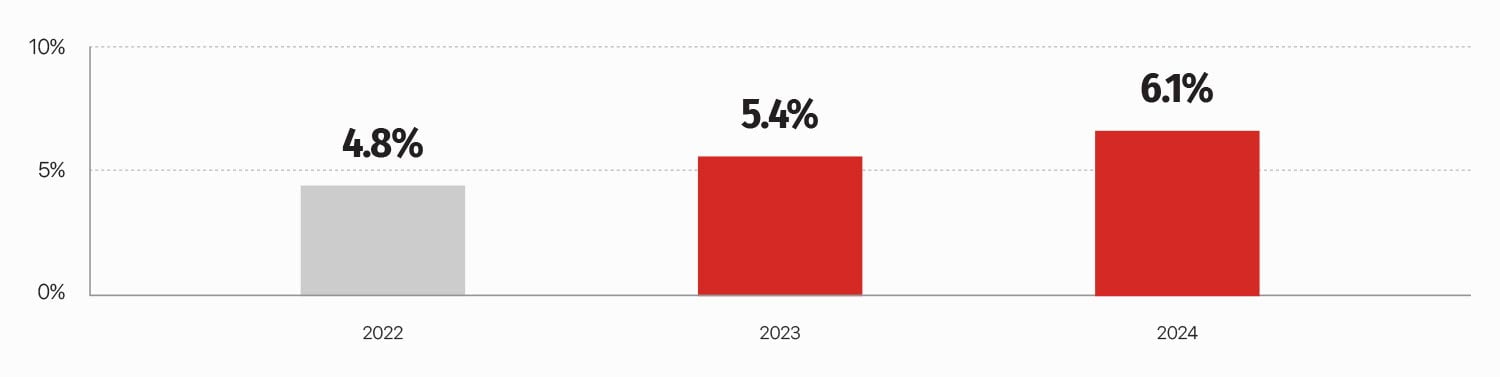

GDP Growth Forecast

Source: Asian Development Bank

The economy of Mongolia is transitioning to post-pandemic expansion, driven by the economic reopening of the People’s Republic of China (PRC), robust demand for mineral commodities, and a revival of domestic demand. This contrasts previous gloomy growth expectations, despite tightened financing conditions globally and domestically, says a new report by the Asian Development Bank (ADB) released today.

In its latest flagship economic report, Asian Development Outlook (ADO) April 2023, ADB projects Mongolia’s economic growth to expand to 5.4% in 2023 compared to 4.8% growth in 2022, before climbing to 6.1% in 2024, supported by exports, recovery in mining, and its positive spillover to transport and other pursuits.

“After 3 years of economic difficulties induced by exogenous shocks, including COVID-19, border restrictions with the PRC, and the Russian invasion of Ukraine, the economy of Mongolia is now on a recovery path, supported by both external demand and domestic policy responses,” said ADB’s Country Director for Mongolia Pavit Ramachandran. “Maintaining growth momentum while reducing the persistently high inflation is critical to ensure that this economic growth is more inclusive.”

“Mongolia’s near-term priority is to boost exports, reduce inflation, and support macroeconomic stability, through fiscal, monetary, and macroprudential policies, additionally focusing on structural reforms in public sector management and in the financial sector to increase savings and strengthen economic resilience. Moreover, Mongolia can design and implement comprehensive investment climate reform to sustain growth over the medium term and create an enabling environment for private sector-led growth,” added Mr. Ramachandran.

Average inflation will moderate to 10.9% in 2023 and 8.7% in 2024 as supply shocks and trade disruption risks wane. However, it will still exceed the central bank target of 6%, mainly on pass-through of local currency depreciation and revived domestic demand. More aggressive fiscal consolidation will support macroeconomic external balance and reduce crowding out impacts on the private sector. The current account deficit is projected to diminish, mainly as merchandise exports increase and the service deficit narrows with lessened trade disruption, lower risk premiums for shippers, and lower transportation service charges.

Downside risks to the outlook stem from a worsening situation regarding the Russian invasion of Ukraine, new COVID-19 variants or waves, a significant commodity price correction, domestic political risks, and the adverse implications of offtake barter agreements.