Highlights

The central region of Mongolia has vast resources of iron ore. Iron ore exports have been steadily increasing since 2008 and have surged significantly since 2012. Prior to the Covid-19 pandemic in 2019, Mongolia’s total exports of iron ore reached historic high of 8.5 million tonnes.

Reserves & Exploration

There is 1.77 bn tonnes of total confirmed reserve of iron ore and 5.5 bn tonnes of unconfirmed resources in Mongolia. In total, 63 deposits are registered, with 6 deposits having more than 50 million tonnes of ore. Mining of iron ore commenced in 2005. The majority of discovered reserves of iron ore in Mongolia is located near the Selenge and Darkhan provinces, considered as the industrial center of Mongolia.

Mongolia’s iron ore products are mainly low grade. Since 2011, an average of 6 million tonnes of iron ore is exported to China annually. In the last 17 years, Mongolia has exported a total of 91 million tonnes of iron ore, generating revenue of MNT 6.6 billion. Tumurtei, Tsakhiurt-Ovoo, Tayannuur, and Ereen were included in the category of deposits with over 50 million tonnes of iron ore reserves. At the end of 2024, there are 82 valid iron ore mining licenses accounting for total area of 50,693 hectares.

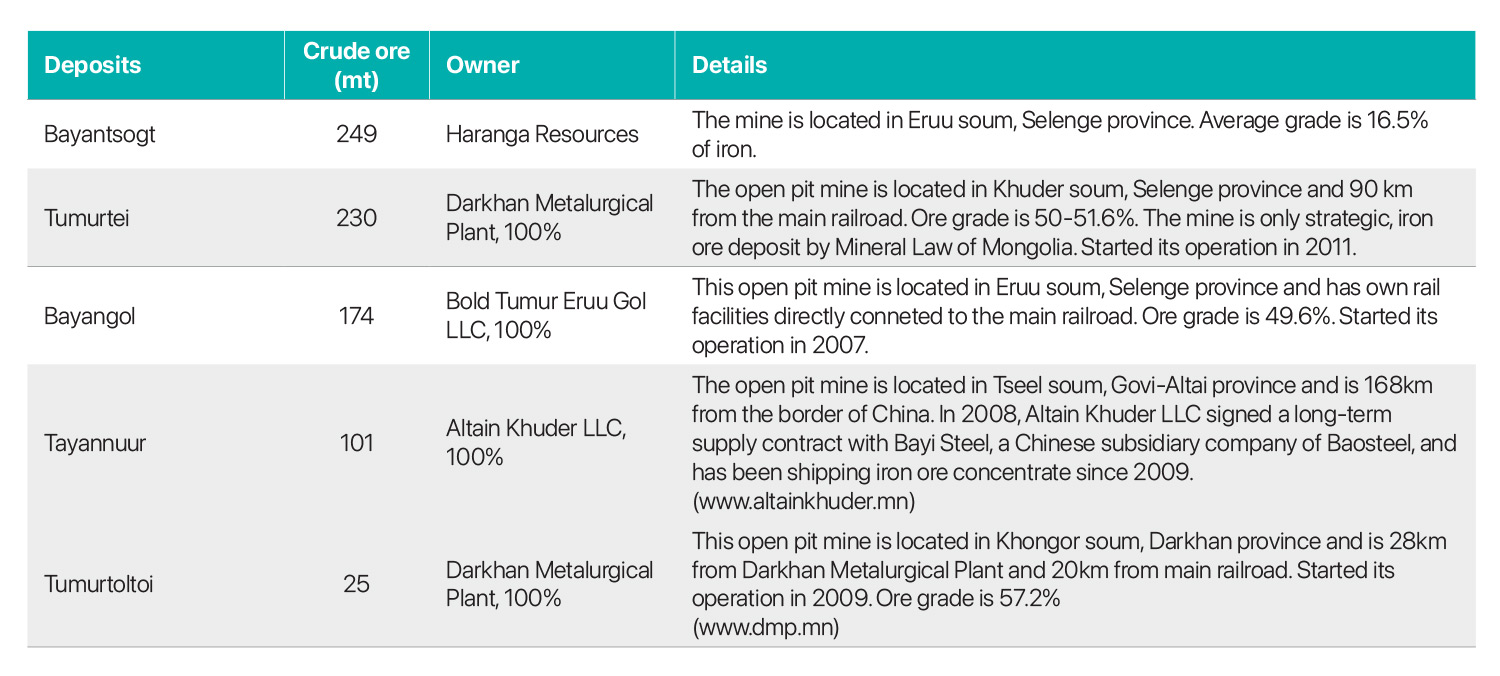

MONGOLIAN MAJOR IRON ORE RESERVES (IN MILLION TONNES)

Source: Economic Research Institute, Mongolian Mining Journal (2014)

Production & Export

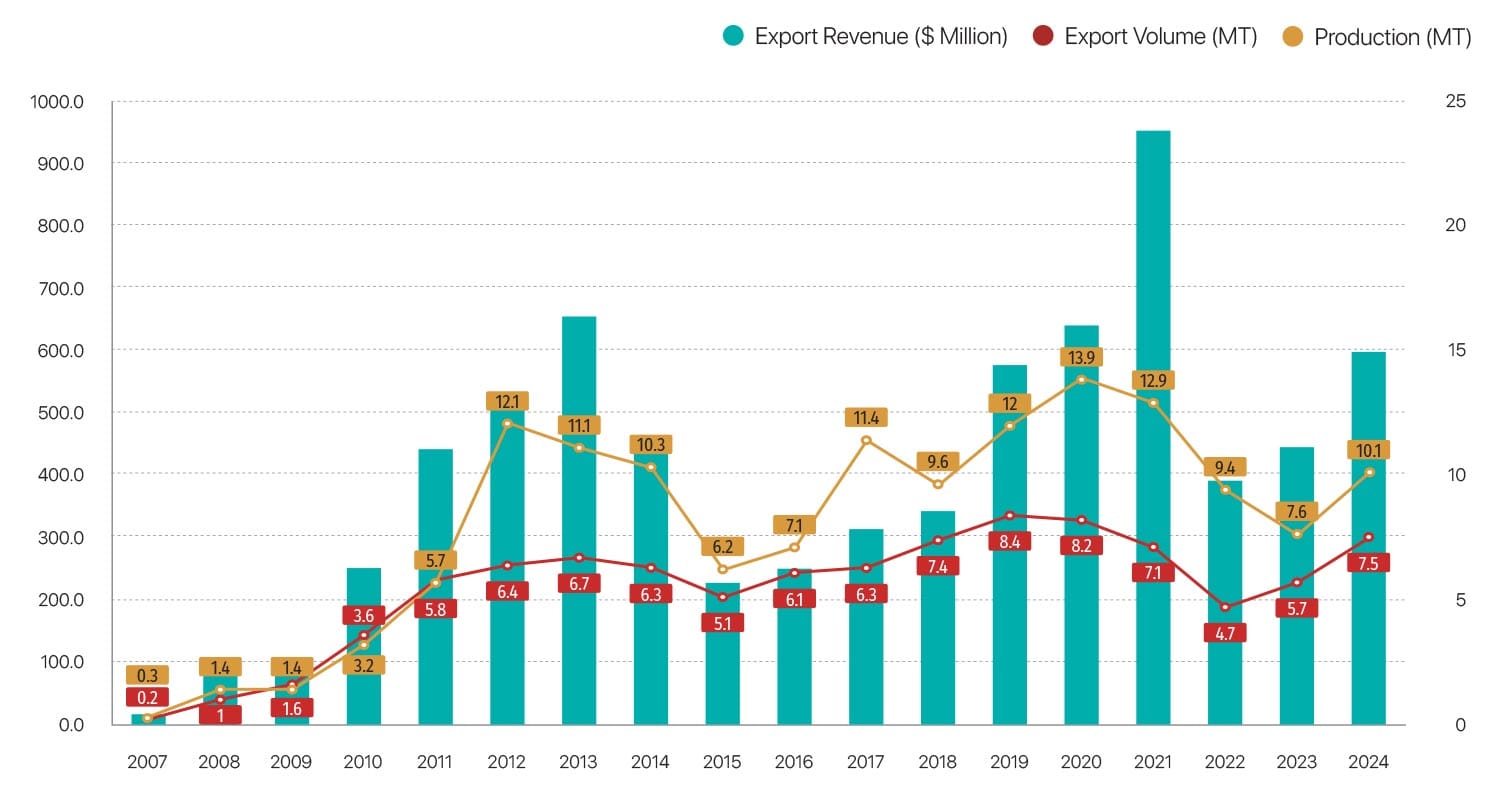

Mining activities and exports of iron ore picked up in 2008 and have been consistent ever since. In 2021, iron ore export accounted for 10% of total minerals export.

In 2024, iron ore exports accounted for 3.8% of total exports, reaching 7.5 million tonnes, which is a 31.5% increase compared to the previous year, while export revenue reached $601 million, marking a 35.8% increase compared to the previous year.In terms of annual production, a total of 10.1 million tonnes of iron ore and concentrates were produced, reflecting a 32% rise compared to the previous year.

IRON ORE PRODUCTION, EXPORT VOLUME AND REVENUE, 2007-2024

Source: The NSO of Mongolia

Infrastructure

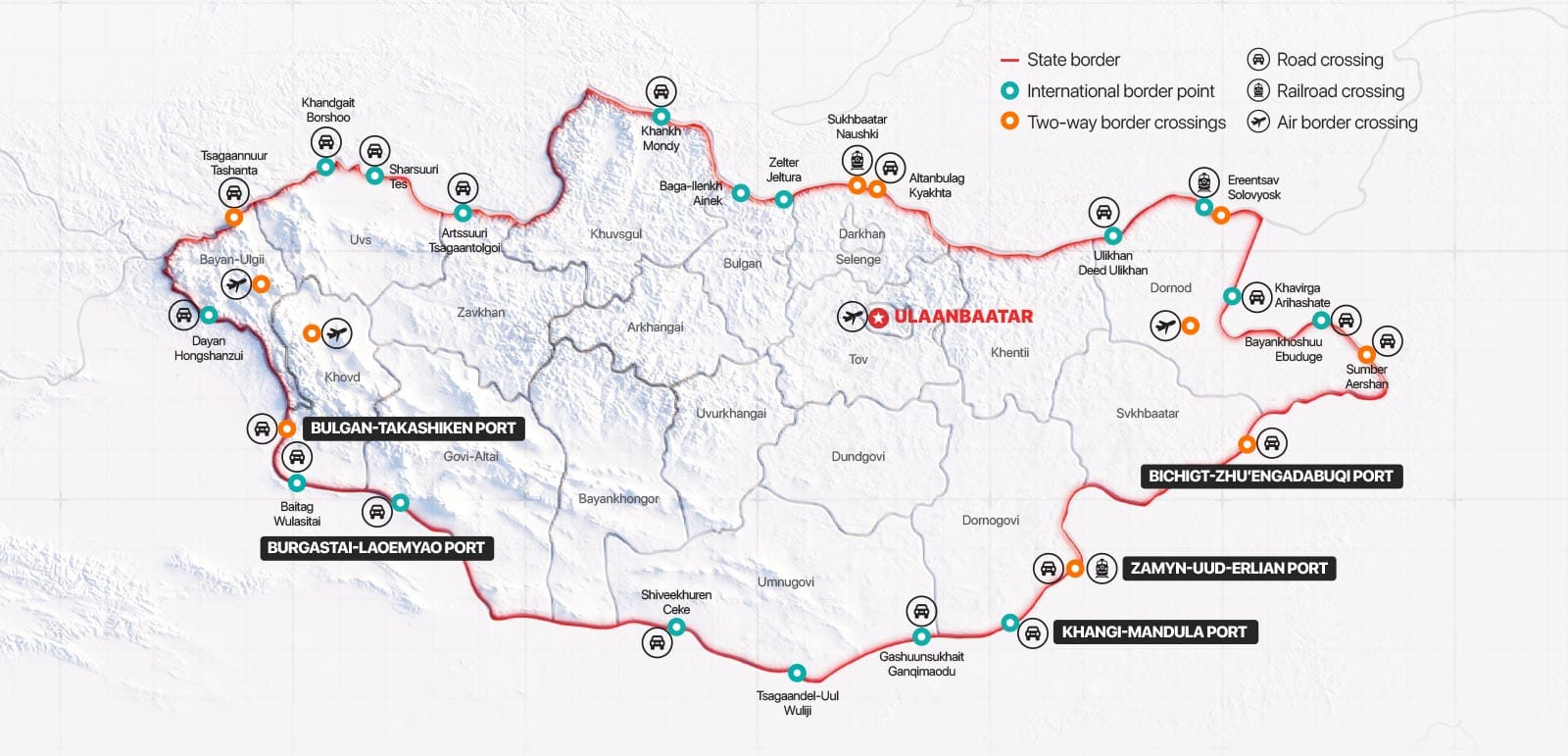

Mongolian iron ore is shipped mainly by rail due to the fact that local road transportation tariffs are higher than railroad tariffs. However, most of the iron ore deposits are small and far from the main railroad. So, building railroads for all of these deposits is not financially viable (MRPAM, 2016).

The major iron ore reserves in Northern Mongolia are connected to the main railroad and iron concentrates are shipped to Chinese steel mills directly via rail. However, Ulaanbaatar Railway holds a monopoly in Mongolia and charges relatively high tariffs on iron shipments. In order to mitigate these costs, there have been several instances where mining companies constructed self-financed railroads.

As a case in point, Bold Tumur Eruu Gol, the largest iron ore mining company, has built an 85km stretch of railway line between its mine in the Eruu district of Selenge province to Ulaanbaatar Railways (ADB, 2014). In total, the distance between the mine and the Chinese border is 1,100 km and it leads to a cost of $17 per tonne only for domestic transportation (Source: Economic Research Institute). Currently, most iron ore mines export to Baotou which is one of the major steel-producing regions of China through the Sainshand – Zamiinuud – Erlian – Baotou route.

The Government of Mongolia completed the development of the 227 km Zuunbayan-Khangi railroad project in 2022, with operations commencing in 2024. This new route will serve as a key export corridor for iron ore and coal, cutting the distance by 318 km compared to the current export route. The railway is expected to drive significant economic growth by reducing transportation costs by $4-8 per tonne and increasing the export volume of mining products by 20-25 million tonnes annually. The cost savings are anticipated to create more competitive pricing for Mongolian iron ore, positioning it favorably against Chinese and Australian producers.

Main iron projects, their geographical distribution and projected capacity in 2013

Iron ore export ports

Source: General Authority for Border Protection of Mongolia

Market

External market:

China imported 1.24 billion tonnes of iron ore in 2024, an increase of 5% on 2023’s 1.18bn tonnes, which was a record-breaking year in itself. Although Mongolia’s iron ore reserves are not as significant compared to major exporters, its geographical proximity to the biggest consumer China is a considerable advantage.

Domestic market:

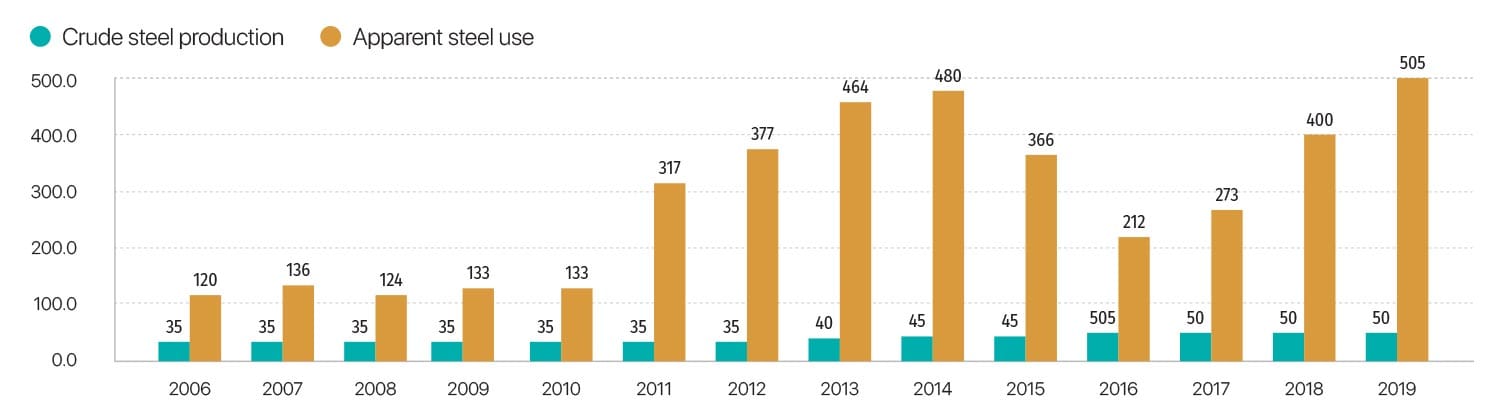

Currently, Mongolia’s steel production is lower than its consumption. The largest steelmaker is Darkhan Metallurgical Plant which uses local steel scraps for its steel production. Its capacity is 100,000 tonnes a year, but capacity usage is only 50-60%.

The Government of Mongolia’s 2024-2028 Action Plan includes the commissioning of a Steel Complex. By implementing this project, the goal is to fully meet the growing domestic demand for steel reinforcement and other steel products, producing 1.0 million tonnes of steel billets and products. Additionally, the steel plant will be established, with the first phase producing 500,000 tonnes of pig iron and 500,000 tonnes of steel billets. From these billets, steel products such as rebar, angle iron, and wire will be manufactured, fully satisfying the domestic demand for construction reinforcement.