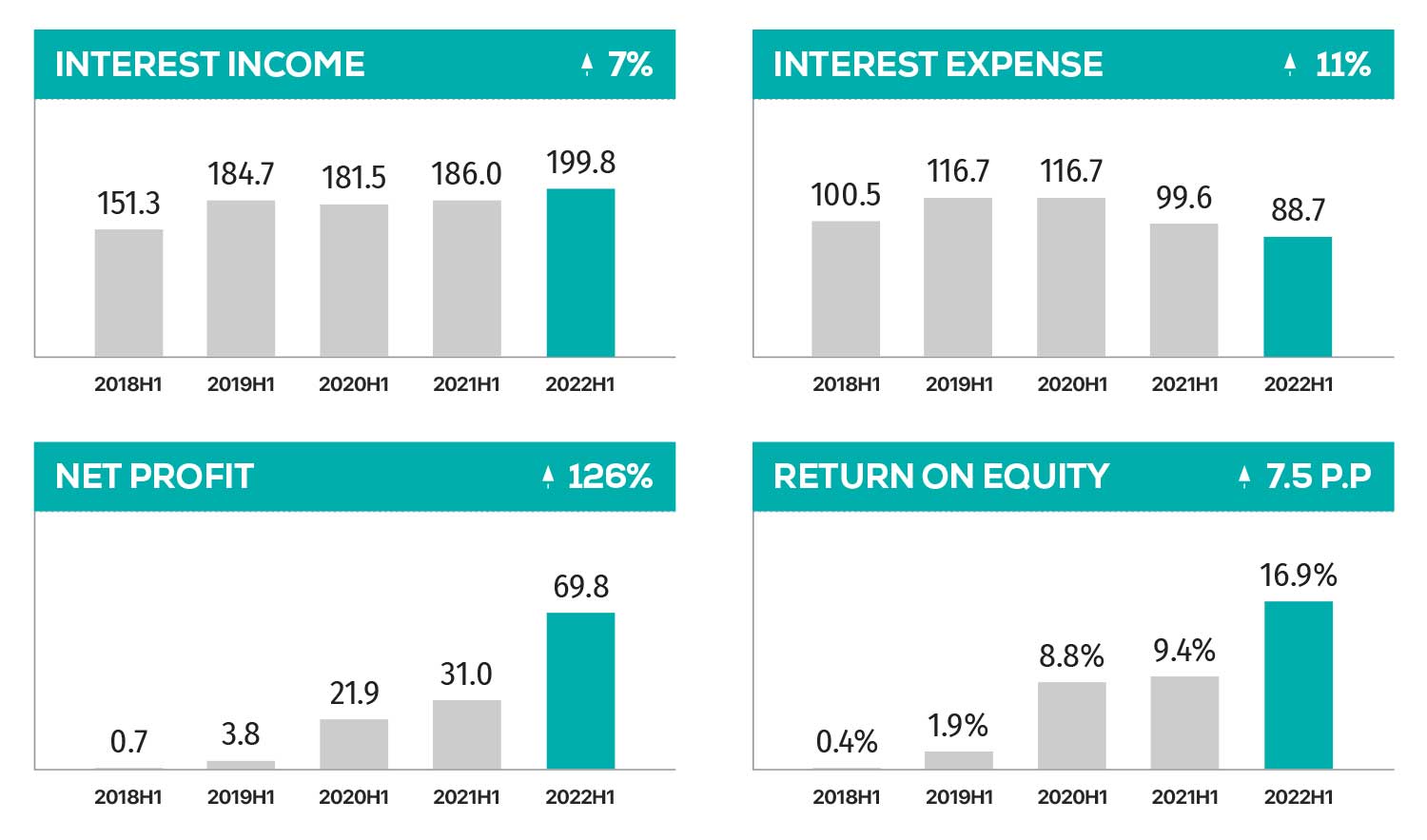

Over the first half of 2022, the net profit of the State Bank jumped 126 percent to MNT 69.8 billion. This increase in profitability was mainly driven by a 7% increase in interest income and an 11% decrease in interest expense.

State Bank

Along with this growth, the bank’s assets grew by 19%. Going forward, the State Bank plans to focus on supporting the middle to lower-middle-income classes by strategy. The bank currently has 494 branches and 1.9 million customers. More than 80% of all pension and social welfare payments are managed by the State Bank. Moody’s rated the credit rating of State Bank at “B3” with a ‘stable’ outlook.

During the reporting period, the Trade and Development Bank (TDB), one of the five systematically influential banks in the Mongolian banking system, earned a net profit of MNT 149 billion. The key driver was the increase in non-interest income which surged by MNT 136 billion. In addition, the total loan portfolio of TDB was up by MNT 155 billion from the previous quarter. The bank financed its loan portfolio by releasing the capital invested. In other words, the bank expanded its loan portfolio through effective asset management.

TDB

TDB, which focuses on the corporate banking segment, currently cooperates with over 36,000 entities. In addition, the bank has announced to provide USD 2 billion in sustainable financing by 2030 and become carbon neutral by 2050.