KEY ECONOMIC INDICATORS

GDP:

GDP growth rate:

GDP per capita:

Unemployment rate:

Central bank interest rate:

Inflation:

Foreign currency reserves:

Foreign exchange rate:

$1 = ₮3,581

(Q2 2025)

FDI:

Average wage:

₮2.7M (~$754)

Trade partners:

145 countries

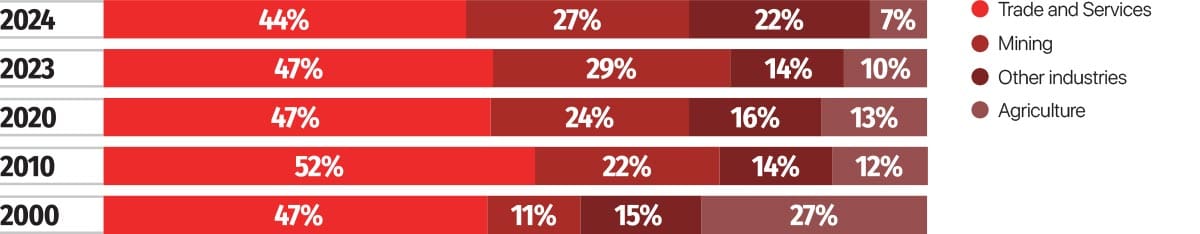

Sector percentage in GDP

Mongolia is currently experiencing an important milestone in its development. The country’s rapid economic growth over the past three decades, driven largely by the mining sector, has significantly expanded its GDP. However, this growth has been accompanied by challenges, including economic volatility driven by fluctuations in commodity markets and high levels of social inequality.

Addressing these challenges and improving quality of people’s life, the country has introduced two key policies: the mid-term development plan, the New Recovery Policy, and the long-term Vision 2050.

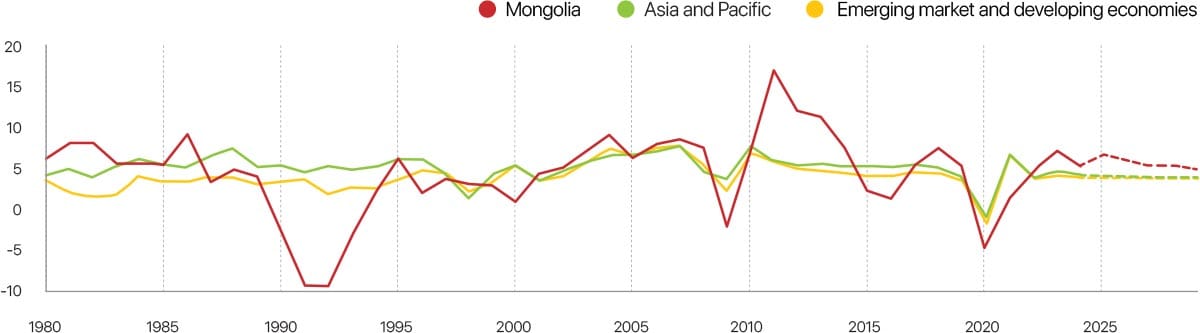

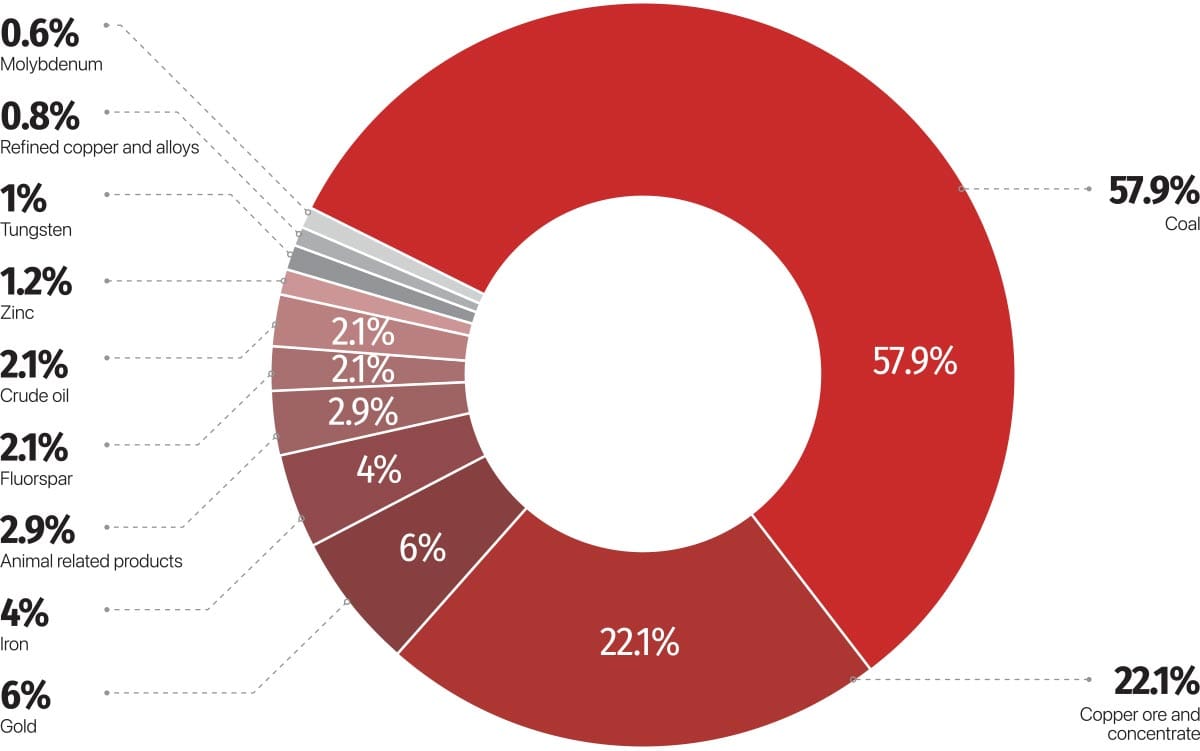

The mining industry is a key growth pillar, with policy targeting an increase in its GDP contribution from 24% to 34%, aiming for $30 billion GDP by 2030, underscoring its significance to policymakers. Mongolia’s mineral export boom is generating positive macro-fiscal outcomes for the second consecutive year in 2024. Following steady growth last year, the country’s economic expansion is projected to accelerate in 2025, fueled by increased Oyu Tolgoi production.

Strong public and private consumption, along with increased commodity exports, are expected to drive growth. Public investment under the government’s four-year action plan and private investment, supported by expanded bank lending and a more flexible monetary policy, are also expected to sustain growth. However, as noted in the World Bank’s November 2024 Mongolian Economic Update, these factors are also likely to drive inflationary pressures, resulting in moderate fiscal deficits and a sizable current account deficit.

REAL GDP GROWTH (ANNUAL PERCENTAGE)

International Monetary Fund, October 2024

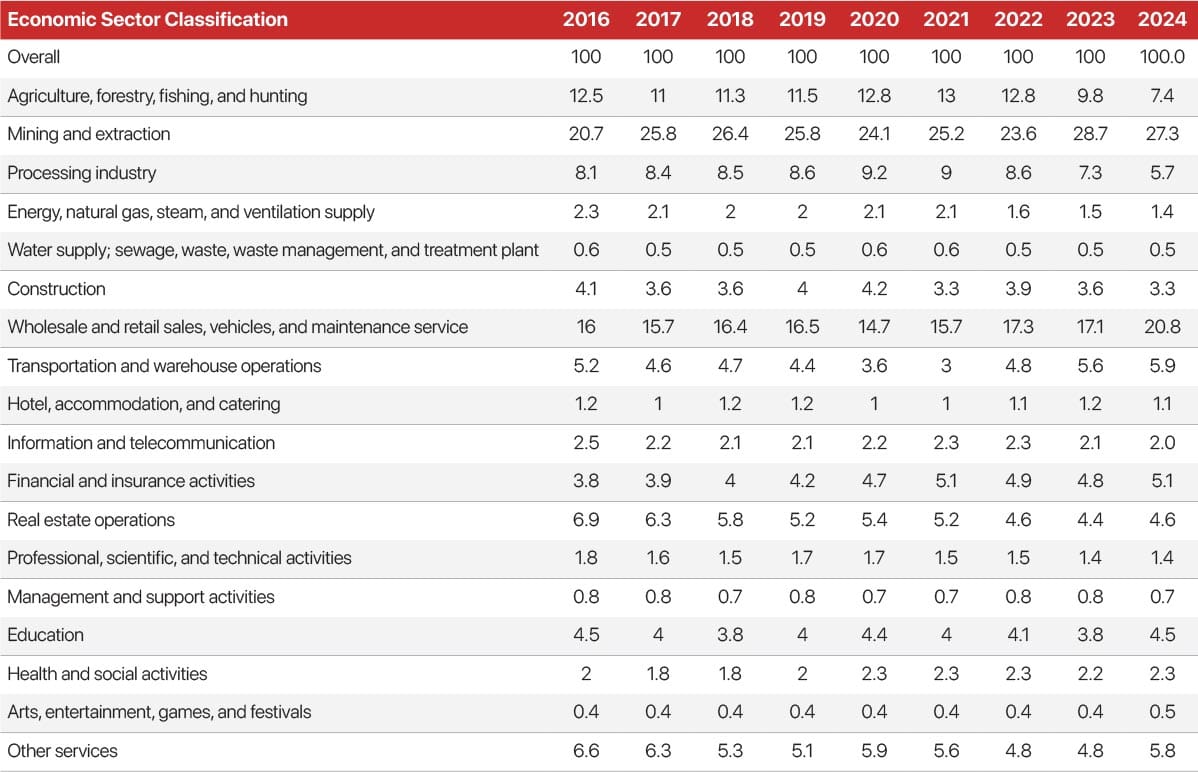

GDP breakdown by industry

Source: NSO of Mongolia

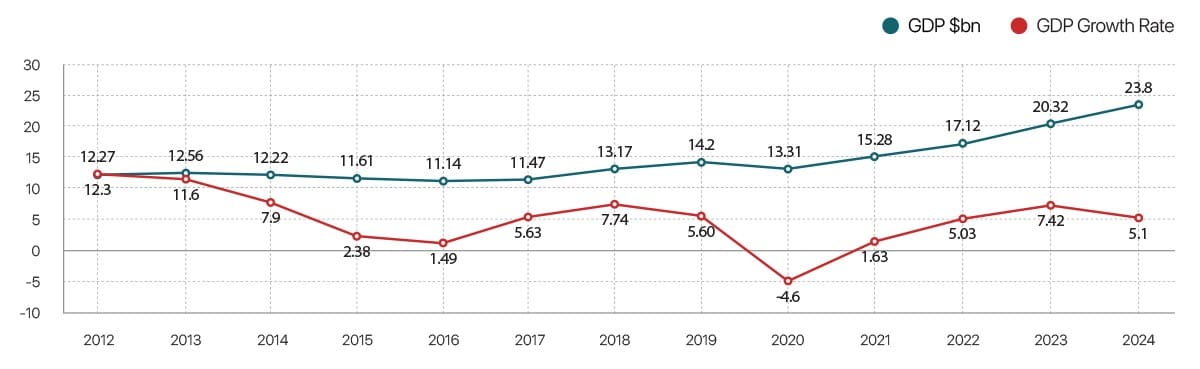

GDP (annual %)

Source: NSO of Mongolia

GDP per capita ($)

Foreign trade

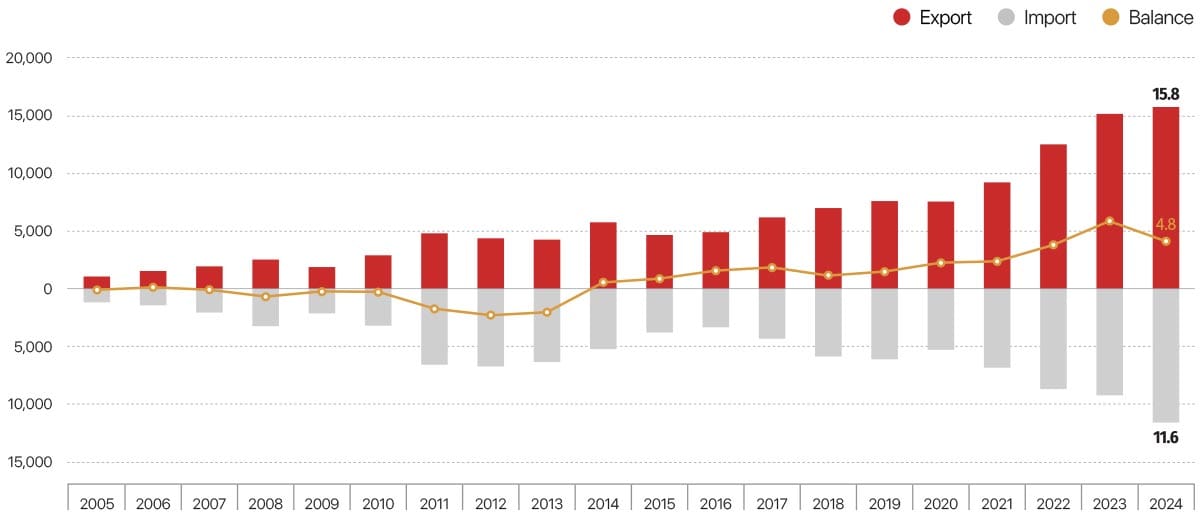

In 2024, Mongolia traded with 164 countries, reaching a total trade turnover of USD 27.4 billion, including USD 15.8 billion in exports and USD 11.6 billion in imports, resulting in a surplus of USD 4.2 billion. Total trade increased by 12.1% from the previous year, with exports up 3.9%, imports up 25.5%, and the trade surplus narrowing by 29.7%.

In the first half of 2025, total trade amounted to USD 12.1 billion, with a surplus of USD 1.1 billion. Compared to the same period of 2024, trade fell by 8.7% as exports declined by 16.6% while imports rose by 2.8%. The export drop of USD 1.3 billion was mainly driven by lower sales of coal and oil, partly offset by increased exports of copper, gold, and zinc.

IMPORT-EXPORT TRADE BALANCE, BY YEAR (IN BILLION $)

- Mongolia has been a member of the World Trade Organization (WTO) since 1997 and applies MFN tariffs for WTO member countries.

- In 2015, Mongolia and Japan signed the Japan-Mongolia Economic Partnership Agreement (EPA) and entered into force on 7 June 2016. The EPA contains 11 chapters covering areas of trade in goods and services, customs procedures and trade facilitation, electronic commerce, investment protection, movement of persons, competition, protection of intellectual property, dispute resolution, and the improvement of the overall business environment.

- In 2016, Mongolia and Canada signed a Foreign Investment Promotion and Protection Agreement (FIPA) and entered into force on March 7, 2017.

- In 2017, Mongolia and the United States signed a Bilateral Investment Treaty (BIT), known as the USA - Mongolia Agreement on Transparency in Matters Related to International Trade and Investment.

- The Mongolia Third Neighbor Trade Act has been submitted to the United States House of Representatives. This bill is expected to exempt Mongolian textiles and knitted products from taxes in the US market.

- Mongolia has also joined the Asia-Pacific Trade Agreement, which took effect on January 1, 2021. Under the agreement, a total of 2,323 Mongolian products will enjoy 10-50% tariff incentives. In addition, 187 products will be completely exempt from tariffs when exporting to the Chinese market.

- As of 2024, Mongolia has concluded tax treaties with 26 countries to avoid double taxation.

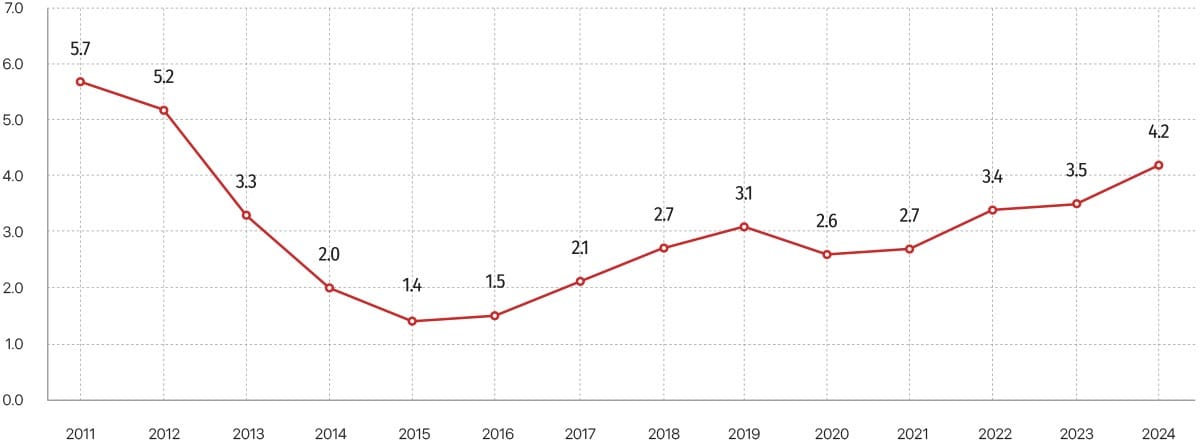

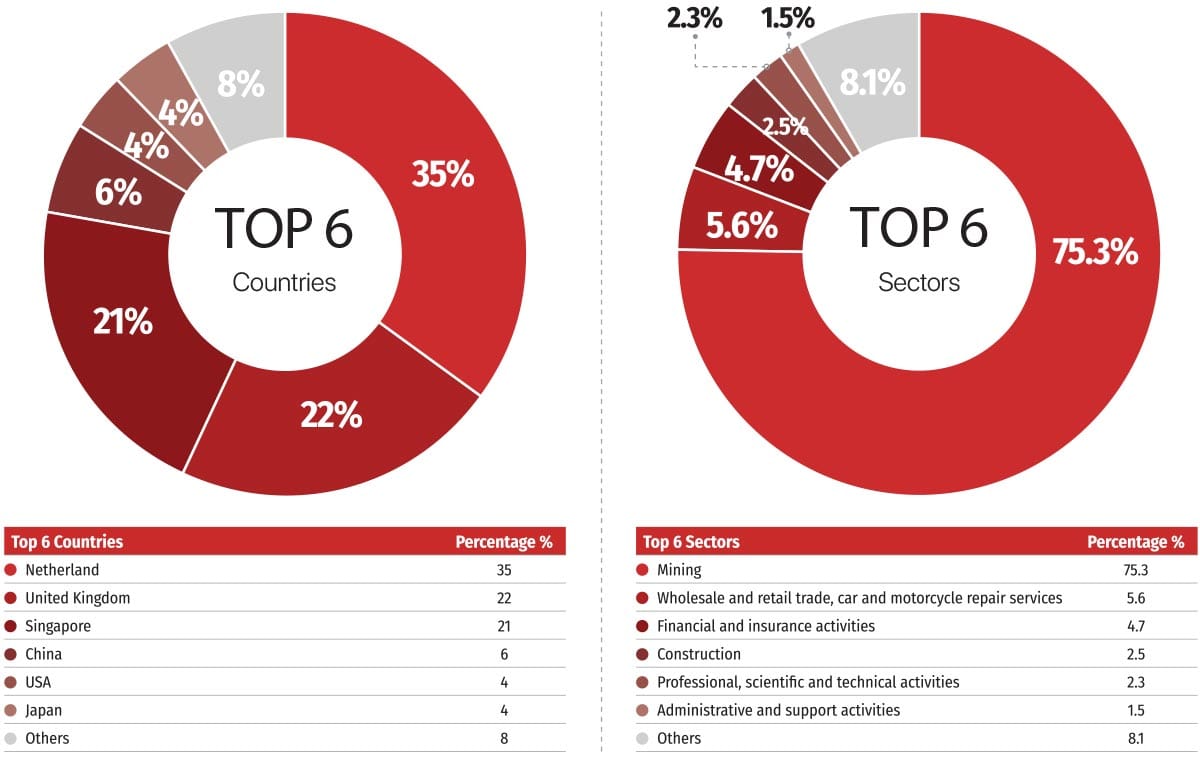

Foreign direct investment (FDI)

Mongolia’s economic growth is directly dependent on the mining sector and the inflow of foreign direct investment. Between 1990 and 2024, Mongolia attracted $47 billion in FDI, with more than 70% concentrated in the mining sector. Since the start of investments in the Oyu Tolgoi project in 2010, the project alone has accounted for half of all foreign investment in the mining industry.

According to estimates by researchers at the University of Finance and Economics of Mongolia, a 1% increase in foreign direct investment results in a 0.76% long-term growth in Mongolia’s GDP, with 0.22 percentage points of this growth directly attributable to Oyu Tolgoi investments.

To support foreign investors, Mongolia has established the Investment and Trade Agency, which operates a “One-Stop Service Center” dedicated to providing assistance and services to foreign investors. Investment relations in Mongolia were initially governed by the Law on Foreign Investment in 1993, which was replaced in 2013 by the Investment Law.

The government recognizes the need to improve the investment environment by facilitating the registration of new investments, streamlining visa and residency permits, simplifying licensing procedures, ensuring investment stability, creating favorable conditions for business operations, protecting the legal rights and interests of investors, and establishing mechanisms to address complaints and requests.

In line with these goals, the government is in the process of drafting a new Law on Foreign Investment to replace the current Investment Law. The proposed law aims to incorporate the following principles:

- Ensure a stable legal environment for investment;

- Uphold the rule of law with consistent and impartial application;

- Prohibit retroactive application of laws that would harm investor rights;

- Guarantee strict adherence to contractual obligations; and

- Promote openness and transparency.

FDI inflow in Mongolia (in billion $)

Source: NSO of Mongolia

FOREIGN DIRECT INVESTMENT STATISTICS

Credit rating

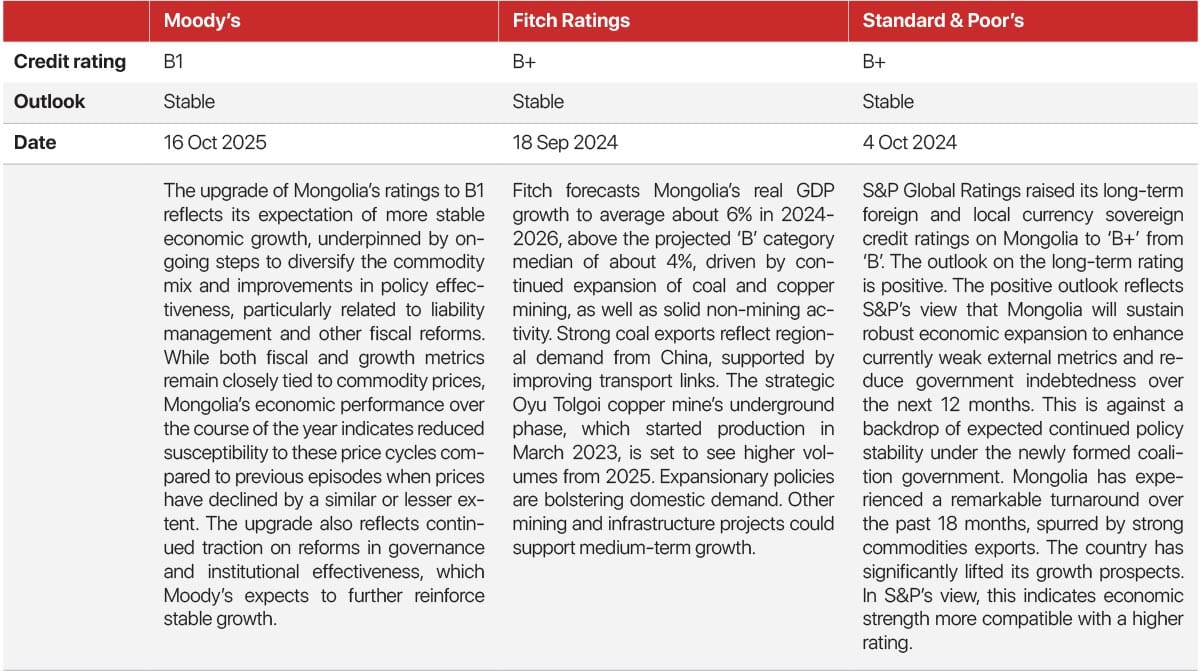

To assess the country’s credit rating, the Government of Mongolia annually references the international credit rating agencies: Fitch Ratings, Moody’s Investors Service, and S&P Global Ratings.

Mongolia’s credit rating has remained stable over the last year, facilitated by the sustained growth of the country’s economy, an expanded financing program in conjunction with the International Monetary Fund, and the stability in commodity markets, despite the Covid-era challenges.

Mongolia’s credit ratings

Currency and foreign remittances

The Tugrik (also known as Tögrög), symbolized as MNT, is Mongolia’s official currency. By the end of Q2 2025, the exchange rate was $1 = MNT 3,581. The rate has been increasing over recent years.

The Government of Mongolia has implemented a liberal policy in relation to foreign exchange. Consequently, the Tugrik is a fully convertible international currency.

Mongolia has a governed floating currency. In other words, the exchange rate is determined purely by the market principle of supply and demand, meaning that the central bank will only intervene occasionally in order to prevent any drastic swings in external foreign exchange markets.

Also, only MNT is used for domestic transactions under the country’s Currency Law.

Investors have the right to freely distribute their assets and income abroad, such as operating profits and dividends without any impediment. The country’s Investment Law states that such monetary capital may be converted into any foreign currency of choice and freely convertible internationally.

No government-caused delays are expected for foreign remittances.

In 2019, Mongolia was placed on the “grey list” by the Financial Action Task Force, a global money laundering and terrorist financing watchdog group. Being on this list means that there are strategic deficiencies in the country’s regimes to counter money laundering, terrorist financing, and proliferation financing that need to be addressed. Within 12 months, Mongolia was off the list. This was extraordinarily quick for a developing country to undertake the reforms and actions needed to get off the grey list, particularly amid a pandemic. As a result, the correspondent banking activities were improved as the major banks of Mongolia maintain correspondent relations with foreign banks and maintain accounts in major world currencies.

CATEGORY

As an exporter of minerals, Mongolia is highly vulnerable to price fluctuations of commodities, therefore, the current turmoil induced by the Covid-19 pandemic poses a risk to the economic stability and exposes its weakness of unsustainable growth. On top of this, the lack of resource management exacerbates its vulnerability as suggested by Fitch Solutions.