Mongolian real GDP growth will pick up only gradually from our estimate of 2.0% in 2022 to 4.5% in 2023, according to Fitch Solutions. Mongolian real GDP growth will pick up only gradually from our estimate of 2.0% in 2022 to 4.5% in 2023. However, these gains will be offset by the impact of high inflation and aggressive monetary policy tightening.

Mongolia - Real GDP, % chg y-o-y

Source: Macrobond, Fitch Solutions

The major positive development for Mongolia in recent months is Mainland China’s shift away from its zero-Covid policy. Mongolia’s goods shipments to China alone historically account for over 80.0% of total exports, and for more than 40.0% of GDP. While pandemic-related weakness in China held back Mongolia’s exports in 2022, this constraint is now set to ease. We forecast growth in China to rebound to 5.0% in 2023.

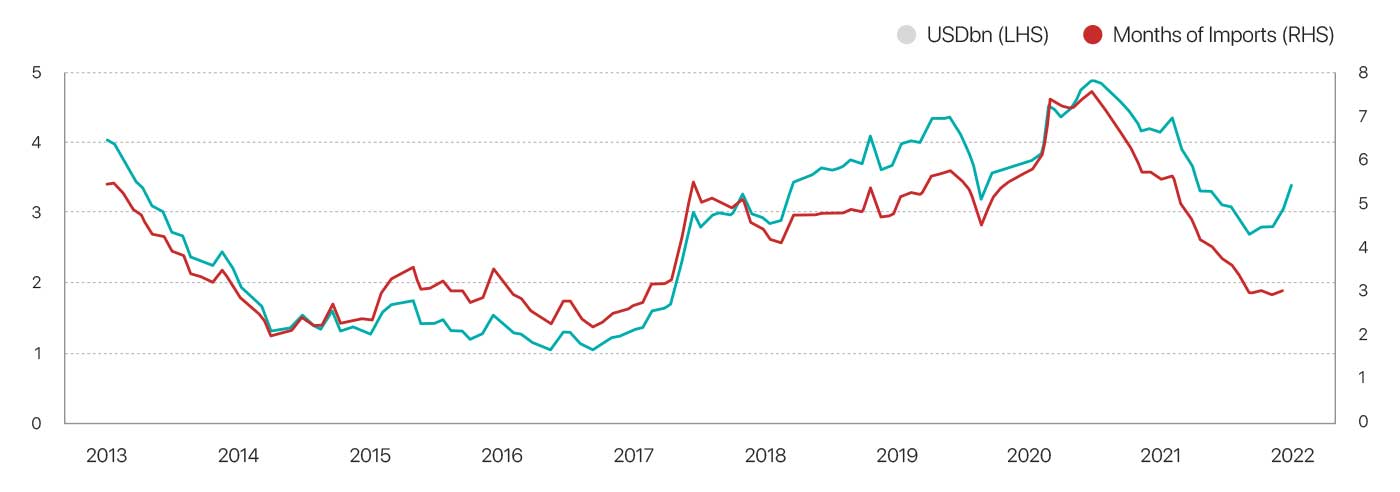

Broader external risks are also starting to ease. For example, the sharp drop in Mongolia’s foreign reserves bottomed out in recent months, having risen from the trough of USD2.8bn in October 2022 to the most recent figure of USD3.4bn in December. The ratio of imports to foreign reserves has been stabilizing too, albeit at a low level.

Mongolia - Foreign Reserves

Source: Macrobond, Fitch Solutions

A resumption in key mining operations will provide a boost to the domestic recovery. Mongolia is home to one of the world’s largest copper and gold deposits, the Oyu Tolgoi mine. Disruptions caused by the pandemic and political frictions have impeded mining operations over the past few years, but they are likely to get back on track in 2023. Major mining company Rio Tinto expects that its next phase of mining activities in Oyu Tolgoi will begin in H123.

However, inflation is likely to remain high over the coming quarters, which will impede domestic demand more generally. Fitch forecasts that inflation will average 12.0% in 2023, well above the Bank of Mongolia’s target of 6.0%. Second-round effects from elevated global commodity prices will continue feeding through into inflationary pressure this year. In addition, the substantial 31.0% hike in minimum wages imposed in January 2023 is likely to prove inflationary.

Fitch highlights that elevated inflation will prompt the Bank of Mongolia to continue tightening monetary policy aggressively. The central bank hiked the benchmark policy rate by a cumulative 700 basis points (bps) in 2022, and Fitch expects that policymakers will raise the rate by a further 200bps to 15.00% in 2023. Throughout Mongolia’s recent history, policy rates only ever rose to that level once, and only briefly in 2016. While aggressive monetary tightening should eventually help to rein in price pressures, it would also come at a cost to the economic recovery.

The risks to growth forecasts are on the downside in the near term. In particular, looser containment measures in Mainland China have recently led to significant Covid-19 outbreaks across the country. China’s near-term recovery may prove weaker than we currently expect, and Mongolia’s exports would consequently take a sharper hit.