Investment-related support

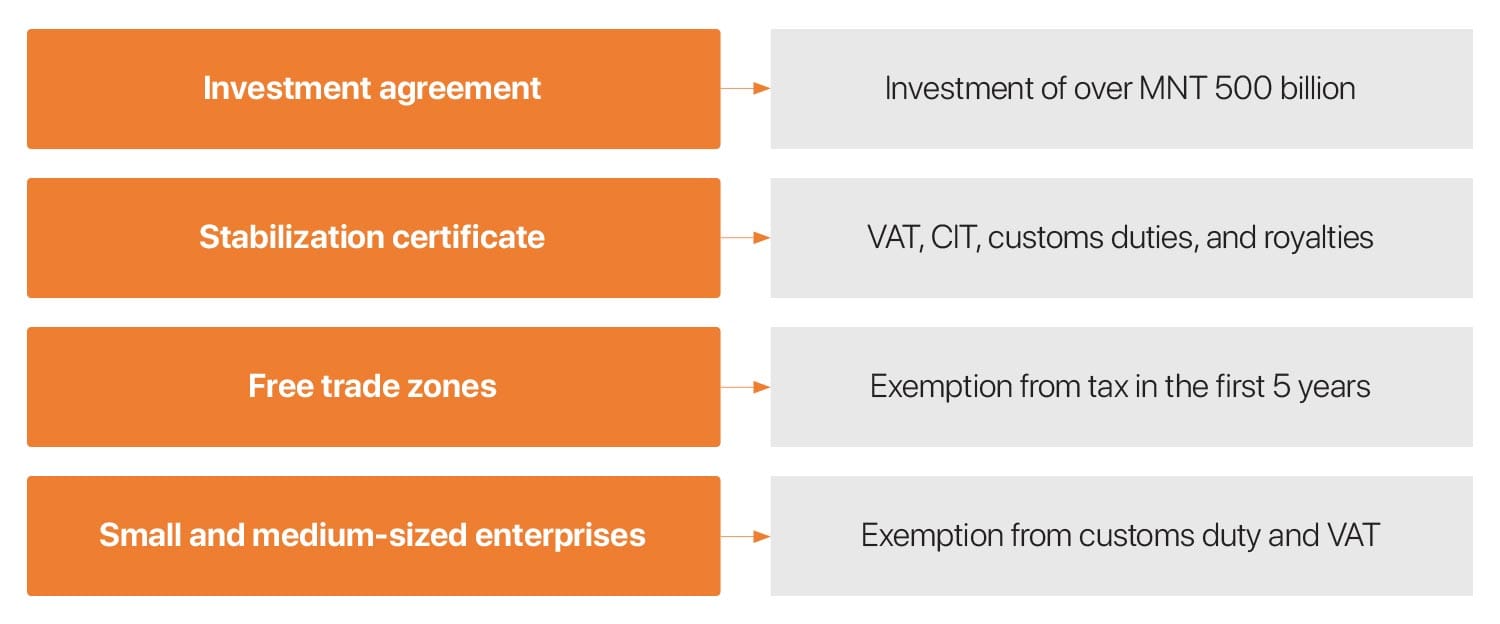

The Government of Mongolia provides support to both local and foreign investors on an equal condition and without discrimination.

Tax incentives include the following:

- Exemptions from tax

- Tax credits

- Possibility to use accelerated depreciation for tax purposes

- Tax losses carried forward

- Deduction of employee training costs from taxable income

Non-tax incentives include:

- Favorable conditions such as supporting the financing of innovation projects and incentives for conducting operations in free trade zones, technology and science parks.

- Increasing the ratio of foreign employees to local employees.

- Simplified visa arrangements.

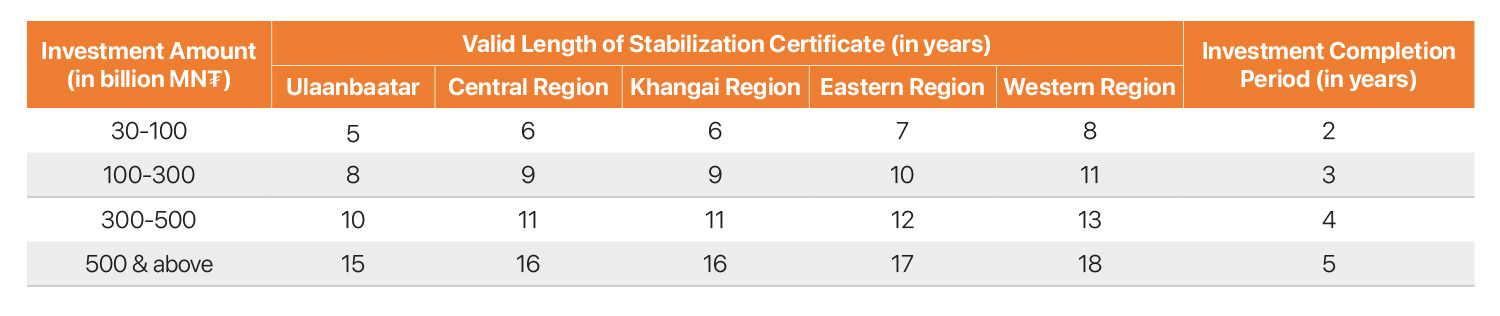

Tax Stabilization Certificate

Furthermore, foreign investors who incorporate companies and conduct business operations in Mongolia are offered “Stabilization Certificates,” which propose a stabilized amount and rate of taxes and other payments to the government during their business operation period in the country.

The holder of a Stabilization Certificate is guaranteed stabilized tax rates for a period of five to eighteen years depending on the amount, industry, and geographic location of the investment in Mongolia, and should comply with the criteria stated in the law.

- Corporate Income Tax;

- Customs Duty;

- Value-Added Tax; and

- Mineral Royalty Tax.

If the above-mentioned four taxes are increased during the effective period of the Stabilization Agreement, they will be ineffective to entities with a Stabilization Certificate and will be effective in cases where taxes are reduced.

The stabilization certificate conditions and grants for mining extraction, heavy industry and infrastructure sectors

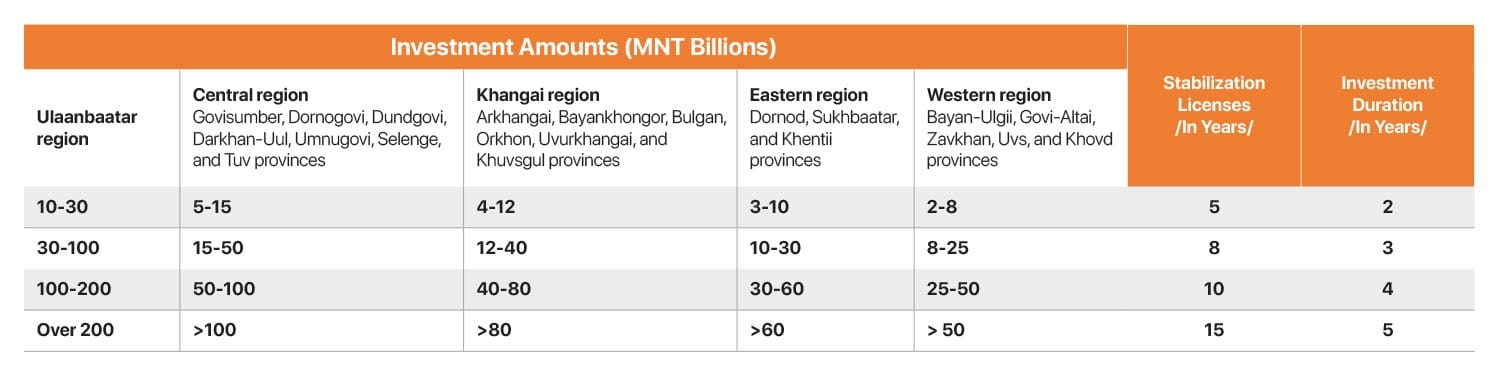

Stabilization certificate conditions and grants for other sectors

State authority in charge of investment affairs may extend by two years the period within which the investment must be made, upon an investor’s application. If certain conditions are met, the stabilization certificate period may be extended by 1.5 times for some projects. In other words, favorable tax conditions can prevail for up to 27 years. Certain conditions include the following:

- Manufacturing of import-competing goods that are important for the long-term sustainable development of Mongolia and goods meant for export.

- Investment worth over MNT 500 billion ($146.1m)

- Projects that require over three years of development.

- When investors and entities meet the requirements for a stabilization certificate are engaged in a value-added processing factory and exporting its main products.

P.S.: Stabilization of taxes will not apply to the manufacturing, import, and sales of tobacco and alcohol.

Requirements and terms for the stabilization certificate include the following:

- A copy of the business plan and the feasibility study.

- Evidence that the total investment amount and investment completion period meet the minimum requirements under the Investment Law of Mongolia.

- Environmentally friendly operations;

- Commitment to the creation of stable employment.

- Transfer of technology & know-how.

Investment Agreement

The Government of Mongolia shall conclude an investment agreement with the investor with intentions of investing sums MNT 500 billion and more at the investor`s request, with the purpose of ensuring the stability of business environment. This means, for example, the tax rate shall be stable over the duration of the investor’s business activities. In other words, if a new tax is introduced later than the current one, it will not apply to the company that entered into the Investment Agreement.

To qualify for an investment agreement, an investor must make a request to the State’s central administrative body in charge of foreign investment matters and will enclose the following documents:

- A detailed plan for creating stable employment.

- Details on what technology and related know-how will be transferred.

- Details on previous activities and projects of the applicant company, including details of its partners, associates, representations etc.

- The certificate of registration for the company being registered in Mongolia or the special permission granted by any other authorized organization, other relevant certificates, as well as a copy of the stability agreement, if exists.

- Certified feasibility study supporting the investment amount of MNT 500 billion or more.

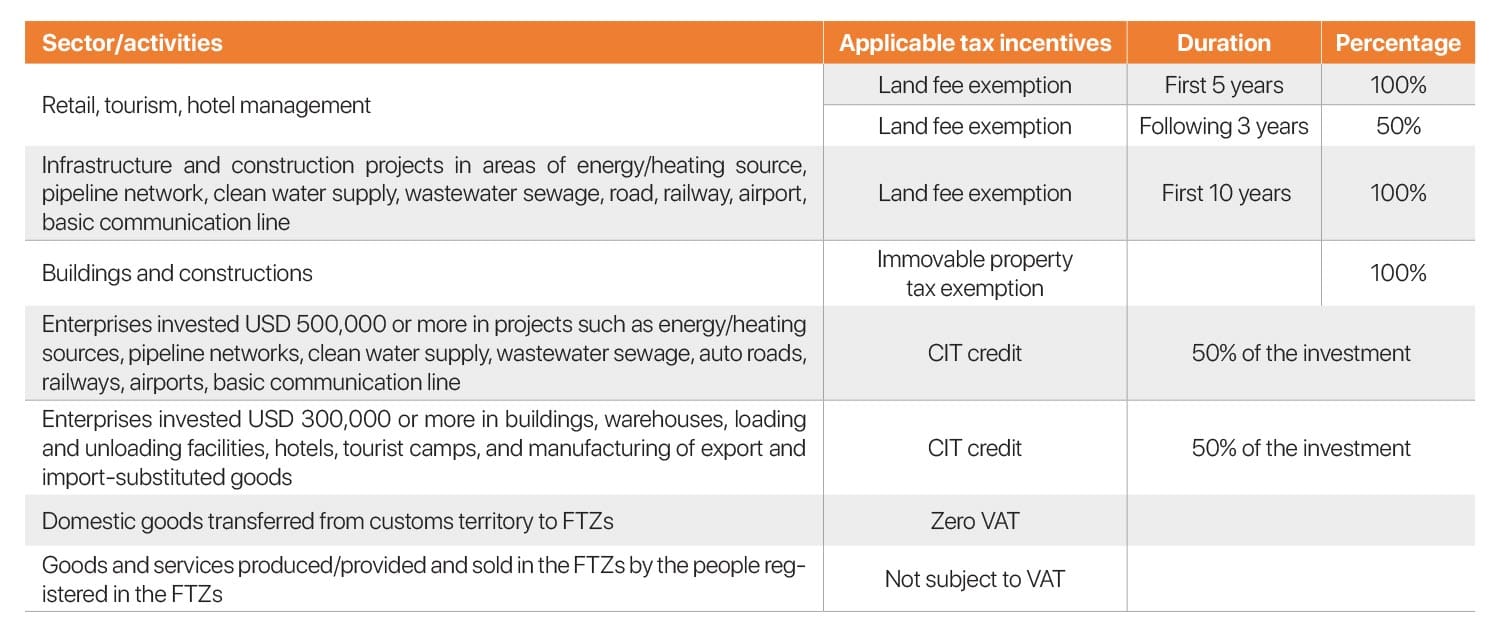

Free Trade Zones

Free trade zones exist at three border crossings, namely Altanbulag, Zamyn-Uud, Khushig Valley and Tsagaan nuur. Special conditions apply to business activities in these zones, including the opportunity for incentives to tax and customs duty, access to transit freight denominated by both foreign and national currencies, easier access to state services, such as special inspections, visa, and better regulations for employment.

TAX INCENTIVES ARE APPLIED IN FTZS

- In addition, equipment imported for construction purposes may be exempted from custom duties and value-added taxes.

Despite this, infrastructures in the free trade zones remains undeveloped and the required follow-up regulations and procedures are not yet in place. Therefore, Mongolian free trade zones still fall short in terms of attracting business.

Non-Tax Incentives

Non-tax incentives may be rendered to investors in the following purposes:

- To render support to investments for business activities in free trade zone , industrial and technological parks, and to provide easier access to public services;

- To support the implementation of the prospective projects in infrastructure, manufacturing, science and education, and to grant the required permits for increasing the quota of the foreign workforce and specialists, thereby exempting them from employment fees.

- To provide the appropriate level of support for financing innovation projects and to guarantee the financing of the manufacture of innovative export-oriented products

- To provide permission to the foreign investors, who have made investment to Mongolia, on multi-entry and permanent residential visas according to the related laws;

- Other non-tax incentives are specified in the applicable laws.

Services for Investors

Investor Protection Council

The Investor Protection Council was established in 2016. The main duties of the Council are to support and provide services to the Government of Mongolia with regards to the protection of investors, legal rights, and interests in line with the leading priority of the Government of Mongolia and to organize negotiations for dispute settlement between investors and the Government.

The Investor Protection Council is composed of a Chairman, 15 members, and a Secretary. The main formation of the Council’s operation structure should be Council’s session. Decisions are reached by the majority of the Council members during the session.

The IPC’s main roles include the following:

- Preview and make a preliminary prognosis on foreign investment-related issues that will be discussed during cabinet meetings.

- Protect the rights of foreign investors and resolve any potential grievances (except the cases examined under court or arbitrage)

- Provide coordination among government agencies, enhance the regulatory investment framework, and promote a favorable and sustainable investment climate.

- Improve the regulatory investment framework, remove duplication and breaches of laws, and introduce investment-related proposals made by relevant organizations to Cabinet.

- Approve any proposals to implement the Investment Law and introduce them to the government.

Online grievance redress system for foreign investors

An online grievance redress system “SIRM” is available for both foreign and local investors. Investors can submit their feedback and complaints to the “Investor Protection Council” or its website www.ipc.gov.mn either personally or through their representatives, as well as receive related information on each processing stage until such time that the complaint has been fully addressed. The submitted complaint shall be resolved with participation from all relevant agencies. This helps create a national database for investor protection that will register all feedback and complaints.

“Invest in Mongolia” – A one-stop service center

Invest in Mongolia – One-stop service center was established to create favorable conditions for investors, set forth for them in legal investment framework, streamline public services, eliminate unnecessary processes and the difficulties that investors are facing.

The One-stop service center provides all public services of State Registration, Social Insurance, Taxation, and Immigration organizations as well as other relevant ministries and public institutions which are related to foreign-invested entities in Mongolia.

The following services are provided by the OSSC:

- Consulting: Information and consulting on investment environment and legal framework in Mongolia.

- Registrations: Processing company registrations, including state registrations, verifications of legal entity amendments and other services related to the legal entities with foreign investment.

- Visas: Issue of visa and residency permits, extensions, foreign investor registrations, and other related services.

- Taxes: Registration of taxpayers, digital signatures, reference, receiving of tax statement, tax collection of foreign-invested companies and foreign investors, provide tax-related guidance and information, as well as delivering the notification of the registration as a taxpayer to their email and mobile phone numbers.

- Social insurance: Registration of social insurance, reference, receipt of statements from foreign-invested companies.

- Banking: Banking services to foreign-invested entities and investors, the opening of bank accounts, transactions, etc.

- Notary services: Notary services, arrangement of all types of agreements, entrustment, certification, signature approval.

- Other services, such as receiving investors’ grievances through the SIRM system, training for investors and entities, big data services, innovation funds, etc.

All services provided by the General Authority for State Registration are available online.

Online services

When you receive an official investor reference letter, please visit http://www.e-invest.mn for more information and to submit your request.

This online platform can also be used by investors to access a wide range of state services.

“In addition, foreign nationals can get various services using the E- Mongolia.mn website”