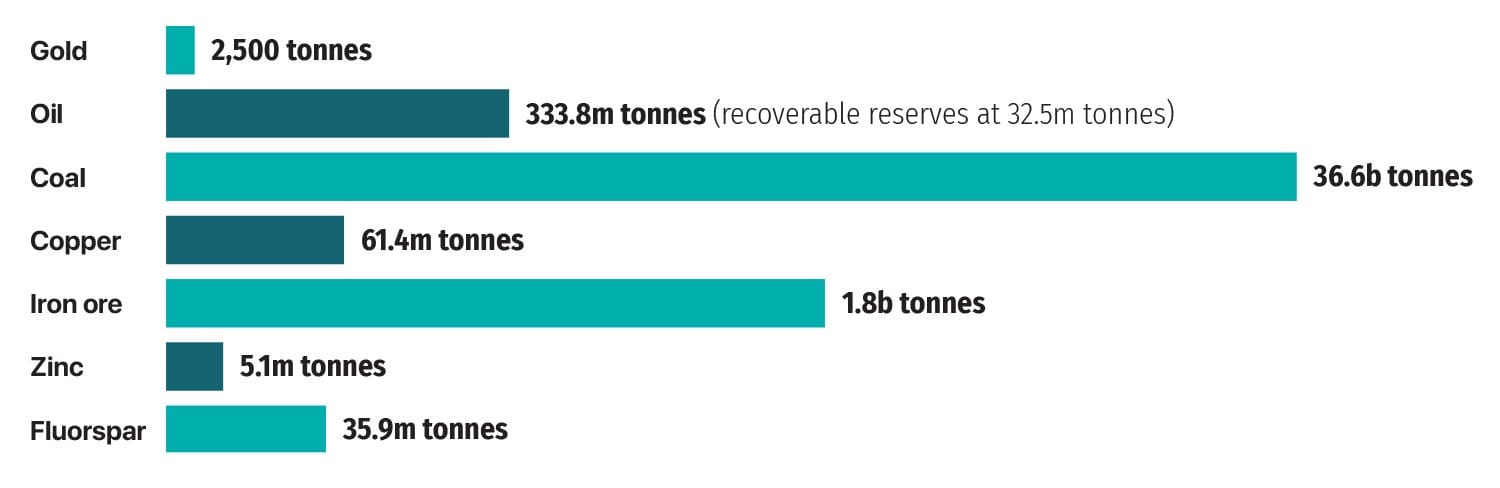

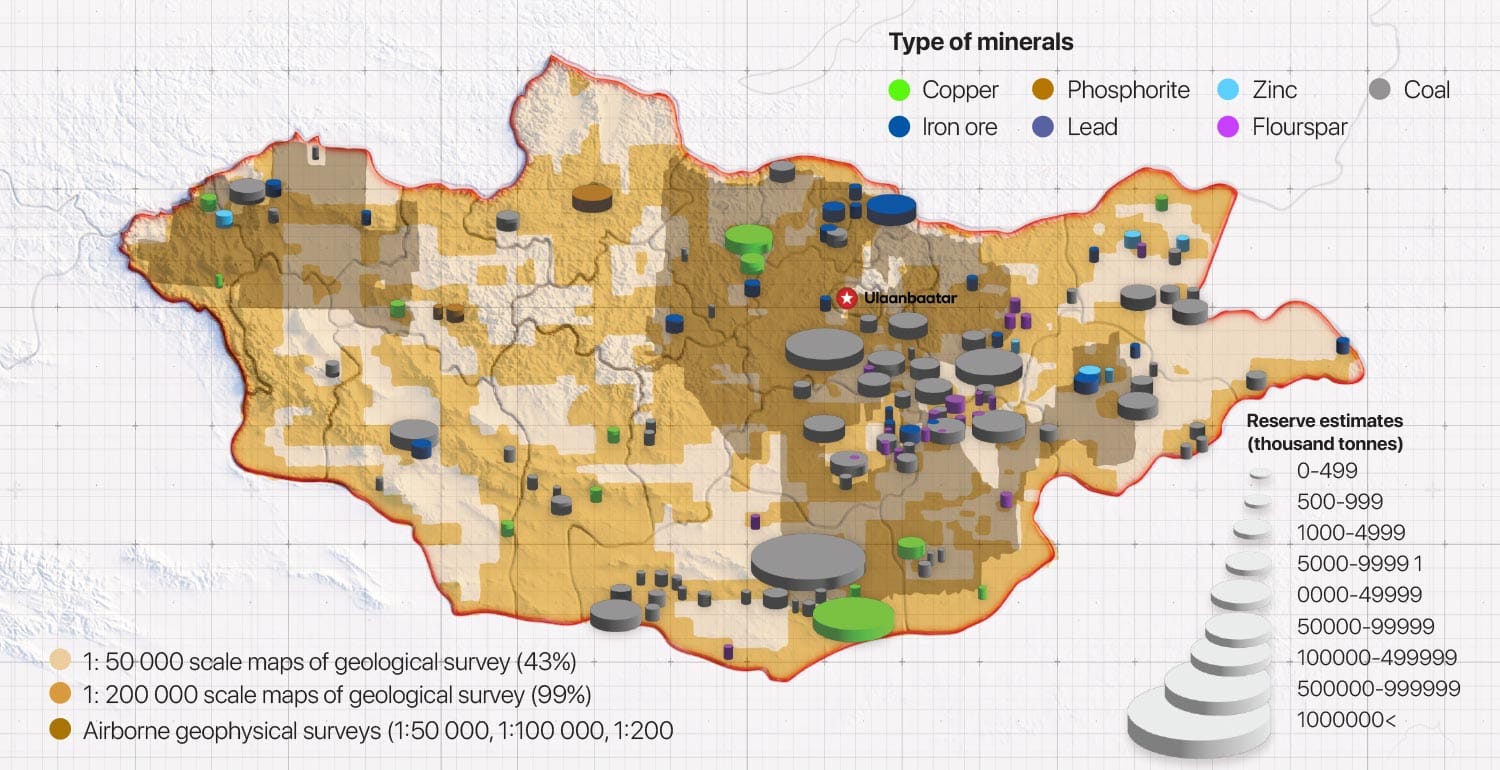

Previous geological surveys and mineral exploration conducted in Mongolia identified a total of 2,500 deposits of 85 types across 10,000 occurrences and thousands of geochemical and geophysical anomalies and mineralized points of interest.

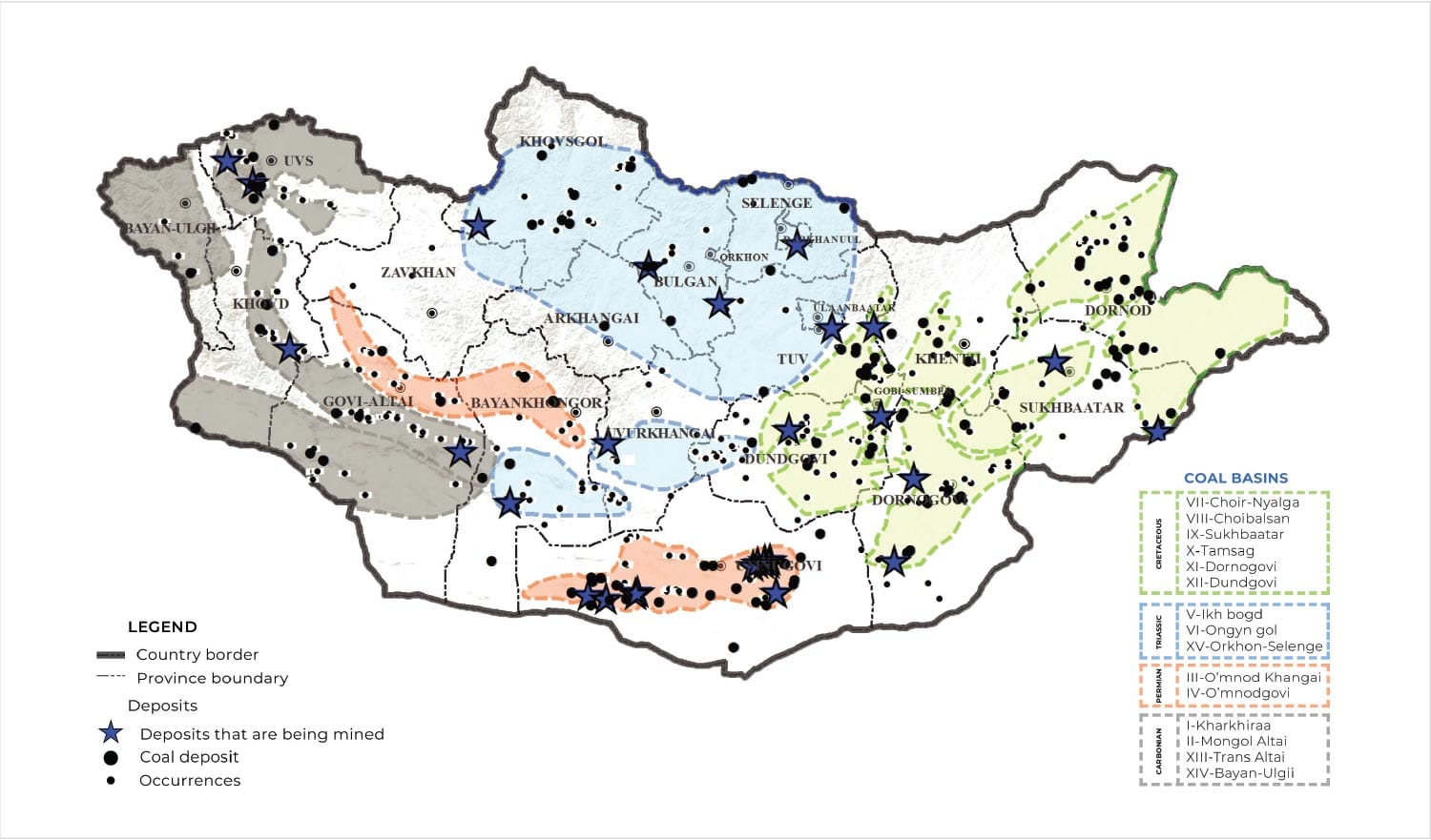

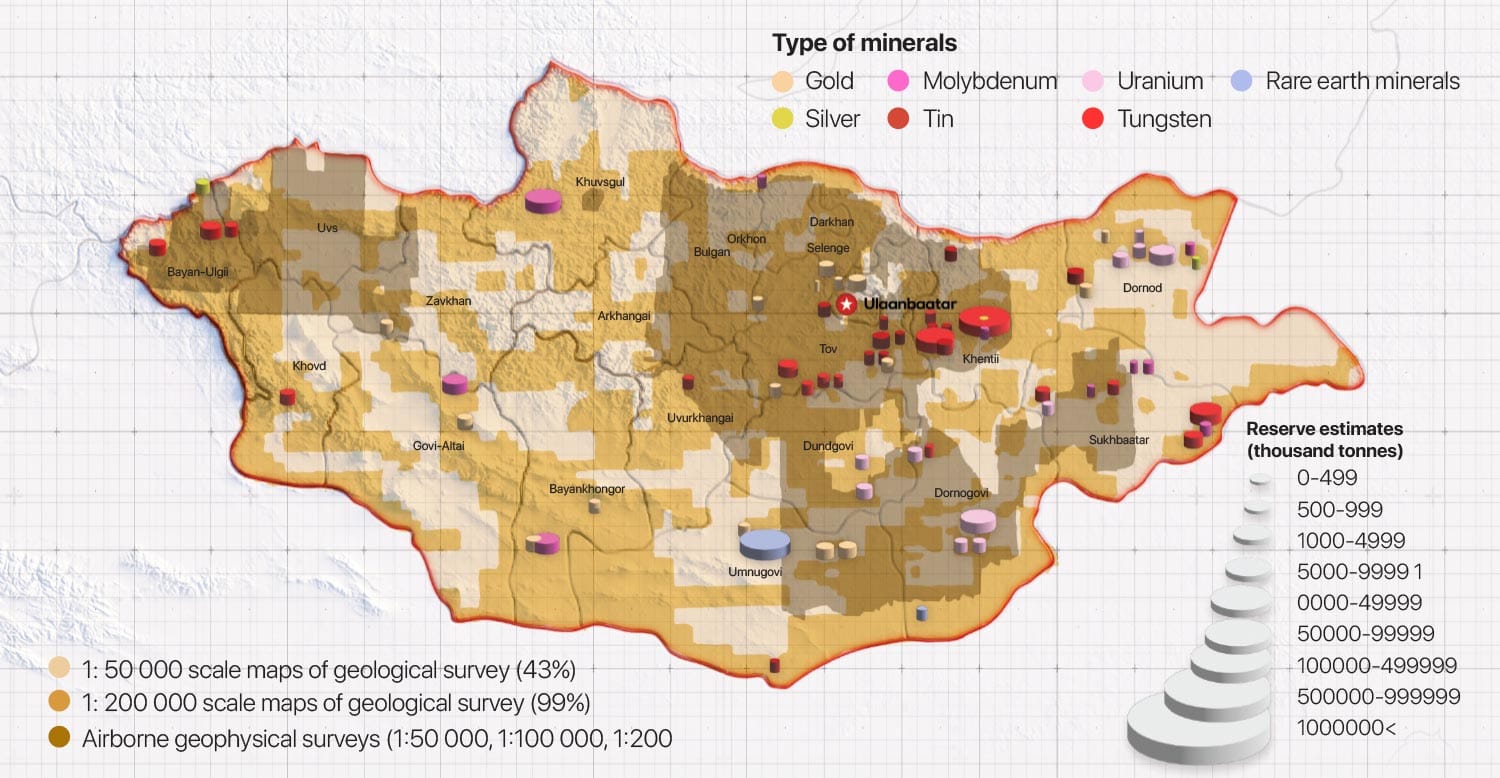

Exploration of gold deposits are mainly located in the southern and northern parts of Khentii and Khangai mountains. Copper and molybdenum deposits are located in the basin of Orkhon and Selenge Rivers, fluorspar is found in Eastern Mongolia and phosphorus in the Khuvsgul region. Large coal reserves are observed in Tavan Tolgoi, Khar tarvagatai, Achit nuur, Bagan nuur and the Uvdug khudag deposits. And the Nalaikh, Sharyn gol, Aduunchuluun and Baganuur deposits play an important role in supplying thermal coal to urban settlements due to their location in key industrial areas.

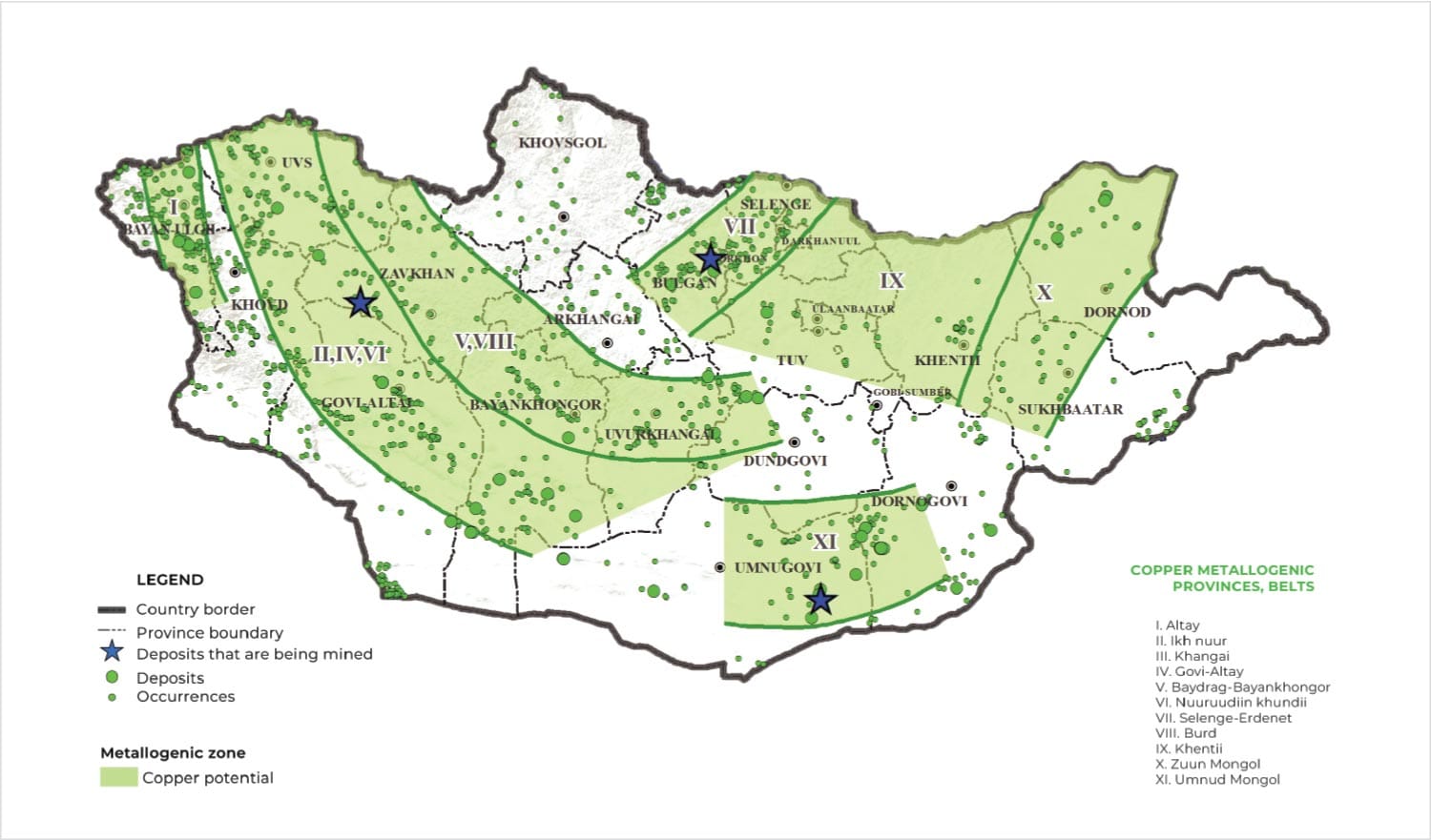

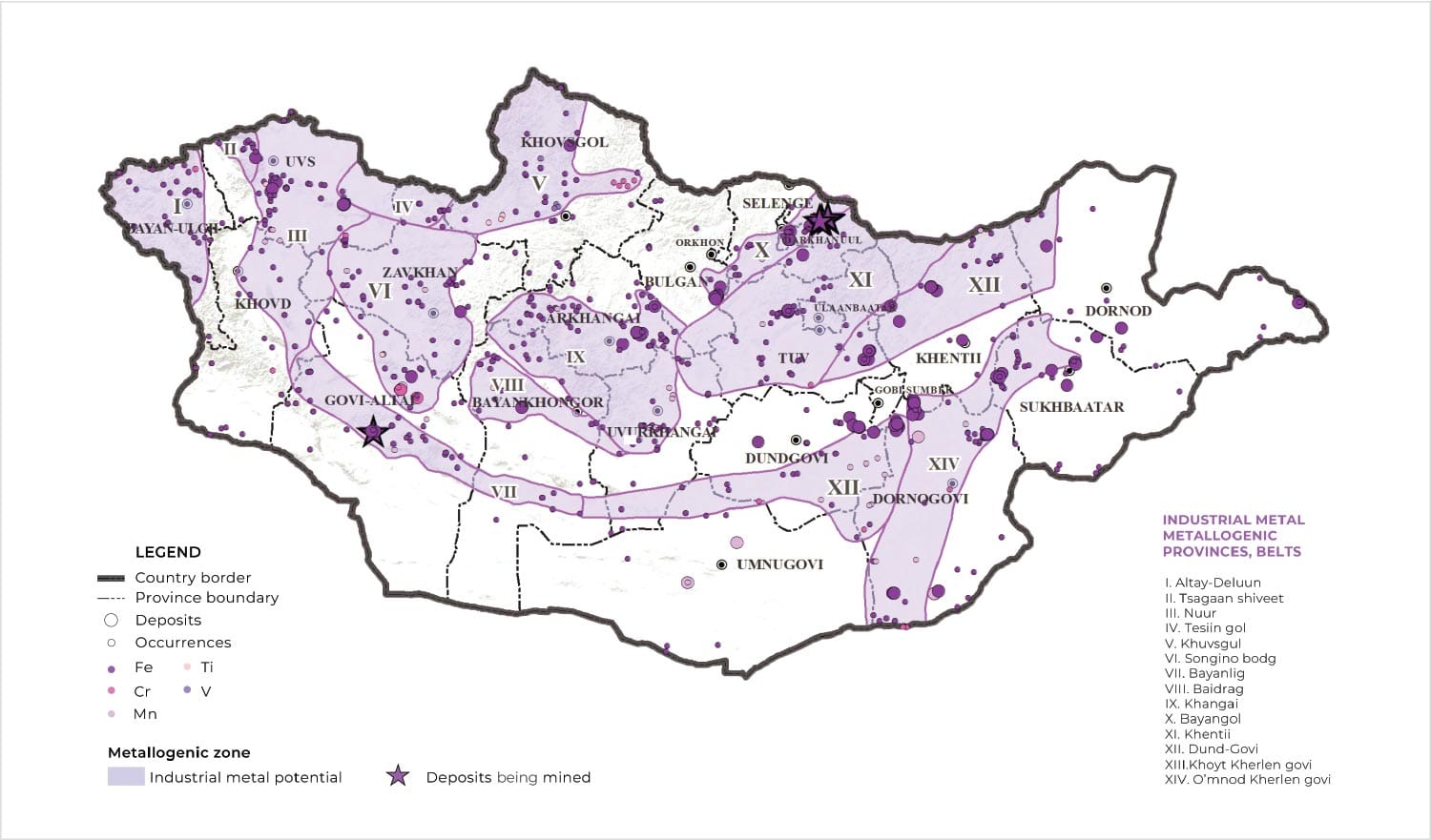

Mongolia has many iron ore deposits such as Tumur tolgoi, Bayar gol and Tamir gol. The majority of copper ore deposits are located in the areas of Orkhon, Selenge, Gobi, south Kherlen, Bayankhongor and Khankhukhii, out of which the largest is the Erdenet Copper Molybdenum deposit in the Orkhon-Selenge province.

The country has many deposits of gold and zinc such as Tumurtyn Ovoo, Salkhit, Tulgatai Mountain and Modon ovoo. The Berkh flourspar mine was opened in 1954 and is one of the largest fluorspar mines in Mongolia. The eastern part of the country also has many fluorspar deposits.

A majority of phosphorus deposits stretch along the west side of Khuvsgul Lake starting at Soyon Mountain. Jewels such as crystal, topaz, sapphire, garnet, chrysolite, amethyst, turquoise and jade can also be found and some of these deposits are of industrial importance.

Mongolia also has the term “strategic mines” which refers to mineral deposits considered critical for the country’s economy and development prospect. These mines typically hold valuable minerals, and in some cases, may demonstrate richness not only in the individual deposits but across the entire region.

Overview of Mongolia’s mineral resources (in tonnes)

Source: The Ministry of Industry and Mineral Resources of Mongolia, 2022

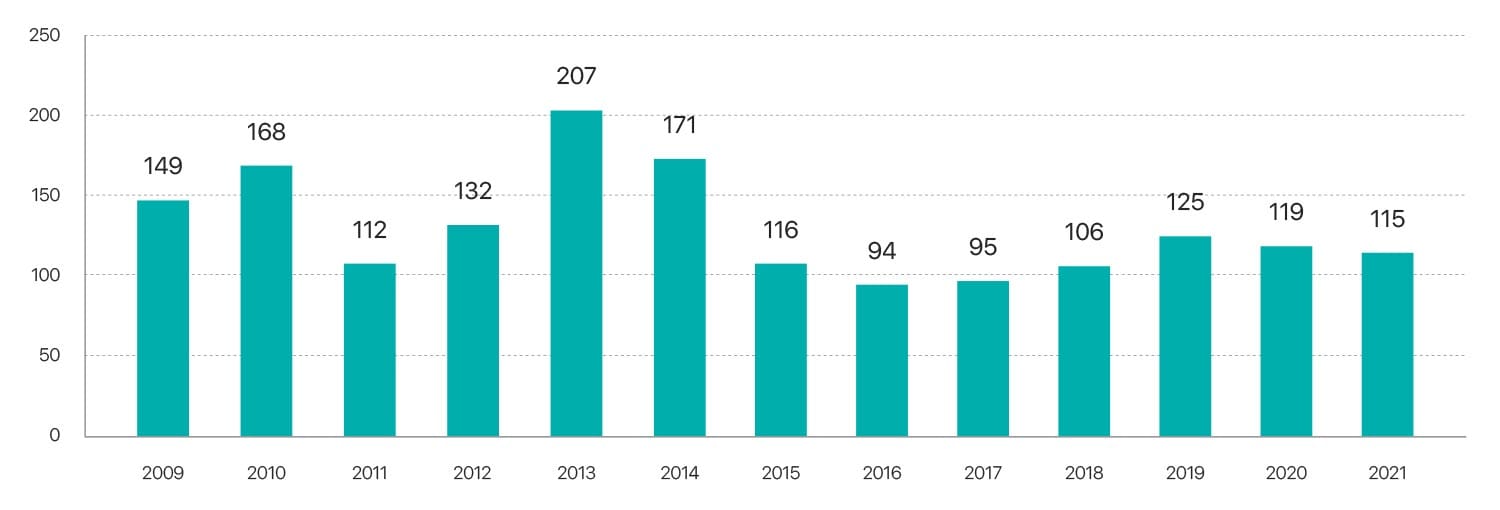

number of registered deposits year by year

Source: The Mineral Resource and Petroleum Authority of Mongolia

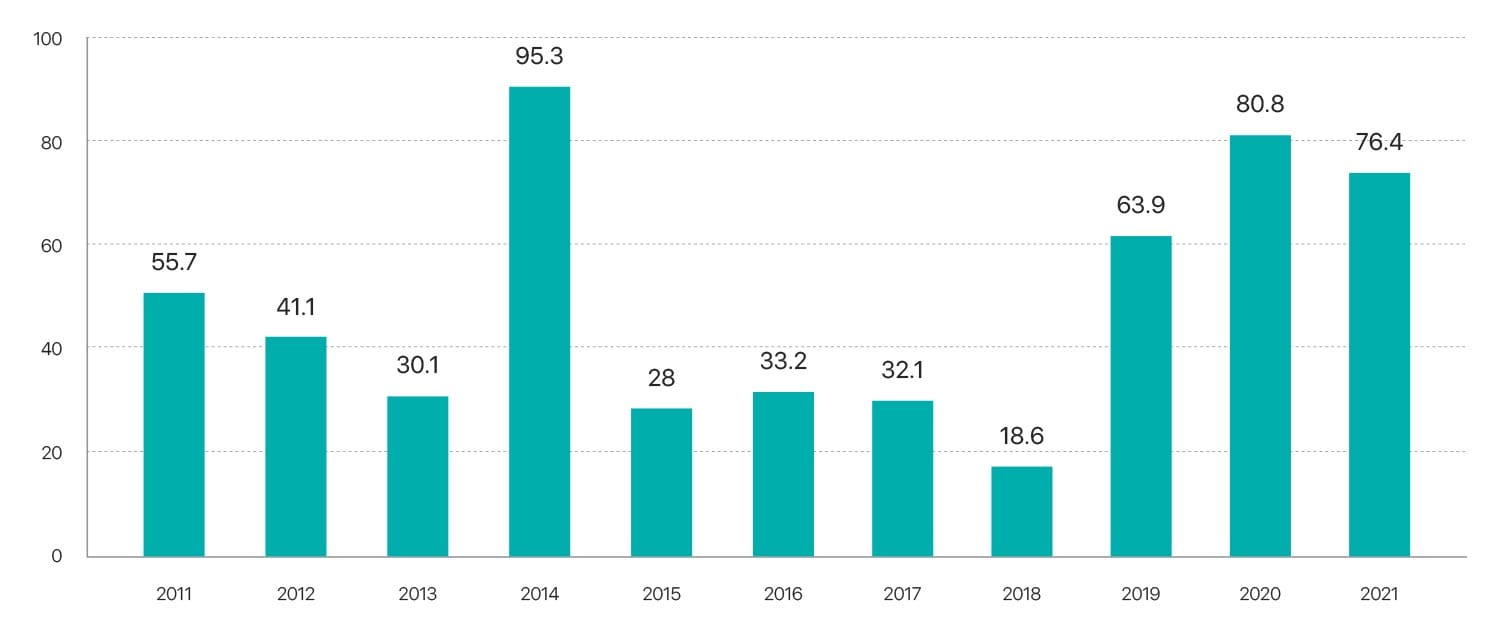

Newly registered hard rock gold mine resources (in tonnes)

Source: The Mineral Resource and Petroleum Authority of Mongolia

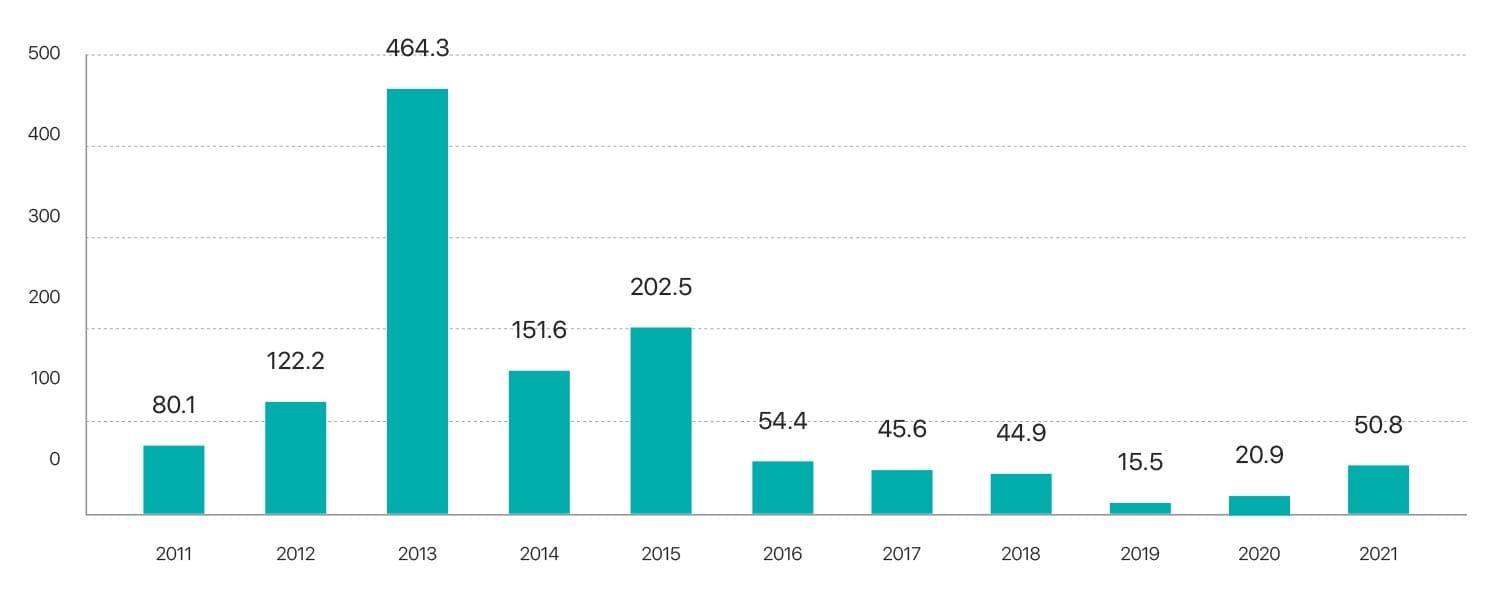

NEWLY REGISTERED IRON ORE RESOURCES (IN MILLION TONNES)

Source: The Mineral Resource and Petroleum Authority of Mongolia

NEWLY REGISTERED FLUORSPAR ORE RESOURCES (IN MILLION TONNES)

Source: The Mineral Resource and Petroleum Authority of Mongolia

To facilitate easy and readily accessible geodata for the industry and investors, Mongolia established the National Geoscience Database, which is managed by the newly formed agency, the National Geological Survey. The database provides clear and accurate information about resources, which is crucial for supporting investment in the sector. In 2022, the National Geological Survey of Mongolia released updated maps of Mongolia’s mineral deposit and occurrence locations, providing a comprehensive understanding of the country’s resource potential.

GEOLOGICAL SURVEY

Source: The Ministry of Mining and Heavy Industry of Mongolia

Location map of coal deposits and occurrences in Mongolia, scale 1: 12 000 000

Source: National Geological Survey of Mongolia

Location map of copper deposits and occurrences in Mongolia, scale 1 : 12 000 000

Source: National Geological Survey of Mongolia

Location map of industrial metals (Fe, Cr, Mn, Ti, V) deposits and occurrences in Mongolia, scale 1 : 12 000 000

Source: National Geological Survey of Mongolia

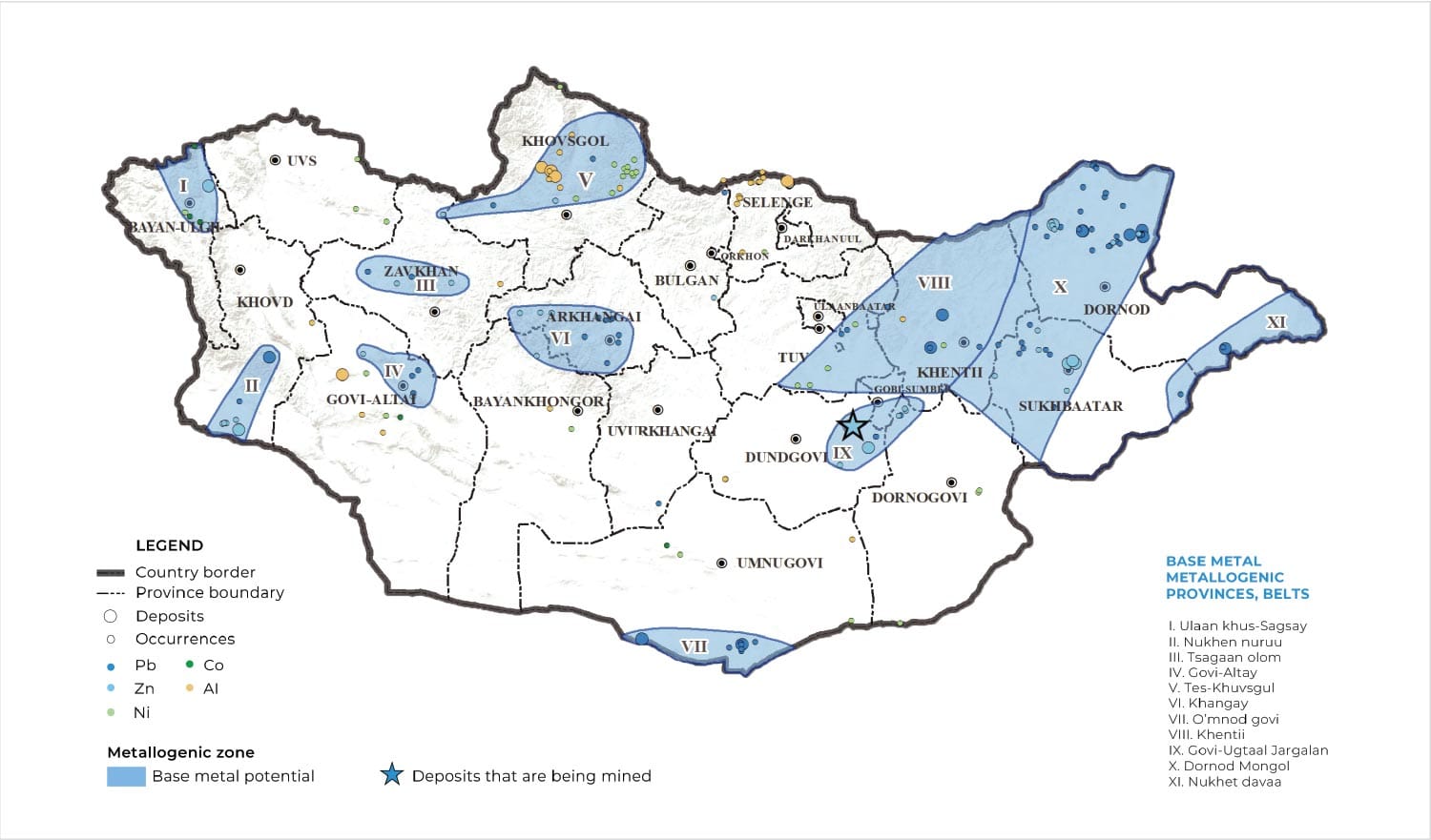

Location map of base metals (Pb, Zn, Ni, Co, Al) deposits and occurrences in Mongolia, scale 1 : 12 000 000

Source: National Geological Survey of Mongolia

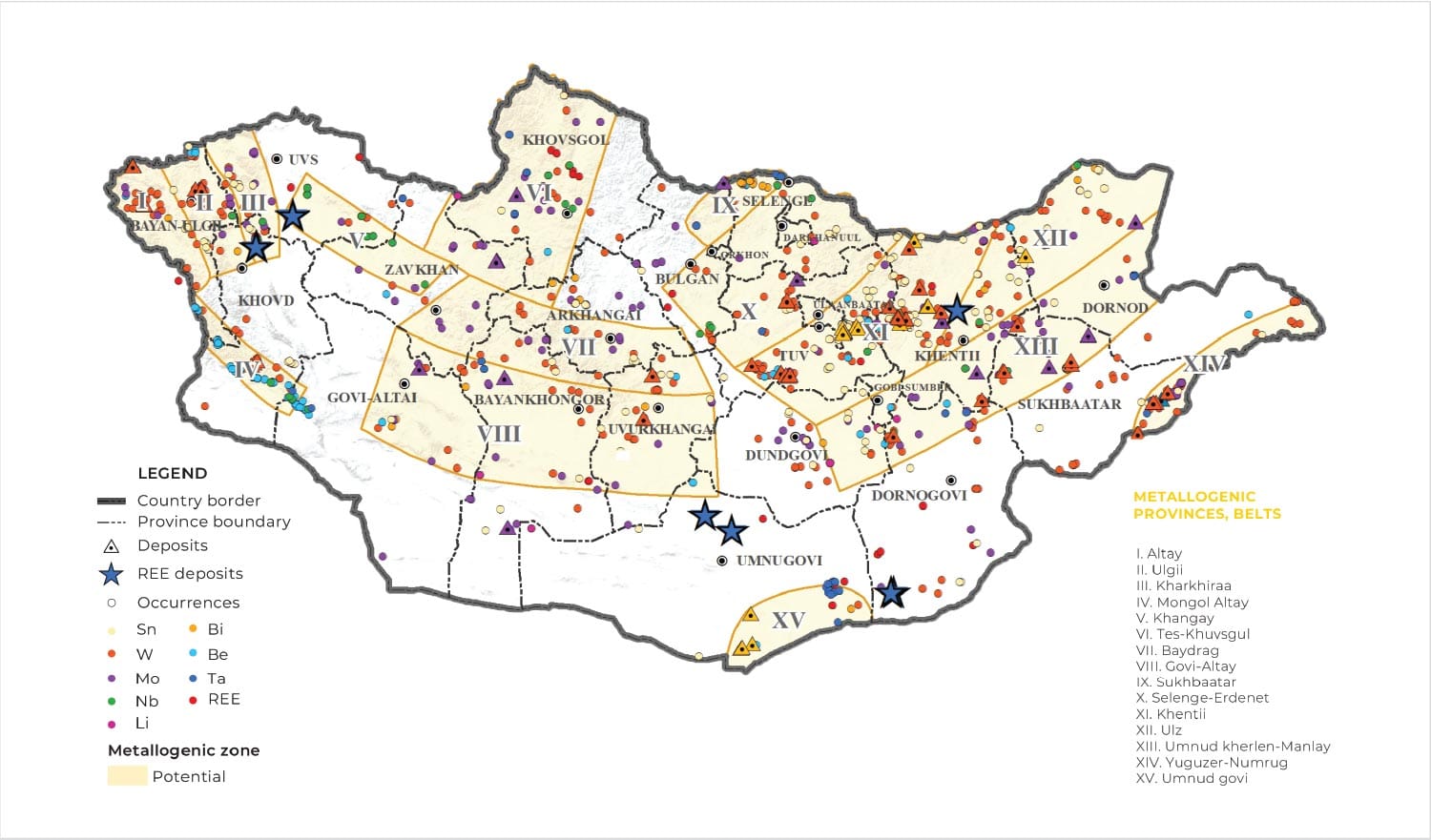

Location map of rare metals (Sn, W, Mo, Bi, Be, Ta, Nb, Li, REE) deposits and occurrences in Mongolia, scale 1 : 12 000 000

Source: National Geological Survey of Mongolia

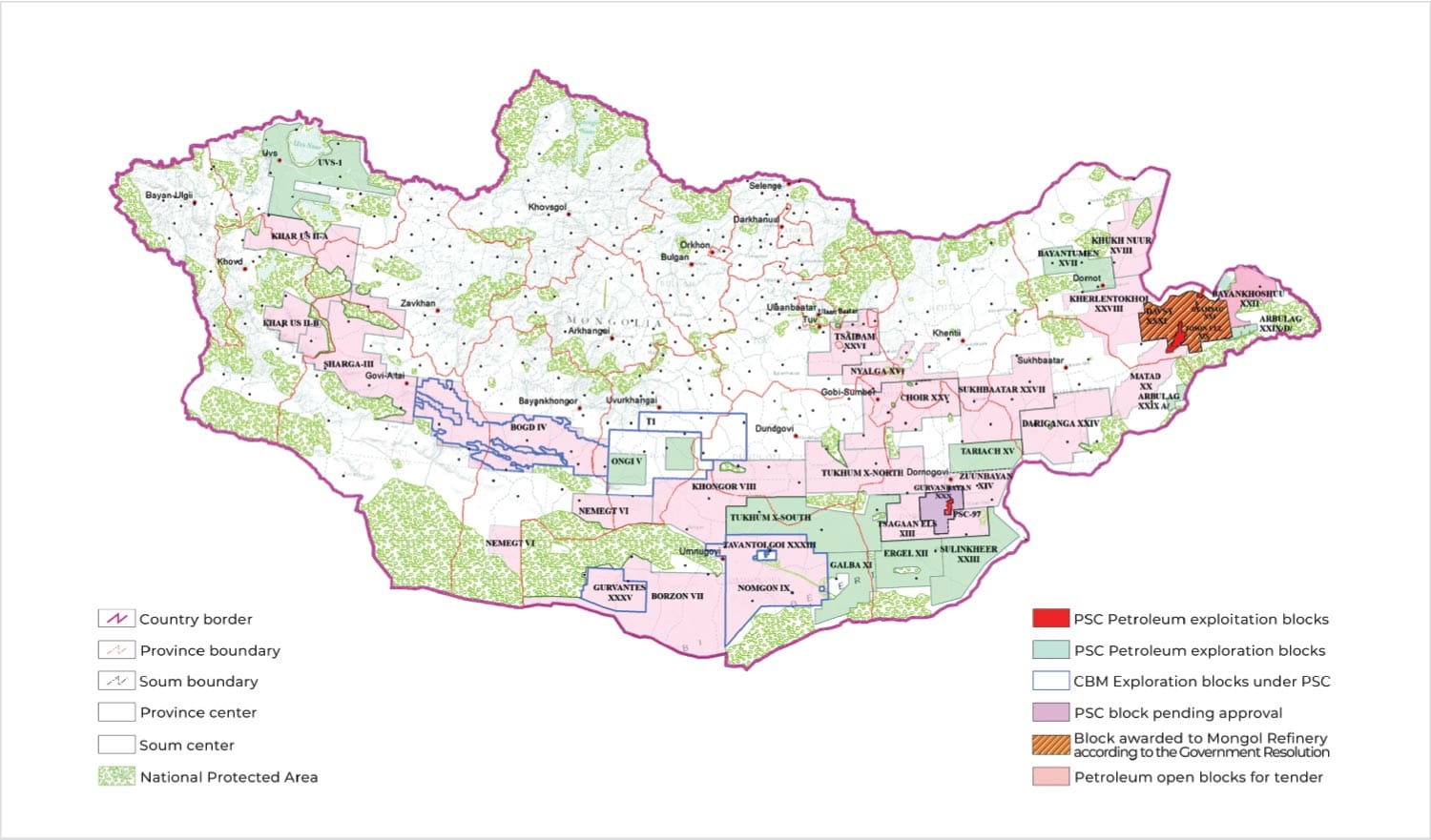

onventional and unconventional oil and gas exploration and exploitation blocks, scale 1 : 6 000 000

Source: National Geological Survey of Mongolia

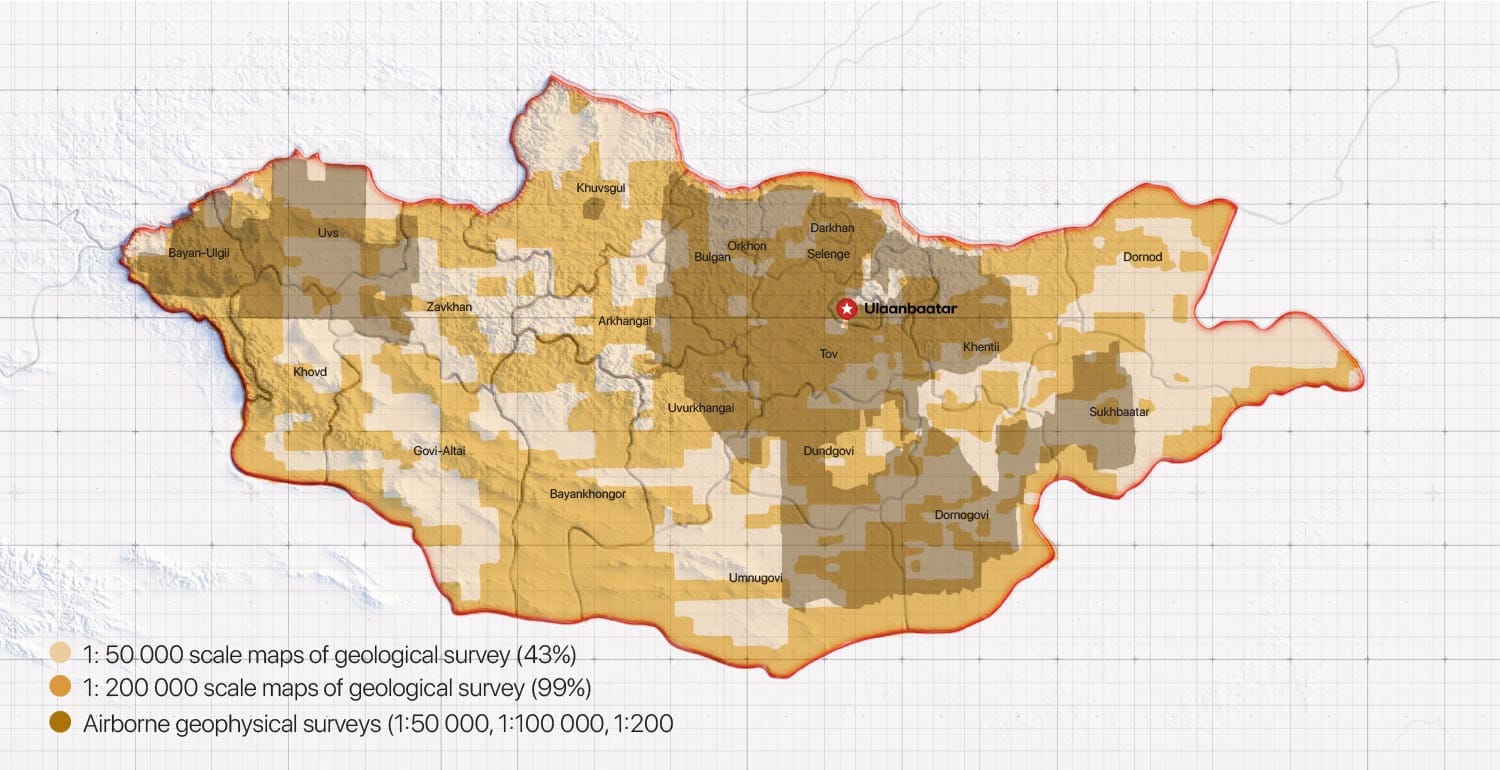

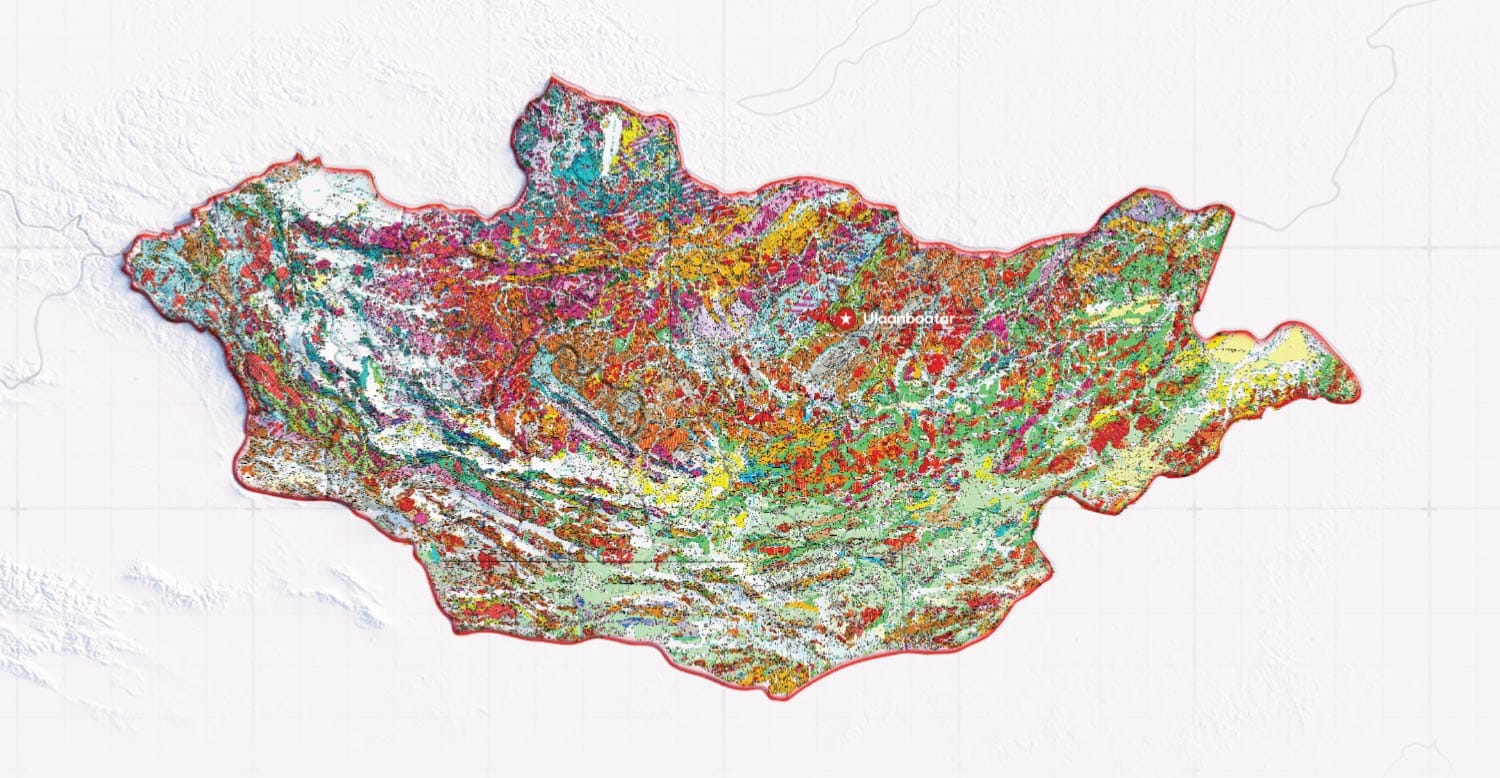

1:200 000 scale outline geological research work had been carried out across 100% of Mongolian territory. However 1:50 000 scale outline work covered only 47% and geophysics research covered 66% of the territory.

Geological and research projects funded by the government of Mongolia 1:50 000 geological mapping and ongoing general exploration projects.

Geological mapping

Source: National Geological Survey of Mongolia

Geological mapping

Source: National Geological Survey of Mongolia

Geological mapping

Source: National Geological Survey of Mongolia

In addition, the government of Mongolia has developed the “MongeoCat” system, a catalog of geological and research reports that meets international standards.

Geological map of Mongolia

Source: National Geological Survey of Mongolia

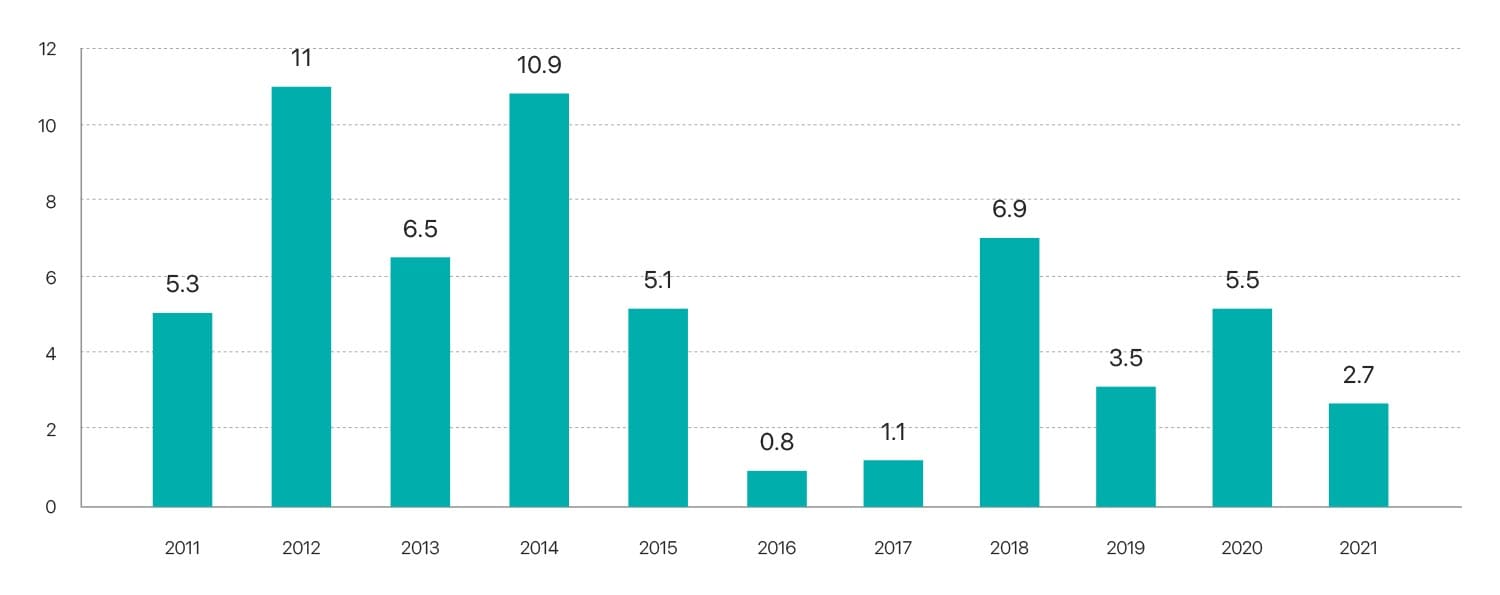

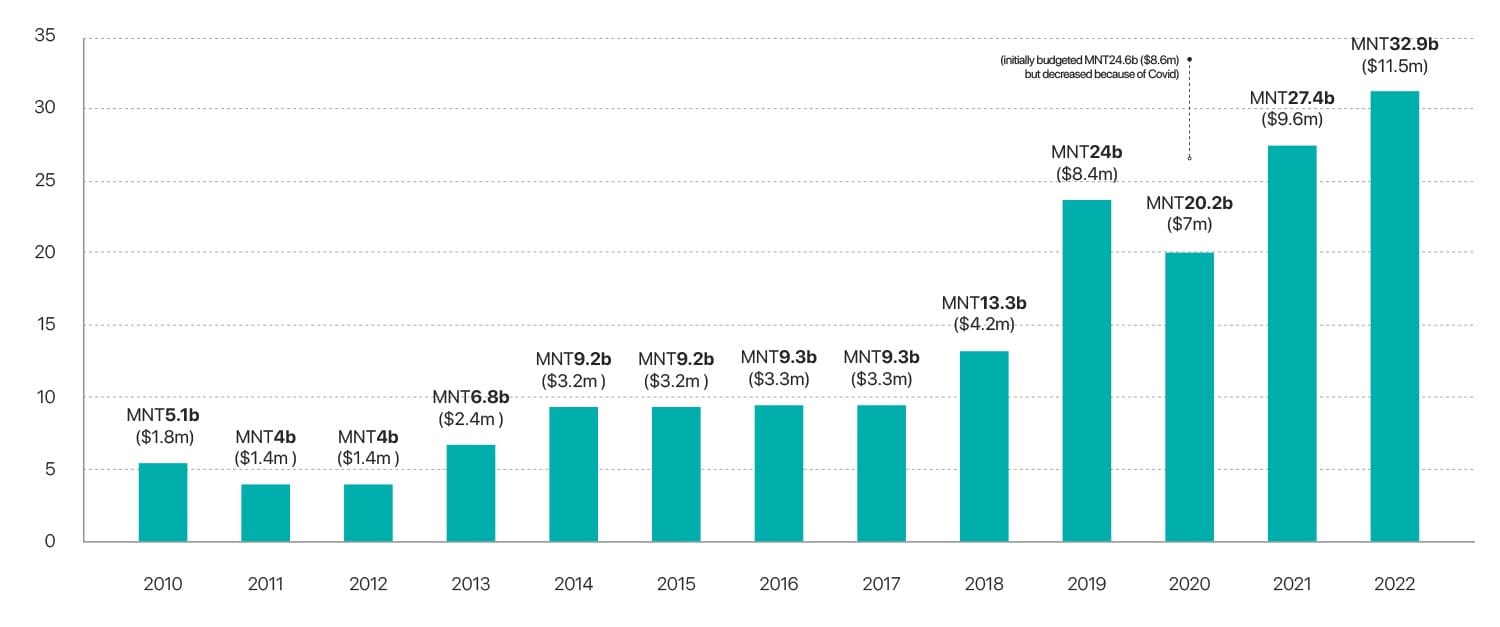

STATE-FUNDED GEOLOGICAL SURVEY (IN MILLION $)

Source: Ministry of Finance, Ministry of Industry and Mineral Resources

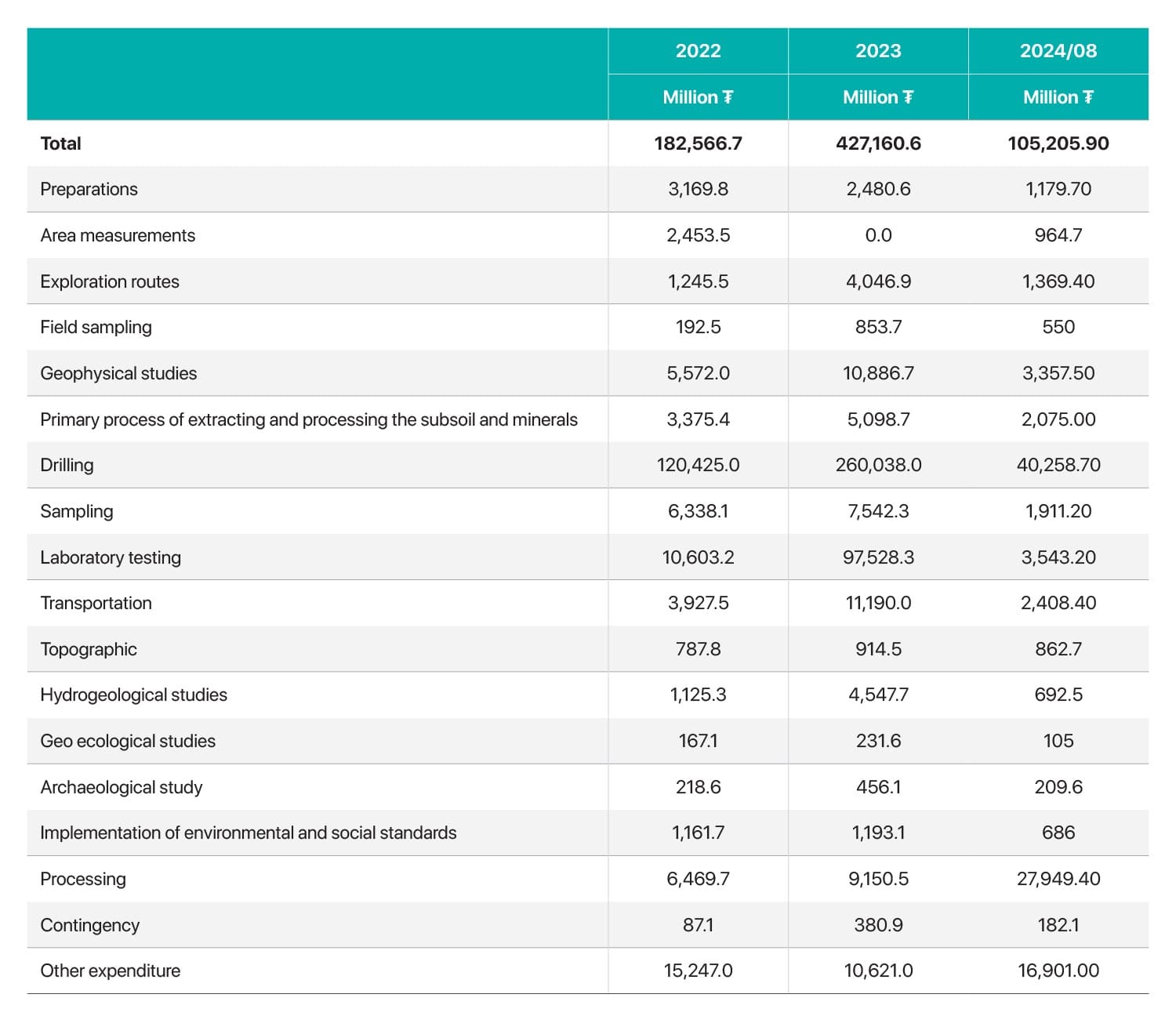

PRIVATE EXPENDITURES FOR EXPLORATION WORKS, BY TYPE OF WORKS

Source: The MRPAM