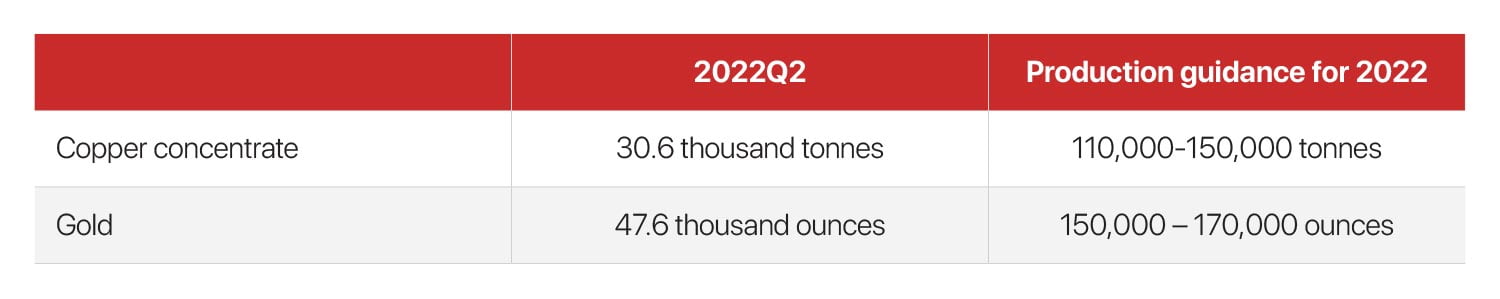

Oyu tolgoi (OT)’s copper production fell 17 percent from the same period last year to 30,600 tonnes, and its gold output shrank 58 percent to 47,600 ounces in the second quarter of 2022.

Copper production guidance for 2022 remains within the range of 110,000 to 150,000 tonnes while 2022 gold production guidance has been revised from a range of 135,000–165,000 ounces to 150,000–170,000 ounces. The force majeure declared on shipments from March 30, 2021 has been lifted. Due to the pandemic, the transportation of copper concentrate was stopped and a “force majeure” was declared.

OT consists of a series of deposits containing copper, gold, and silver. With considerably higher mineral grades than the open pit, underground deposits have always been the key to OT’s overall profitability. Over 80 percent of the mine’s total value lies deep underground. It is one of the biggest copper-gold ore bodies in the world. Once the underground mine is fully operational, Mongolia is expected to have a high-tech underground mine that is ranked fifth in the world, becoming one of the major copper players in the international market.

For the underground development update, the first drawbell of the Hugo North underground mine was fired in June. The undercut progression remains on track to achieve first sustainable production from Panel 0 in the first half of 2023.

A cost and schedule reforecast was completed in June 2022. According to the reforecast, the total project cost is estimated at USD 7.06 billion, which remains under review by the OT Board. This is USD 0.3 billion higher against the 2020 Definitive Estimate, which is largely related to COVID-19 disruptions.

OT is the largest copper and gold mining company in Mongolia. 34 percent of the company is owned by the Government of Mongolia or “Erdenes Oyu Tolgoi” and 66 percent by Canada’s “Turquoise Hill Resources”.