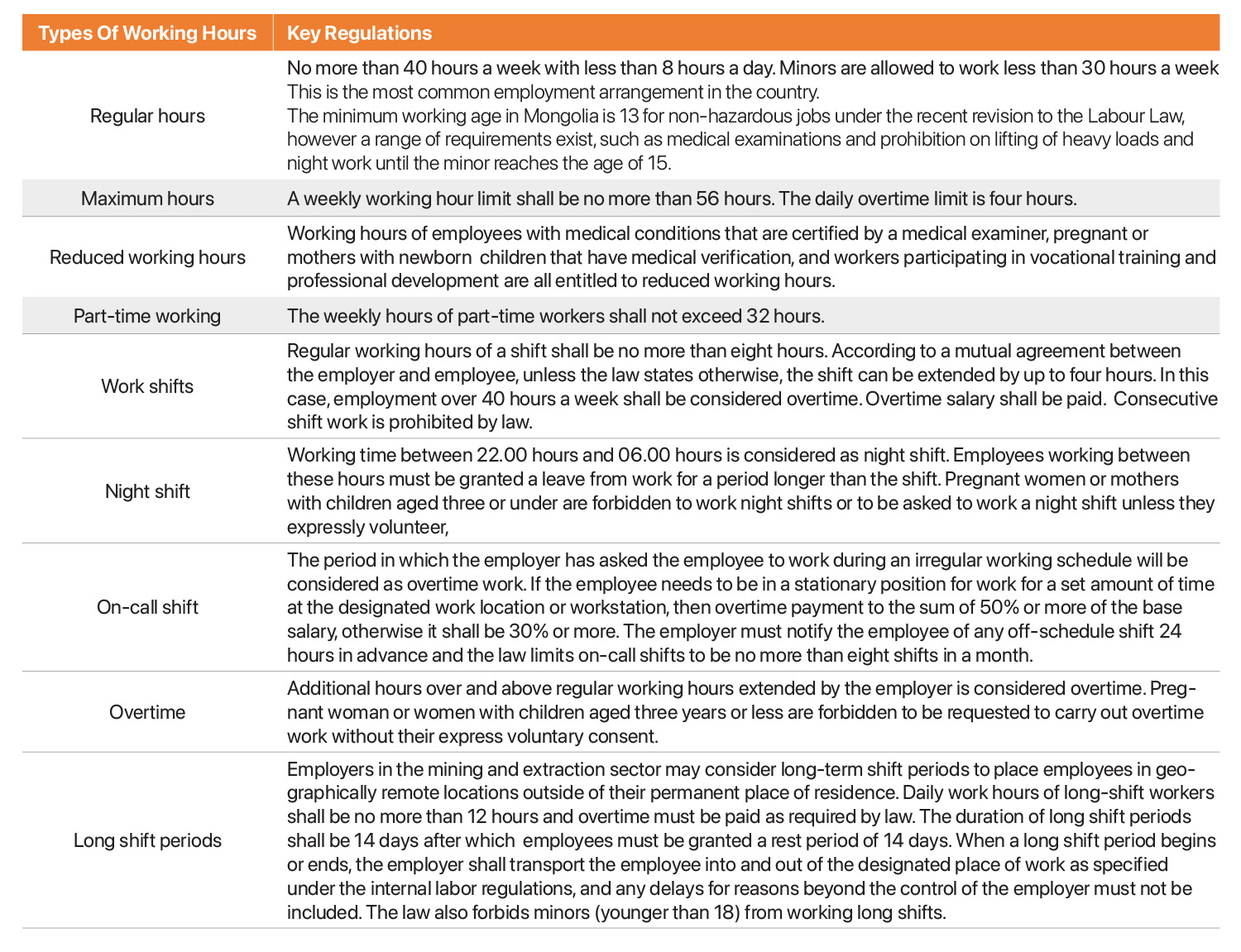

WORKING HOURS

Annual Leave

Employees must be granted annual leave. If the employee is unable to take a vacation out of work related necessity, they can be provided with cash incentives instead. The base period of annual leave shall be 15 days. Depending on the number of year of expertise and/or employment, additional days shall be added to the base period.

ANNUAL LEAVE OF THE WORKERS

Employees can partially take their annual vacation in different periods within the year at their request. The duration of partial vacations shall be no less than 10 days.

Public holidays

- New Year: January 1st

- Lunar new year: First three days of the first spring month of the lunar calendar (usually in February)

- International Women’s Day: March 8th

- Buddha’s Great Equinox Day: The 15th day of the first summer month of the lunar calendar;

- Children’s Day: June 1st

- Naadam Celebration and the Anniversary of the People’s Revolution: July 11th – 15th

- The Great Chinggis Khaan Day: The first day of the first winter month of the lunar calendar where Chinggis Khaan was born

- Day of the Proclamation of the Republic: November 26th

- National Freedom and Independence Day: December 29th

Employees can be called on a public holiday if necessary for special occasions, such as maintaining continuous production, carrying out public services, for transportation, telecommunications, and other necessary duties. The law, unless agreed voluntarily, forbids the employment of pregnant women, or mothers with children under the age of three, or employees with disadvantaged children under the age of 16 years old that require permanent care, on weekends or during public holidays.

Wages

Employment conditions, labor norms, standards, tariffs, and salaries of employees in their respective sectors are discussed and approved by both inter-sector and cross-sector agreements in the following industries:

- Geology, mining, and heavy industry

- Construction

A tripartite agreement between trade unions in the energy sector, labor, and social security consent has set the minimum wage in the sector higher.

Employers are required by law, collective agreements, and contracts to adopt and enforce internal payroll lists, job descriptions, labor norms, standards, and wage regulations.

Wages include the following:

- Base salary

- Benefits

- Extra salary,

- Vacation pay

- Bonuses.

Terms and form of payment: Salaries shall be allocated at least twice a month on fixed dates. If the day of allocation is either a weekend or a public holiday, the salary must be paid on the previous workday. The law stipulates that an employee’s salary may be paid by the hour, day, or week by agreement between both parties. The salary shall be paid in the national currency.

Extra salary:

The following extra salaries shall be paid in case an employee was not able to take a compensatory vacation:

- The hourly wage for overtime and on weekends shall be 1.5 times higher than the base salary of the employee.

- The hourly wage for night shifts shall be 1.2 times higher than the base salary of the employee.

- The hourly wage for public holidays shall be twice as high as the base salary.

Vacation pay: Annual vacation pay shall be calculated based on the employee’s average annual salary for the position. Employees that were unable to take their annual leave due to work necessities shall be paid 1.5 times their base salary. An employee shall be paid vacation pay for the period of employment when the employment contract is terminated.

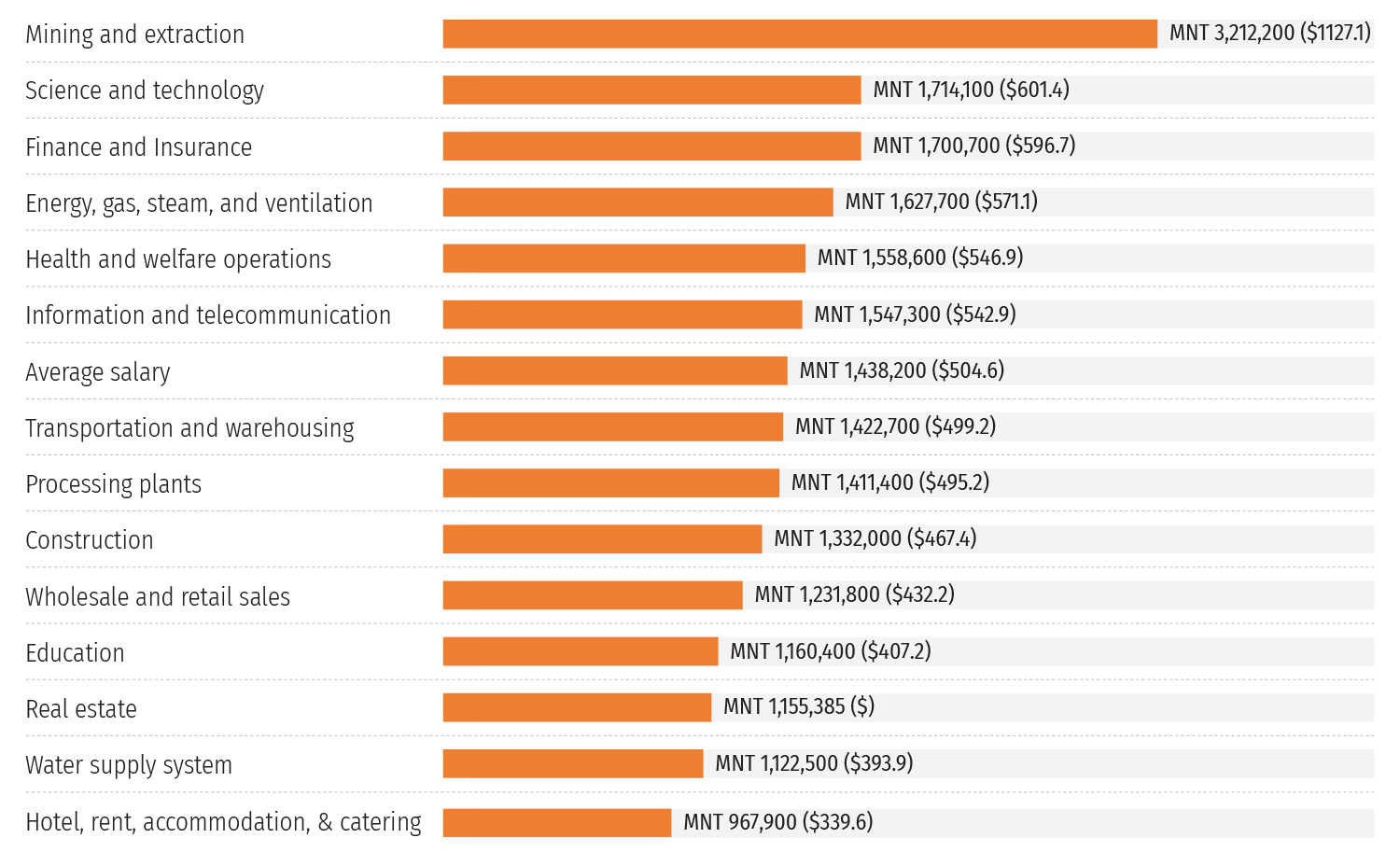

MINIMUM WAGES IN MONGOLIA

Minimum wage:

• MNT 550,000 per month ($159.7)

Some sectors have higher minimum wages.

For instance:

• Mining: MNT 640,000 ($225)

• Construction: MNT 648,000 ($227)

• Energy: MNT 512,000 ($180).

Employment agreements

The employer and the employee shall mutually agree and conclude a contract of employment. The contract shall be made indefinitely, except for part-time, probationary, seasonal work, replacement of an employee whose job is retained, a temporary job, and time-limited work related to funding and scope of work to be performed.

For further information on Mongolian labor law, please click on the following link:

https://www.legalinfo.mn/law/details/565

Trade unions

A trade union responsible for representing and protecting employees’ rights and legal interests may be formed. Regardless of the employee’s membership in the union, the employee shall not be discriminated against in any way. The trade union can initiate and organize a strike within the legal frames of the relevant laws.

Employees’ social and health insurance systems and taxes

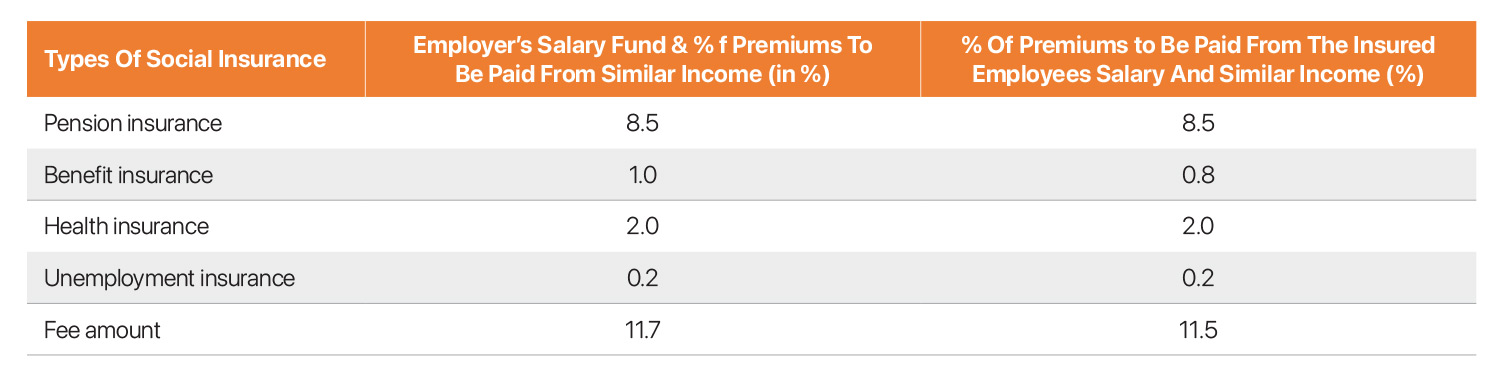

Social insurance: the employee and employer shall pay a monthly social insurance premium on a fixed date.

SOCIAL INSURANCE RATIO

Health insurance: social insurance premiums paid by employed persons shall be at least 4% of their wages or similar income, while employers and insured shall pay 2% respectively.

Personal Income Tax: when calculating the taxable income from salaries, bonuses, benefits, extras, and similar employment income, health and social insurance premiums shall be deducted. Employees are subject to a 10% fixed rate of income tax.

A progressive income tax will be effective starting in 2023 with a 10 percent rate on total taxable income, including salary wages, equivalent income, and indirect income, up to MNT 120 million, a 15 percent bracket on a total taxable income of MNT 120-180 million, and a 20 percent bracket on a total taxable income above MNT 180 million. In other words, if the average monthly income exceeds MNT 10 million, a 15 percent tax will apply to the excess income and a 20 percent rate on the excess income of over MNT 15 million taxable income.

Job placement in Mongolia

The key employment policies are developed and implemented by the Ministry of Labor and Social Protection, while the General Agency for Labor Welfare Services was established by the Government of Mongolia to maintain the balance of supply and demand within the labor market. Government agencies and private entities with a license provide labor matchmaking services in Mongolia. Between 40,000 and 50,000 citizens are employed by these services annually.

Job placement in Mongolia is not only about recruiting qualified staff, but looks at broader opportunities in the labor market, such as finding highly skilled employees, headhunting, and selecting executives. Multiple options are available for job seekers in Mongolia, such as online platforms, LinkedIn, and in-person submission requests. In other words, employers have the opportunity to exploit state services, private entities, and online platforms to attract workers.

Labor situation and legal environment in Mongolia

Employers and employee relations are governed by the Labor Law in Mongolia, which was recently revised and will take effect on January 1, 2022. The previous law added more government control in the relations between employers and employees during this transition period. Revision in the law on the other hand clarified the relations between the employer and employee in an attempt to reflect evolving labor market trends and to suit the modern economic situation of Mongolia.

Also, the law includes articles on telecommuting – a growing area of interest growing popular around the globe since the Covid-19 outbreak.

As of the first quarter of 2022, Mongolia has a working age population of total of 2.1 million people, of which 1.25 million are considered to be in the active workforce with an average monthly salary of MNT 1.57m ($456.7). The monthly minimum wage is currently at MNT 550,000 ($159.7)

As of the third quarter of 2022, the unemployment rate stood at 5.4%. Over 104,000 people are registered as unemployed as of the first quarter of 2022.

The overall workforce is moving gradually into a high-level specialization as the enrollment rate to higher education has reached 65.6% according to the World Bank.

Furthermore, certain sectors such as construction and some mining activities temporarily cease operations during winter due to heavy snowfall and the severe cold.