Debt risk

Mongolia saw significant foreign currency outflows in the first half of 2024 as it met major payments on external loans, bonds, and swap agreements. The central bank repaid 4.5-billion-yuan, half of its swap agreement with the People’s Bank of China, while $177 million from foreign reserves was allocated to refinance government bonds. These actions lowered external debt and eased repayment pressures on large obligations expected in the coming years.

External debt repayment pressures are anticipated to remain minimal in 2025, with the next major payments—US$600 million in sovereign bonds and US$800 million from the Bank of Mongolia’s foreign exchange swap with China—falling due in 2026.

In 2024, Mongolia’s total external debt reached $37.1 billion, a 7.4% increase ($2.5 billion) from the previous year. This growth was driven by higher long-term loans from banks and loans from investors to foreign-invested companies. The government’s external debt increased by $476.9 million to 8.9 billion, while Central Bank debt decreased by USD 698.5 (39.1%) million from the previous year.

Until recently, the Mongolian government relied on external borrowing to benefit from lower global financing costs. Plans for new domestic securities issuances were postponed, leading to a sharp decline in the pool of domestic debt securities available to the Central Bank of Mongolia for its monetary policy operations, according to the International Monetary Fund’s October 2024 report.

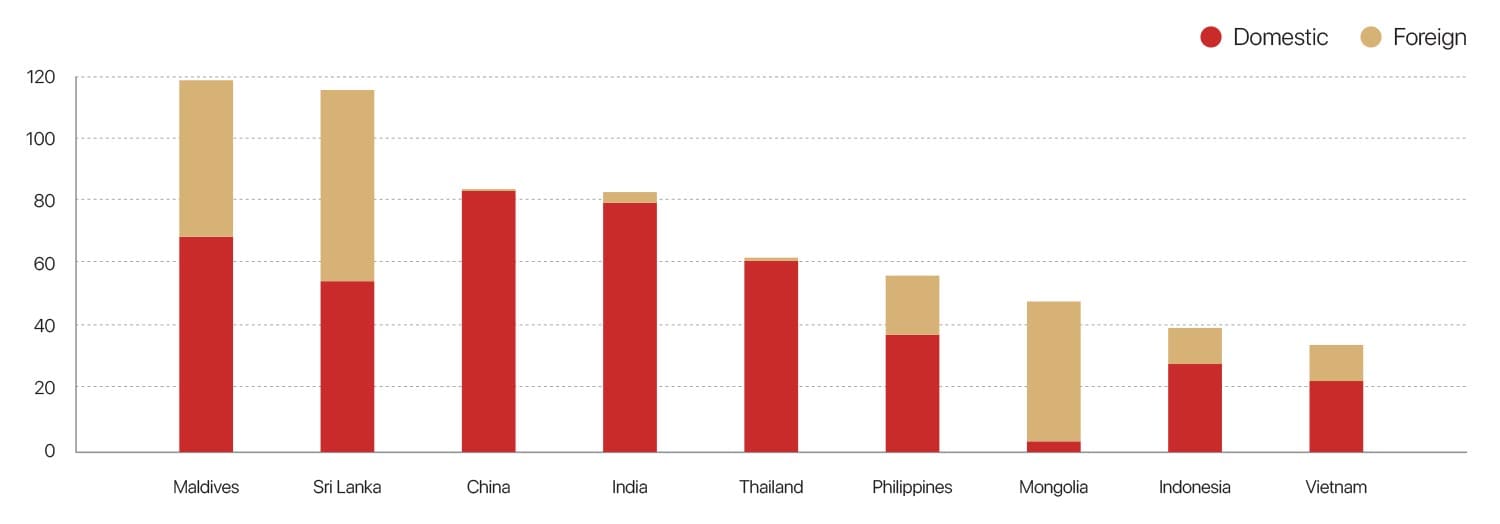

GOVERNMENT DEBT AND PERCENTAGE OF GDP AS OF 2023

Source: Mongolbank

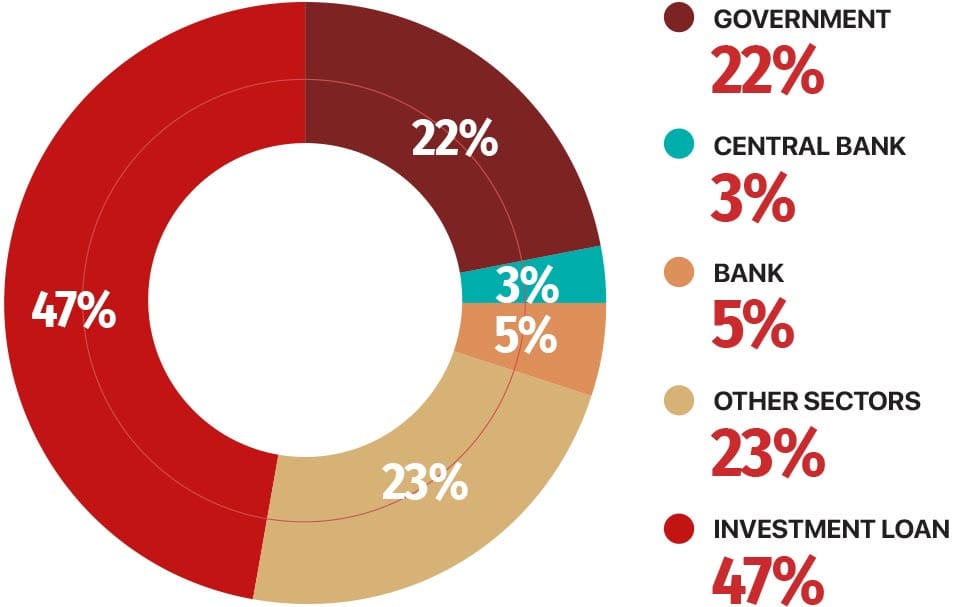

MONGOLIA’S EXTERNAL DEBT AS OF Q2 2024 (MILLION $)

Source: International Monetary Fund

Inflation risk

The Central bank of Mongolia aims to stabilize inflation at around 6% annually, within a +/-2 percentage point range in the medium term. Starting in 2027, the target is set to be reduced to a midpoint of 5% with the same ± 2% range.

The annual inflation rate began to rise again since June 2024, reaching 9.6% in February 2025. In response, the Central Bank of Mongolia, which had previously lowered its policy rate, raised it by two percentage points to 12% and maintained tight monetary policy stance to manage prices and anchor inflation expectations.

Inflation in Mongolia hit 8.2% in June 2025, driven by rising electricity and heating prices. Despite the policy rate hike in early 2025 and some moderation in recent months, inflation is expected to stay above the Central Bank’s target band over 2025-6. Non-food inflation is likely to rise gradually, influenced by higher import prices and increased utility bills. In Mongolia, 40% of inflation is driven by changes in the prices of meat, flour and flour products, vegetables, and fuel.

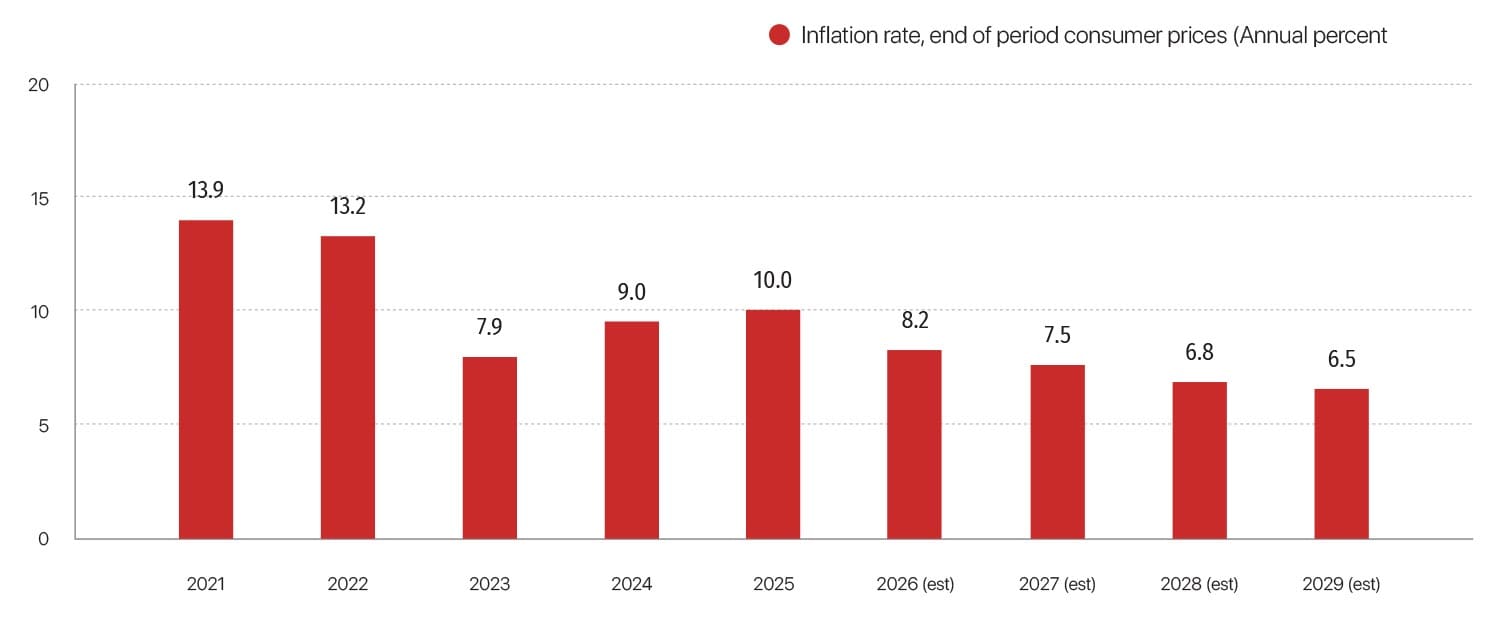

Mongolia’s Inflation Growth Expectations

Source: International Monetary Fund

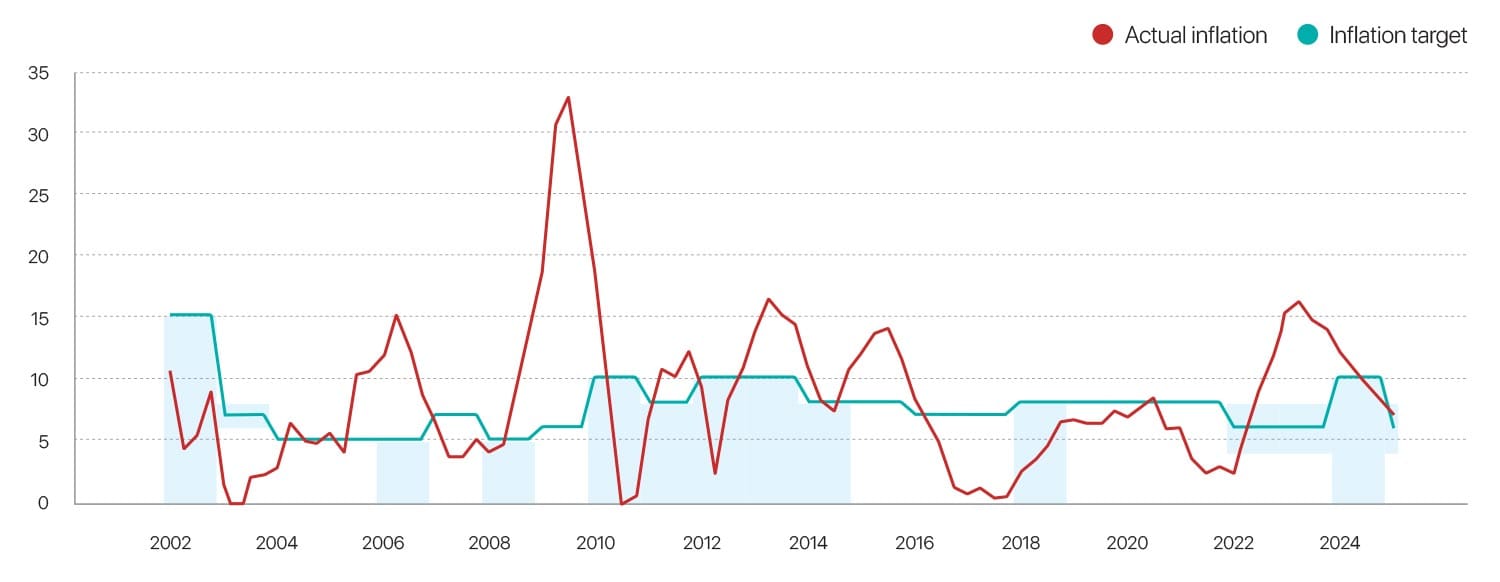

Mongolia’s inflation exceeded the central bank’s target multiple times in recent years

Headline inflation and inflation target, year-on-year percent change

Sources: Bank of Mongolia and IMF staff calculations

Note: Inflation target and band (shaded area) have varied over time and are based on Bank of Mongolia’s annual monetary policy guidelines. Currently, the inflation target is at 6±2 percent. The central bank intends to reduce the target to 5±2 percent starting in 2027.

Credit growth risk

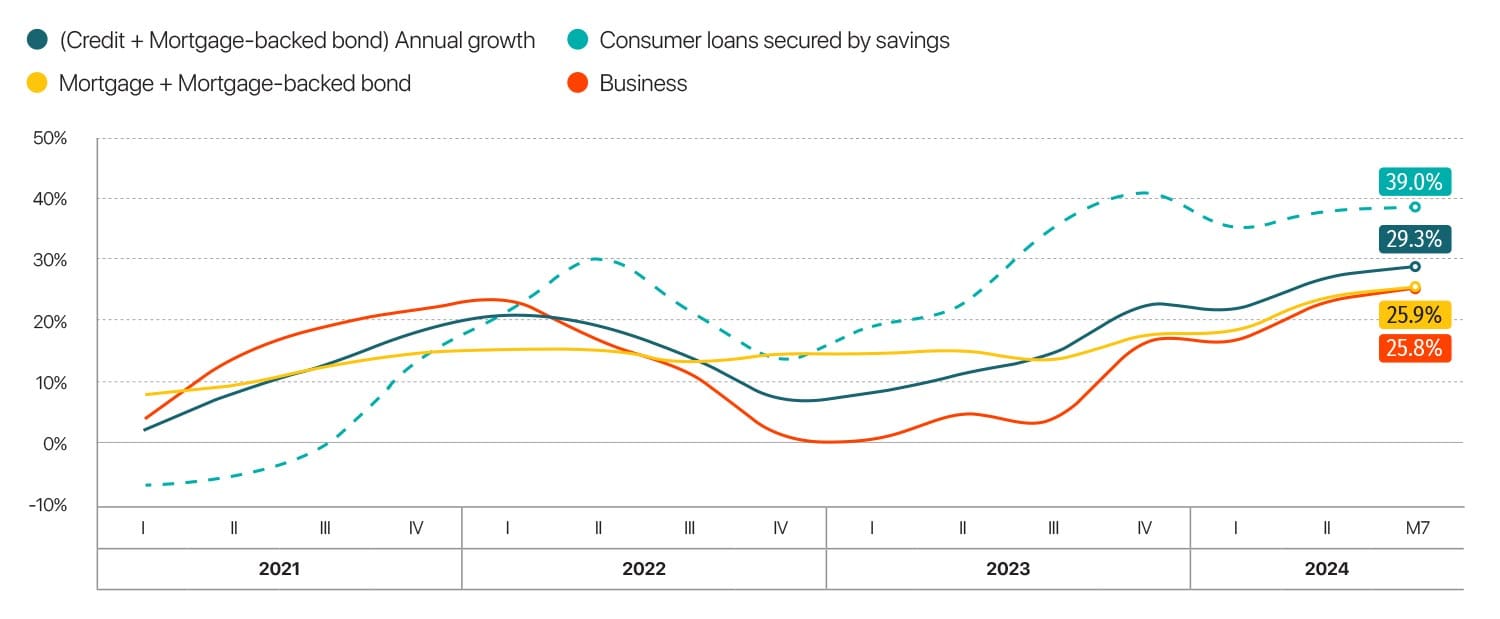

Nationwide credit growth remains at a high level, which could increase inflationary pressures and accumulate risks within the financial system, as noted in the Central Bank’s Monetary Policy Council meeting minutes for Q4 2024.

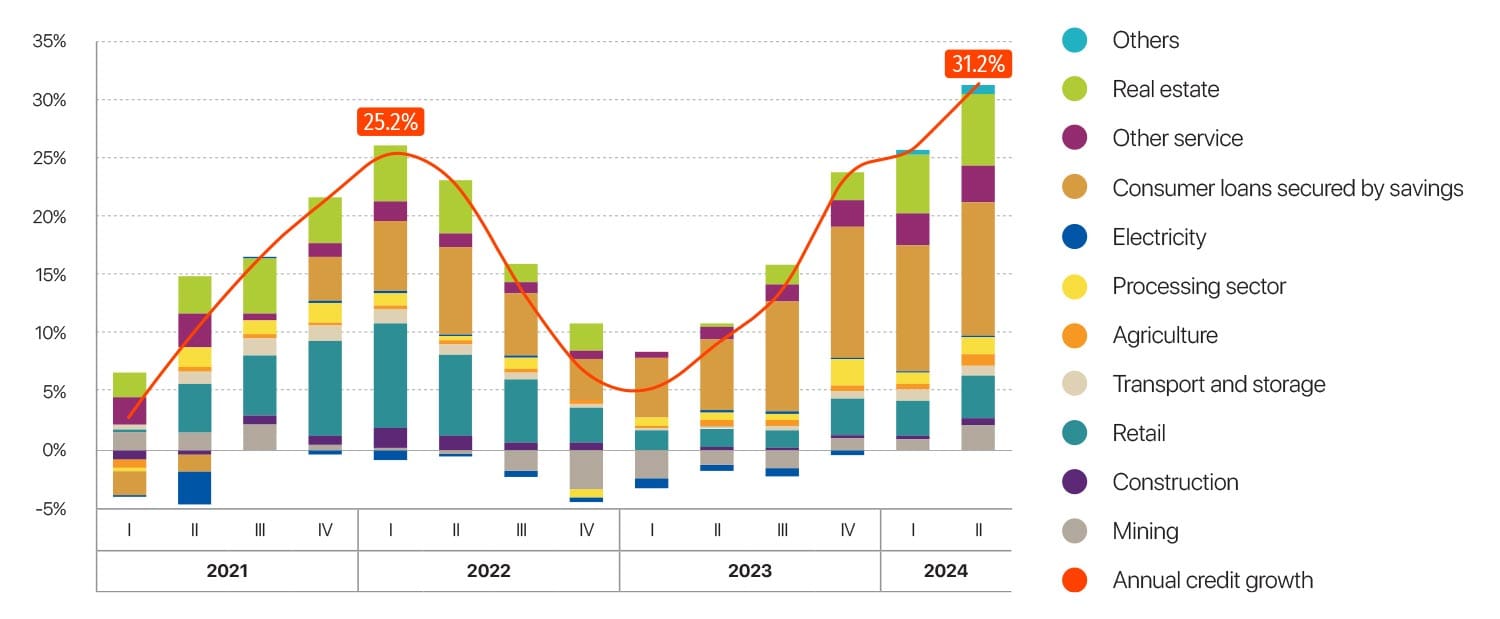

Total credit growth has shown an accelerating trend over the past six quarters. In April and June 2024, the salaries of public sector employees and pension increased, further driving credit expansion. Consumer loans backed by wages and pensions experienced robust growth, contributing about one-third of the total credit expansion by September 2024. Business lending also accelerated from early 2024, adding another one-third to the overall credit growth.

Additionally, various government lending programs with subsidized interest rates contributed to overall credit growth. These included the long-standing subsidized housing mortgage program and agriculture-related programs, which together accounted for 19.6 percent of total outstanding loans by September.

Total annual credit growth

Source: Mongolbank

Sectoral Credit Growth in the Banking Industry

Source: Mongolbank

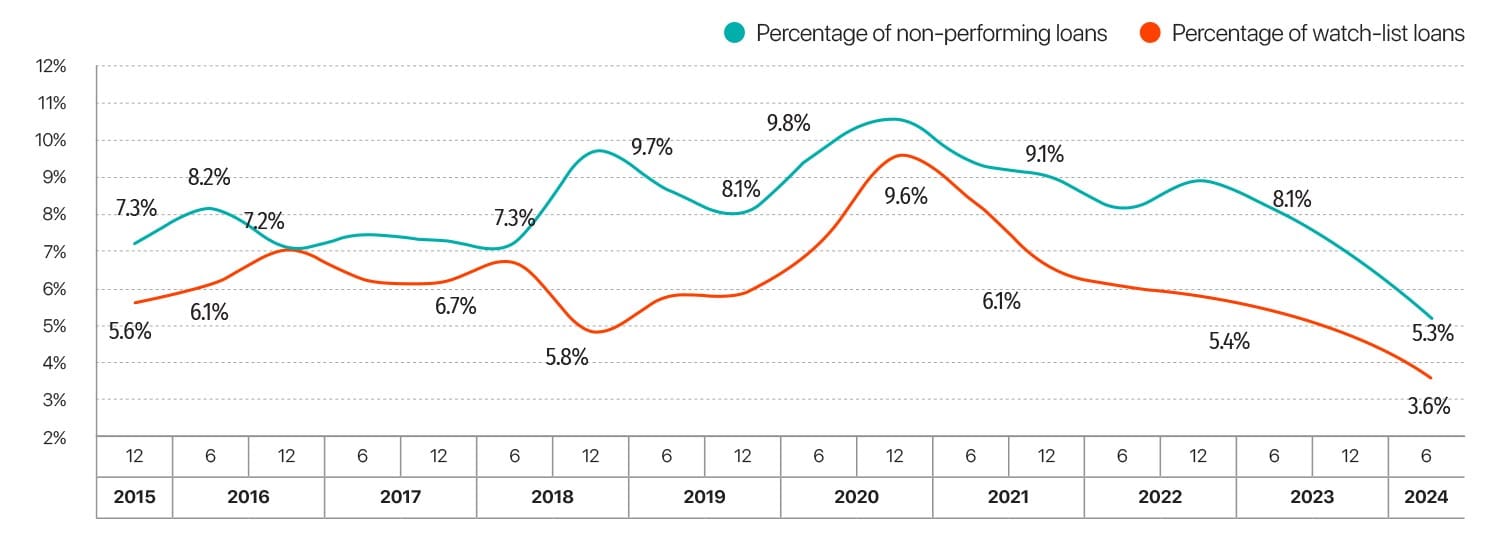

Improvements in the quality of business loans, along with strong economic activity, likely reduced banks’ risk aversion toward business lending. For instance, the non-performing loan (NPL) ratio for business loans declined from 12.0 percent at the end of 2023 to 9.5 percent by September 2024, as businesses in sectors such as construction, real estate, and mining flourished, based on the World Bank’s Mongolia Economic Update released in November 2024.

Percentage of total loans comprised of watch-list and non-performing loans

Source: Mongolbank

Economic Vulnerability

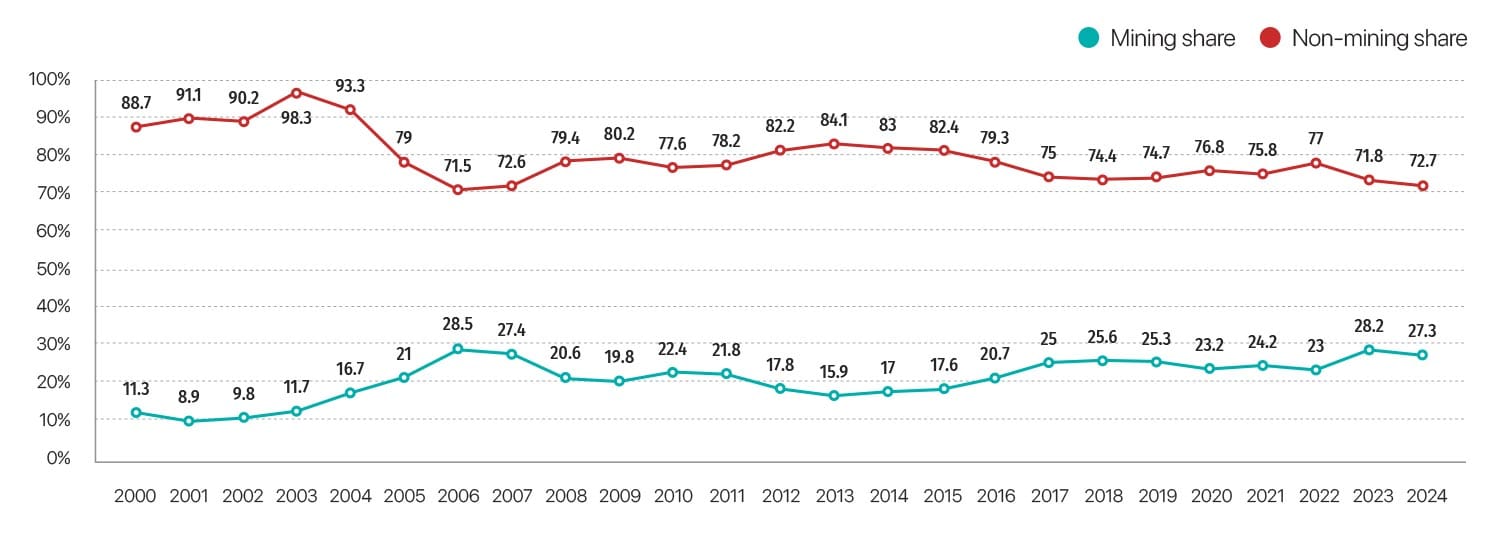

Mongolia’s economy depends heavily on the mineral exports, making it vulnerable to fluctuations in the global commodity market. Especially, after the discovery of major deposits in the early 2000s, the country has been becoming more and more reliant on its commodity sector. Today, mining accounts for 30% of GDP, up from one-tenth in 2000.

Mining industry share of GDP in percentage

Source: NSO

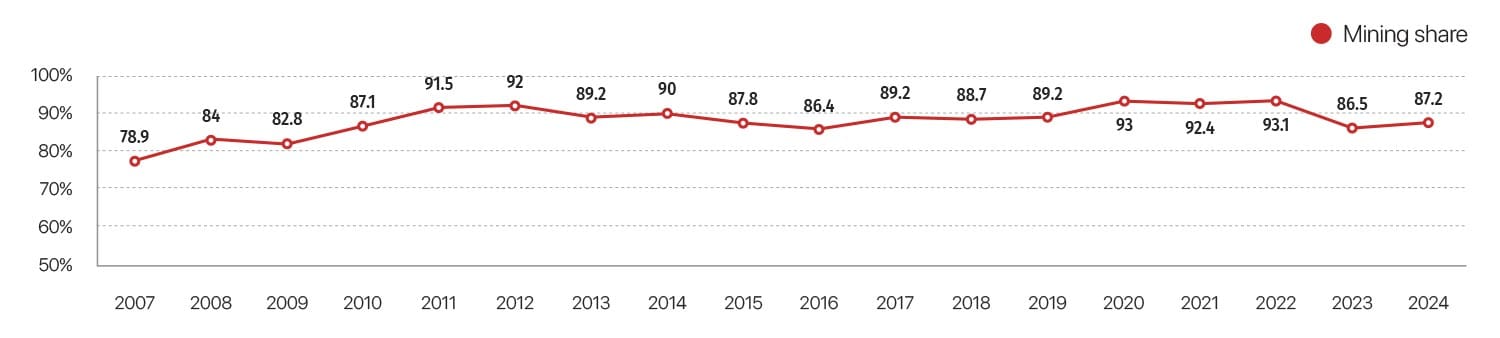

Mining share of total export in percentage

Source: NSO

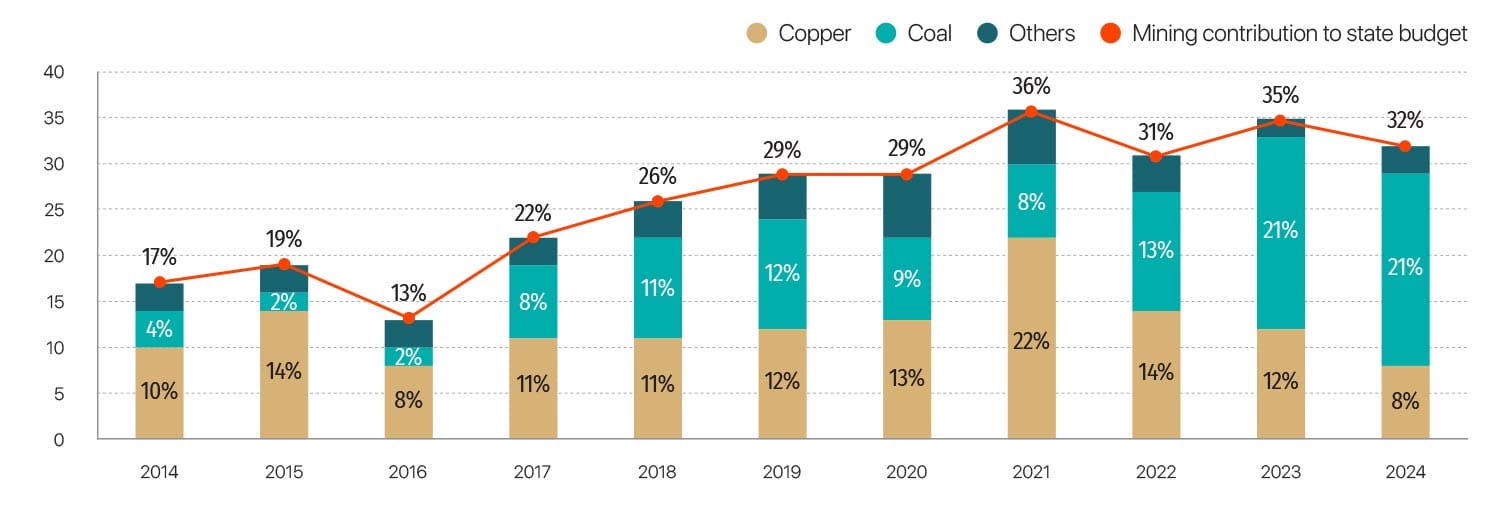

Mining Sector Tax Share by Mineral Type

Source: NSO

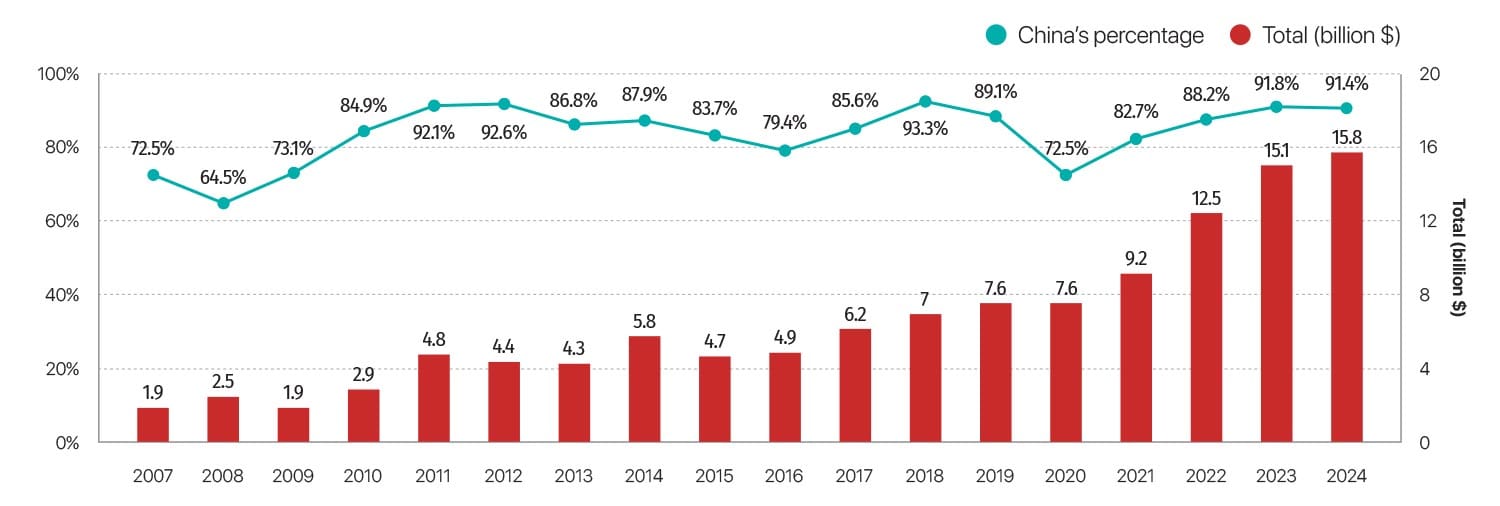

Mongolia’s commodity export performance relies heavily on Mainland China given that it accounts for nearly 80.0% of total shipments and nearly 40.0% of the country’s GDP. This reliance poses a significant risk to Mongolia’s economic outlook, particularly if China experiences an unexpected economic slowdown or coking coal price decrease in China’s buyers, Fitch Solutions noted.

Share of Exports to China in Mongolia’s Total Exports

Source: National Statistics Office of Mongolia