Mongolia continuously enhances its tax environment, driven by the government’s commitment to reducing excessive tax burdens. Mongolia’s modern tax system was established in 1990, and in 1992, the Law on Taxes and a package of five tax laws were adopted.

In 2019, the Parliament of Mongolia approved revised versions of the General Tax Law, the Corporate Income Tax Law, and the Personal Income Tax Law, marking the beginning of tax reforms. These key tax laws introduced various new rules and international tax concepts such as GAAR, controlled foreign company (CFC) rules, transferee tax liabilities, and a legally binding tax ruling by way of example.

Mongolia also joined the Inclusive Framework of the Base Erosion and Profit Shifting Project (BEPS Project) implemented by the OECD on 25 December 2017. Therefore, many BEPS Project recommendations, including the minimum standard requirements, are included in the newly revised tax laws.

The tax law reform was built on the following principles:

- Promoting investment and business facilitation.

- Eliminating complicated legal provisions.

- Introducing modern and innovative global tax principles.

- Ensuring transparency.

- Building capacity across the tax authority.

In Mongolia, 60.2% to 74.6% of the total consolidated budget revenue comes from tax income. According to the National Audit Office of Mongolia, the share of tax revenue in the state budget decreased from 2013 to 2016 but increased from 2017 to 2022. Over 65.0% of tax revenue is collected by the Tax Authority, while approximately 35.0% is collected by the Customs Authority.

The main tools for paying taxes in Mongolia are:

- Online payments using approved tax forms. Please refer to the website: etax.mta.mn

- Submitting a tax form using the E-Mongolia application

- Tax reports are compiled by the taxpayer, tax agent, or representative. They must be prepared in Mongolian and submitted electronically, along with supporting documentation in Mongolian.

Main Taxation Laws

There are several principal tax laws affecting companies.

The General Law of Taxation contains general provisions relating to tax but does not impose taxation. It also includes provisions regarding the administration of taxation, including the rights and duties of both taxpayers and administrators, as well as tax audit protocols. The main laws are laid out as follows:

- The Corporate Income Tax Law: The provisions within this law apply to all companies. No separate corporation tax law exists for mining companies.

- The VAT Law of Mongolia: This is an indirect tax regime relevant to all companies, with no separate application for mining companies.

- The Personal Income Tax Law of Mongolia.

- The Mineral Law of Mongolia: This contains provisions specific to the prospecting, exploration, and mining of minerals and also imposes royalties on mining license holders.

1. Corporate tax system:

Mongolia operates a system of worldwide taxation on both corporations and individuals. The Law on General Taxation contains general provisions relating to tax (including tax administration and the rights of taxpayers and the tax authorities). However, it is the CIT Law that legislates which income and expenses are taxable or deductible.

Taxpayers:

Permanent residents of Mongolia are taxed on their worldwide income. A company is regarded as a permanent resident of Mongolia if it is incorporated in Mongolia or if a foreign entity has its head office in Mongolia.

Non-residents of Mongolia are taxed on Mongolia sourced income only. Non-residents are defined as foreign corporate entities that conduct business in Mongolia via a representative office and foreign entities operating there that do not qualify as permanent residents.

Taxable income:

- Income from activities (i.e., income from business activities, sale of rights, shares and securities).

- Income from property (rent, royalties, dividends, and interest).

- Income from the sale of property (both immovable and movable).

- Other income.

Corporate income tax rate:

- 10% for annual taxable income up to MNT 6 billion ($1.75m).

- 25% plus MNT 600 million ($175,000) for the annual taxable income exceeding MNT 6 billion ($1.75m).

Discounts and Waivers:

For companies with an annual sales income of MNT 0-300 million ($0 – $87,700):

- Submission of semi-annual reports.

- 1% tax on all taxable income.

For companies with an annual sales income of MNT 0.3-1.5 billion ($87,700 – $438,540):

- Submission of semi-annual reports.

- 10% tax on all taxable income.

- Receipt of a 90% tax rebate.

Mineral exploration, exploitation, utilization, transport, and sales, production of petroleum products, imports of all types of gasoline and their wholesale and retail thereof, exploration and exploitation of oil and its sales, production of alcoholic beverages, production and import of tobacco shall not be subject to tax discounts and waivers.

Taxpaying period: Advance payment shall be paid by the 25th of each month. A quarterly report shall be submitted by the 20th of the first month of the following quarter, and the annual report by the 10th of February of the following year to the tax office who shall conduct the final calculation of annual tax payments.

Concept of Ultimate Beneficial Owner and

License-Transfer Tax

One of the most interesting changes made since 2018 is the tax imposition on the trade of shares of Mongolian legal entities owning mining licenses, or those with licenses to own or use land. This provision also gives some clarity to the concept of “ultimate beneficial owner.” and provides that companies owning land and mining licenses report on their own “ultimate beneficial owner” and the changes of such owners.

In case there is a UBO change as a result of a sale of shares, the transaction is deemed a ‘sale of rights’ and subject to 10% CIT on a net basis.

The tax base for the transaction can be determined either of the share purchase agreement or the value of the associated mining license or land use/possess right.

Methods for defining the tax base for the sale of rights transactions are regulated by secondary legislations approved by the Ministry of Finance.

The Ministry of Finance manages the formulation of tax imposition rules, and methods of calculation of assessment and evaluation of special permit for land use and ownership, licenses for exploration for minerals, radioactive minerals, petroleum, and their production, and calculation of imposed taxes.

The imposed taxes shall be paid by the 10th of February of the following year.

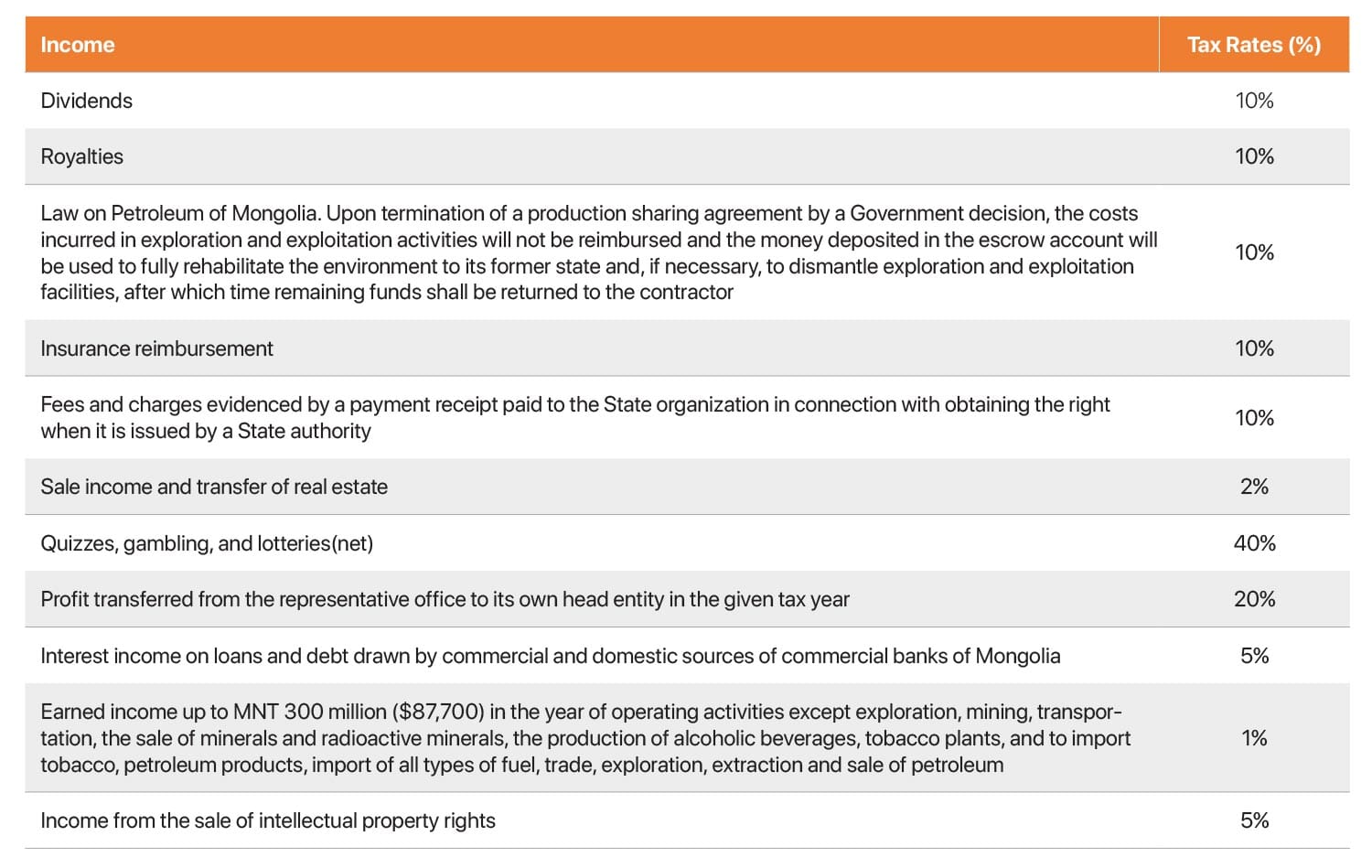

OTHER TAX RATES

Deductible expenses and tax losses

Deductible expenses in taxable income are reflected in the corporate income tax law. Deductible expenses include costs of interest revenue transfer and credit interest payments of shareholders.

Expenses incurred from obtaining mining license and license-transfer and contractors’ rehabilitation and mine closure costs are to be deducted as parts of operational costs each year during the effectiveness of respective special licenses.

The law also provides that, if the entity has made investments of $500,000 or more to free zone infrastructure development, taxes shall be waived for 50% of taxable income.

Tax losses can be carried forward for four years and the use of such losses is limited to 50% of taxable income in any year. However, losses incurred by the overseas representative office of the Mongolian legal entity shall not be deductible from corporate income tax imposed in Mongolia.

Other key provisions:

- Companies located in remote areas (500 km from Ulaanbaatar) will receive a 50% tax refund. Those located 1,000 km from Ulaanbaatar will receive a 90% tax rebate.

- Companies producing seeds, potatoes, vegetables, fruit, animal fodder, and forestry goods will receive a 50% tax break.

- The depreciation timeline for buildings and construction of the companies (excluding mineral, oil, and exploration license holders) has been lowered from 40 to 25 years.

- Interest income of loans and debt instruments of Mongolian commercial banks from local and foreign sources will be taxed at a rate of 5%.

- Tax Administration will exchange information with 190 countries for tax purposes.

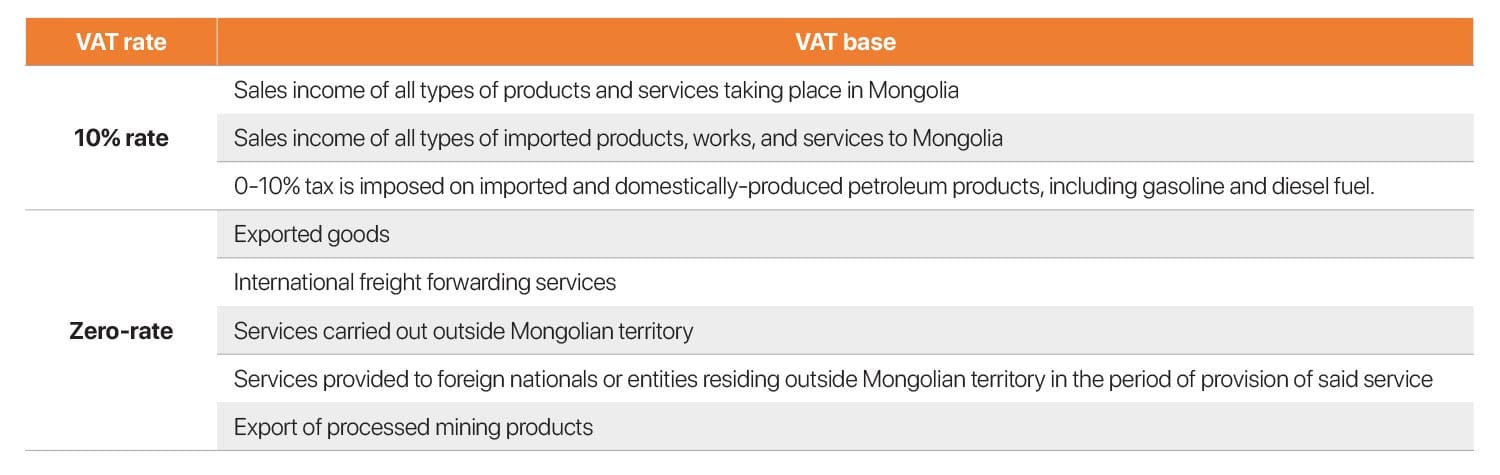

2. Value-added tax

Registration requirements:

Taxpayers must register for VAT when taxable turnover exceeds MNT 50 million ($14,620)

- VAT payers shall submit a request to be registered as a taxpayer within ten working days to the affiliate tax office.

- The affiliate tax office shall register within three working days and issue a certificate.

- Taxpayers can voluntarily register for VAT when taxable turnover reaches MNT 10 ($2,925)

Payment period:

VAT is accounted for monthly and VAT payments must be made by the 10th day of the following month.

Where total tax paid exceeds the tax liability, the excess can be credited against other taxes due, credited against future tax payments, or refunded. Since refunds take six months to one year, credits are usually preferred.

Returns must be submitted by the 10th of the month.

Refunds:

In line with the Law on Value-Added Tax, VAT refunds of up to 20% of the total taxes paid can be allocated after each quarter. An amendment to the law provides that refunds shall be allocated quarterly.

To allocate the VAT refund, the corporate taxpayer must meet the following requirements:

- Purchases must be made by VAT payer.

- The made purchases must be registered to the tax office.

- The purchased goods and services must be taxable.

- The history of purchases must be recorded in registration machines.

A corporate taxpayer must register the receipts of said purchases made before midnight of the last day of each quarter through the online tax system (www.ebarimt.mn) within the 8th day of the following month. In case of failure to register the receipts within the provided deadline, a discount of up to 20% shall not be exercised.

Pro-Innovation Policy

Exports of equipment and instruments required for innovative products and services are exempt from customs tax and VAT, whereas the sales income obtained from innovative products and services are VAT exempt. The defined list of innovative products and services is formulated and approved by the Cabinet

3. Personal Income Tax

Types of taxable income include the following:

- Salaries, wages, benefits, and other labor-related income.

- Operational income.

- Capital income.

- Asset sales and transfer income.

- Indirect income.

- Other income.

Taxpayers are classified into the following categories:

- Permanent residents of Mongolia.

- Individuals residing in Mongolia for a total of 183 or more days within the last 12 consecutive months.

- Individuals earning 50% or more of their total taxable income within or sourced from Mongolia.

- Non-permanent residents of Mongolia, including individuals who do not meet the above criteria.

Rate: Personal income tax is rated at between 1% and 40%, with a 10% rate imposed in general practice. A personal income tax of 40% is imposed on incomes obtained from paid quizzes, betting games, and lottery winnings.

Under the package of tax laws:

- Resident tax is 20%

- Overpaid taxes will be refunded to taxpayers

Payment period: VAT payer shall receive deductibles at the end of each month and pay personal income tax, whereas a business shall pay the income tax within the 15th day of the following month of each quarter.

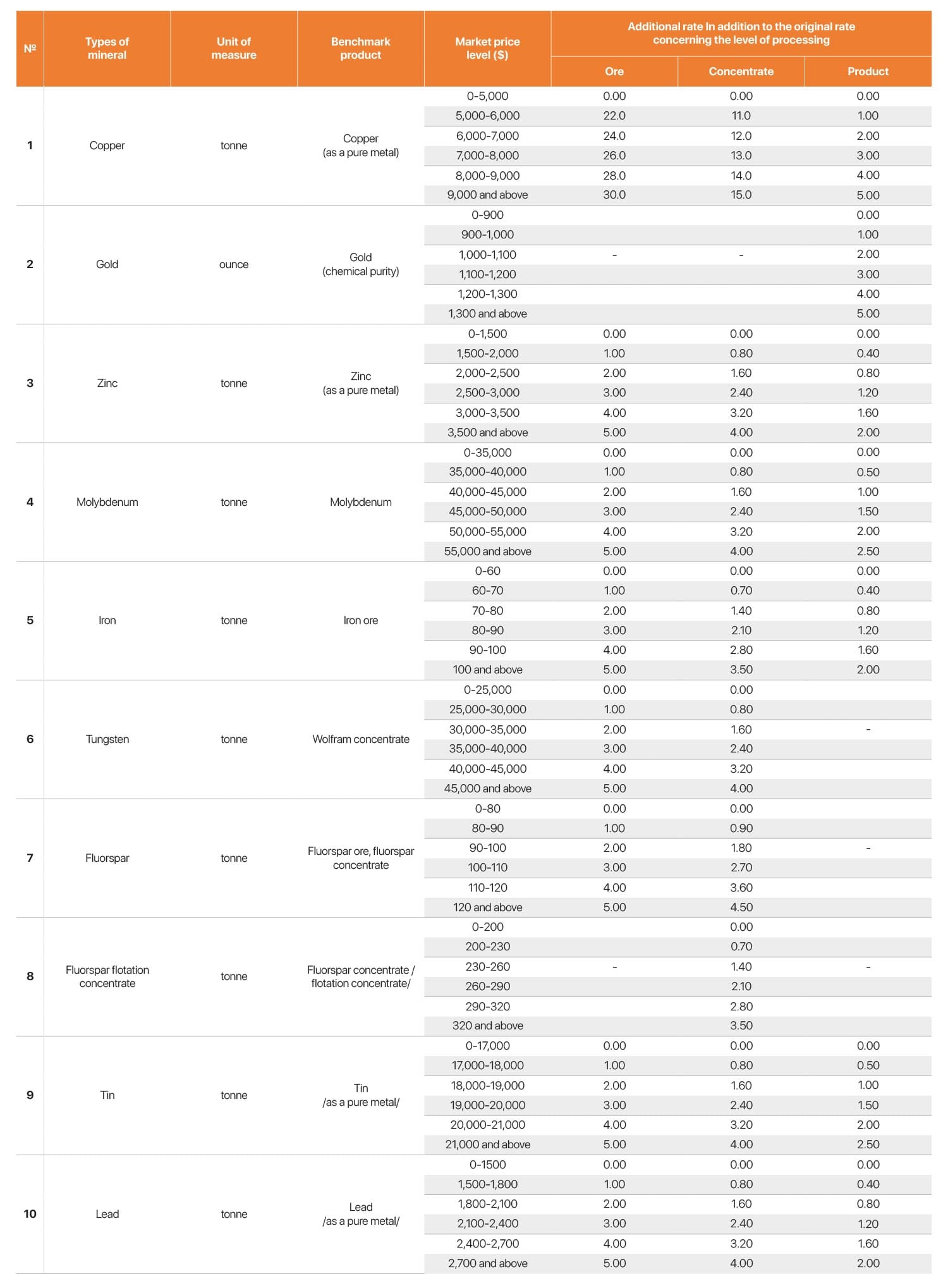

4. Royalty payments

The primary tax that applies to mining companies is the royalty imposed on offtake under the Mineral Law of Mongolia. A mining license holder must pay a royalty that is calculated on the basis of the total sales value of the minerals extracted. The sales value is determined differently depending on the product, as mentioned below.

Mineral license holders. Royalties for domestically sold coal for energy and common mineral resources shall be (2.5% of the sales value of all products extracted from the mining claim that are sold, shipped for sale, or used. Other royalties for extracted products shall be five 5% of the sales value of all products.

Mineral exporting entities: For exported products, the sales value shall be based on regularly published international market prices or determined through recognized principles of international trade,

Any person who delivers gold to the Bank of Mongolia and its authorized commercial bank: Royalties on gold sold to the Bank of Mongolia and its authorized commercial bank shall be five 5% of sales value.

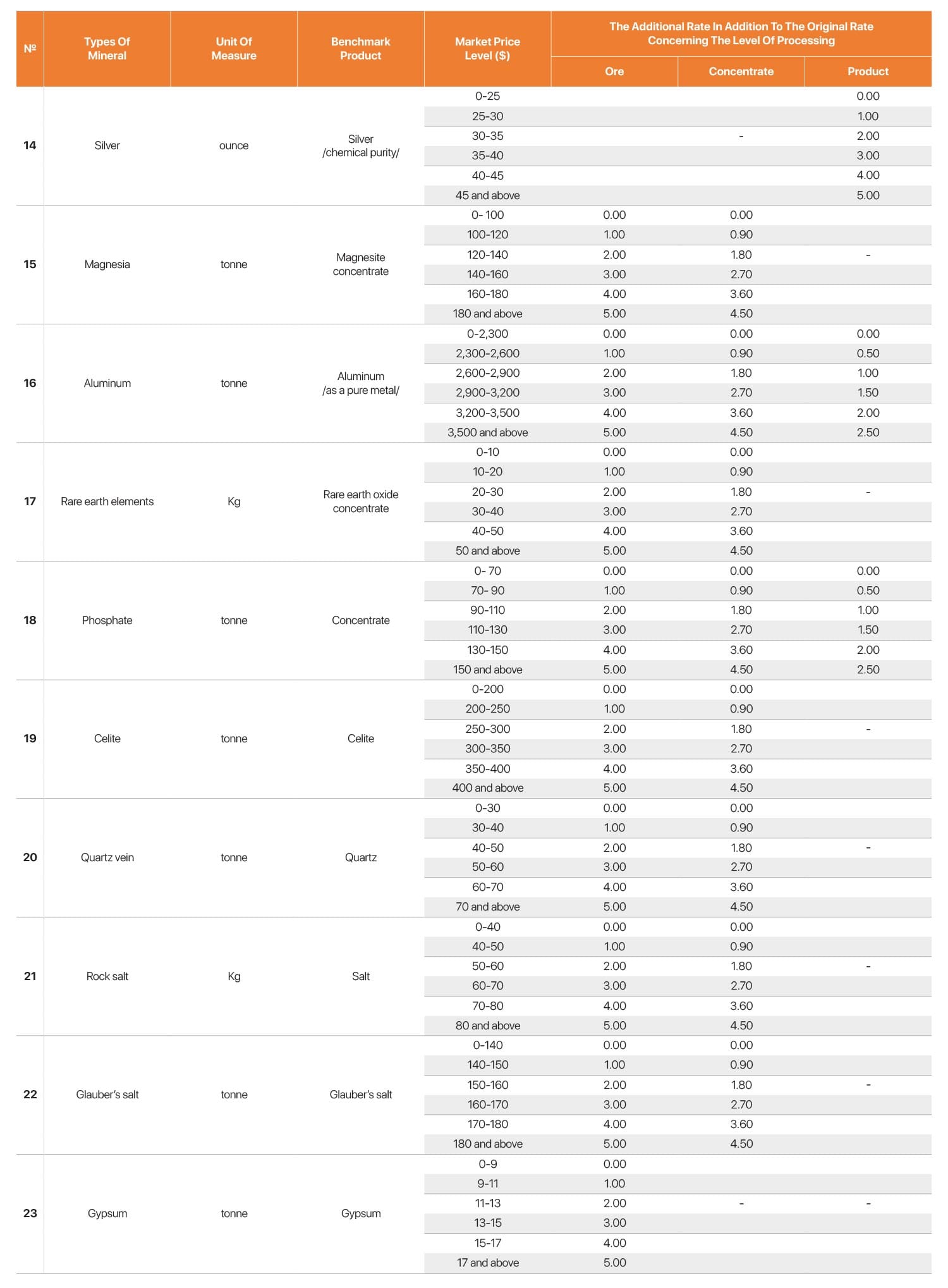

The surtax royalty rates are designated by types of minerals as follows:

Royalty rates by types of minerals

The following rates for coals and coal products can be subject to increase in consideration of their types and price increase on the market.

Royalty rates of coal and coal products

Payment period: Monthly royalty payments incurred from all minerals sold, shipped for sale, exported, and used for production shall be collected and contributed to the state budget within the 20th day of the following month, with the exclusion of those with remittances of gold to the Bank of Mongolia or other accredited banks by the Central Bank.

Tax Disputes

In case a taxation act or other documents issued by a tax office is deemed invalid or illegal, the taxpayer is entitled to administer a claim to the administrative court or higher level of justice within 30 days after receipt of said document or act.

The taxpayer, its accredited representative, or a specialized adviser is entitled to issue a complaint to the affiliate tax dispute committee after receipt of such act or document.

Before submitting a petition to the tax dispute resolution committee, the taxpayer must pay 10% of the disputed amount, which should not exceed MNT 100 million ($29,235), as a cash deposit to the state budget.

The deposit shall be refunded in case the tax dispute is resolved in favor of the taxpayer. Both parties of the tax dispute, the taxpayer and the tax office, are entitled to appeal the court decision to the administrative court.

Mongolian Tax Treaties

Mongolia has double tax treaties with the following countries:

- Austria

- Belarus

- Belgium

- Bulgaria

- Canada

- China

- Czech Republic

- France

- Germany

- Hungary

- India

- Indonesia

- Italy

- Kazakhstan

- Korea

- Kyrgyzstan

- Malaysia

- North Korea

- Poland

- Russia

- Singapore

- Switzerland

- Turkey

- Ukraine

- United Kingdom

- Vietnam

Trade Agreements and Customs Tariff Relief

Mongolia signed a free trade agreement with Japan in 2017 and exempted customs tariffs for more than 15,000 goods. In addition, by joining the Asia Pacific Trade Agreement (APTA), Mongolia is now able to enjoy commercial relief with six countries.

1. The Mongolia-Japan Economic Partnership Agreement (EPA), formulated in 2015, is Mongolia’s first free trade agreement. in the framework of the agreement, about 5,700 types of products falling under 97 categories from Mongolia, and 9,300 types of products falling under 97 categories from Japan were allowed for customs tariff relief. The negotiations enabled exemptions from the original 10-14% customs duty on more than 1,200 types of textiles and knitted goods from Mongolia to be imported to Japan.

2. Mongolia has joined the Asia-Pacific Trade Agreement (APTA) as its 7th member. Under APTA, Mongolia’s 10,677 types of products qualify for customs tariff relief of between 5% and100% to other member countries of APTA. The trade agreement includes provisions such as:

- China: Mongolian manufacturers shall enjoy 10% to 100% tax exemption for imports of 2,323 types of products, including coal, cashmere, and leather goods. Within the scope of the agreement, China exempts 50% import tax on Mongolian coking coal. As a result, Mongolia’s export revenue is projected to increase. Tax exemptions range from 100% for rapeseed, and 11-50% for leather products, to 35% for goat cashmere.

- South Korea: Mongolian companies will enjoy 10-50% tax exemptions on 2,900 types of goods, including pharmaceuticals, coal, and cashmere.

- India: 5% to 100% tax relief on 3,253 types of goods,

- Laos: 10% to 35% tax relief on 1,081 types of goods,

- Sri Lanka: 5% to 50% tax relief on 568 types of goods,

- Bangladesh: 10% to 70% tax relief on 608 types of goods imported from Mongolia, respectively.

3. European Union’s General System of Preferences (GSP+) offers customs tariff relief for 7,200 types of goods of Mongolian origin.