Highlights

Mongolia is ranked 7th in the world in terms of its total copper resources and is the 6th largest exporter of copper ores. Two key copper deposits, namely Oyu Tolgoi and Erdenet, are the largest in Central Asia.

Copper plays a significant role in Mongolia’s economy and its contribution to the mining industry in the overall economy is considered the third highest in the world, ranking the country above other mining-driven economies like Uzbekistan and Kazakhstan (joint 16th), Georgia (22nd), and Russia (23rd). The Rio Tinto-backed Oyu Tolgoi project is forecasted to become the world’s 4th biggest copper producer by 2030.

Reserves & Exploration

Mongolia has the 7th biggest resource of copper in the world with 56.5 million metric tonnes. The country is also 13th in terms of copper production and 6th worldwide in terms of copper ore exports. As of 2024, there are 19 copper deposits across Mongolia with valid mining licenses. Of these, the biggest deposits are the Erdenet, Oyu Tolgoi, and Tsagaan Suvarga deposits.

In 2018, the National Development Agency estimated the value of Mongolia’s copper reserves at about USD 529 billion based on the copper reserves and market prices at the time.

Exploration projects are progressing at a rapid phase, especially in the gold and copper porphyry belt of Southern Mongolia, where the Oyu Tolgoi and Tsagaan Suvarga projects are in operation. By way of example, the ASX-listed Xanadu Mines and TSX-listed Kincora Copper have been exploring the region for years.

VALID COPPER MINING LICENSES (AS OF 2024)

Source: MRPAM

Production & Export

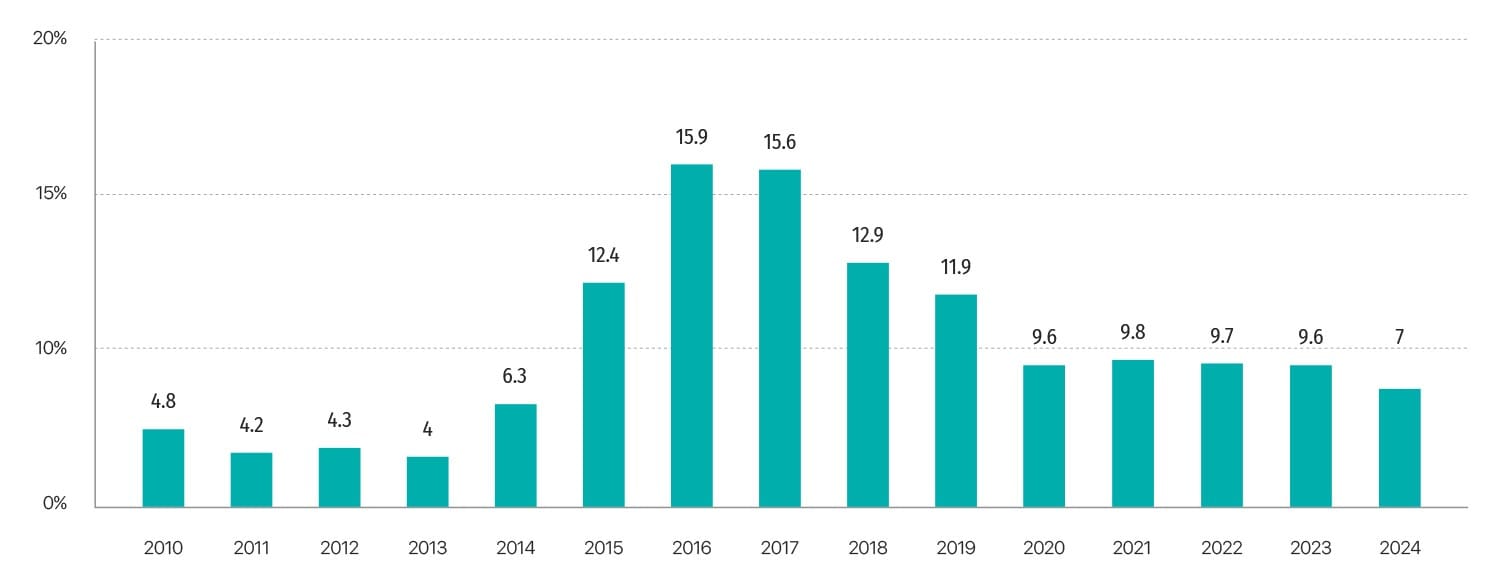

In Mongolia, two main concentrators produce export copper concentrate – the Erdenet and Oyu Tolgoi projects. The country began exporting copper concentrates in 1970 with the establishment of the Erdenet mine which is the key deposit for copper concentrates. Copper exports accounted for 22.2% of total exports in 2013 when the Erdenet Plant was the only copper exporter. After Oyu Tolgoi became operational in the following year, 44.5% of total exports were copper, which increased to 49% in 2015.

As the Mongolian mining industry grows, the market for copper concentrate has also expanded. Notably in 2024, the production and export volume of copper concentrate peaked, accounting for 22.1% of the total export value.

Mongolian refined copper is supplied by both Erdmin LLC and Achit Ikht LLC.

Achit Ikht LLC exports processed copper cathode to China. Erdmin LLC produces copper cathode and copper products, such as copper wires, for domestic consumption.

Looking forward, Mongolia is interested in processing copper concentrates and producing copper cathode. Therefore, the following two projects are included in the long-term development program “Vision-2050”:

- Inaugurating a copper refinery with an annual capacity of 124,100 tonnes near “Erdenet Mining Corporation” SOE.

- A copper refinery project that will use copper concentrates of Oyu Tolgoi to produce copper cathode.

With new projects such as the Tsagaan Suvarga and Kharmagtai projects, Mongolia is expected to become one of the world’s largest copper suppliers in the decades to come.

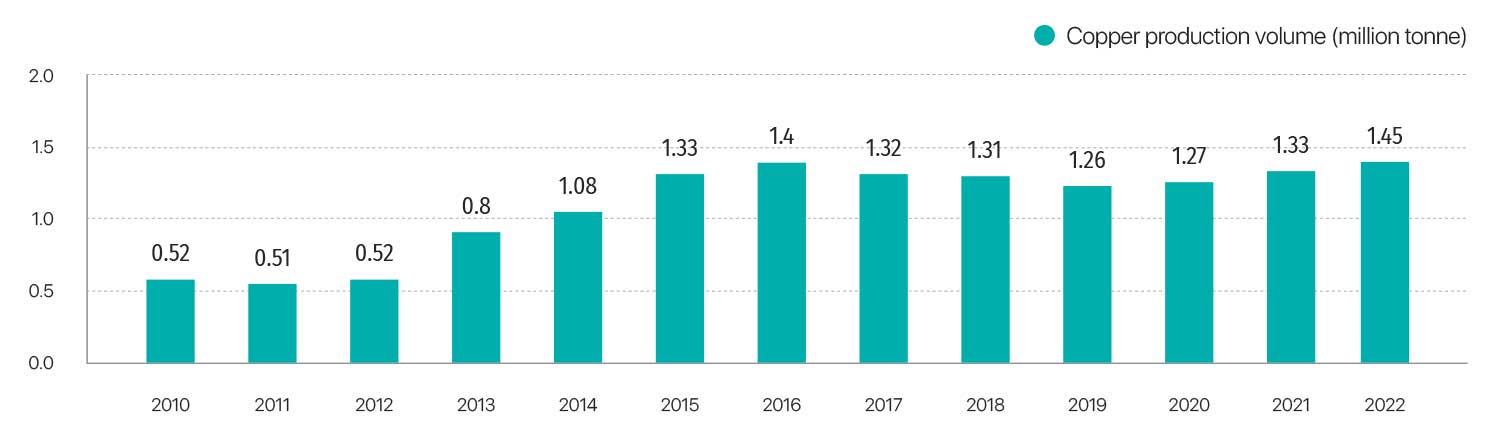

MONGOLIA’S COPPER CONCENTRATE PRODUCTION VOLUME (IN MILLION TONNES)

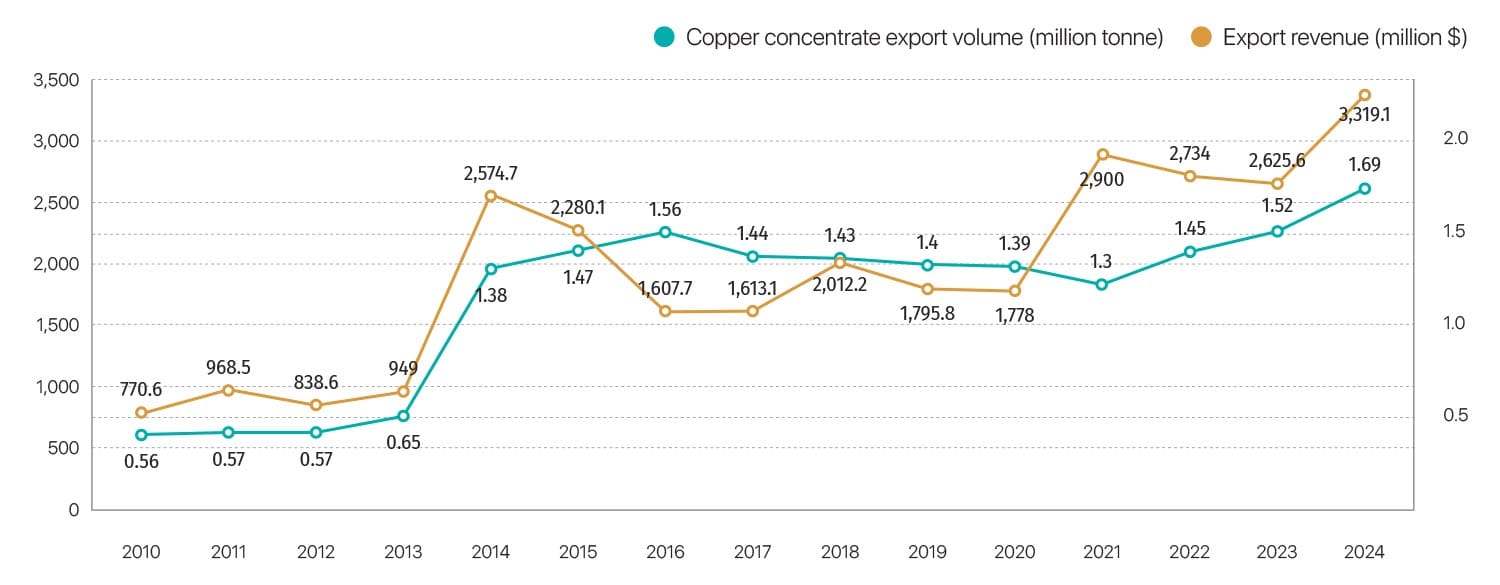

COPPER CONCENTRATE EXPORTS VOLUME (IN MILLION TONNES) AND REVENUE (IN MILLION $)

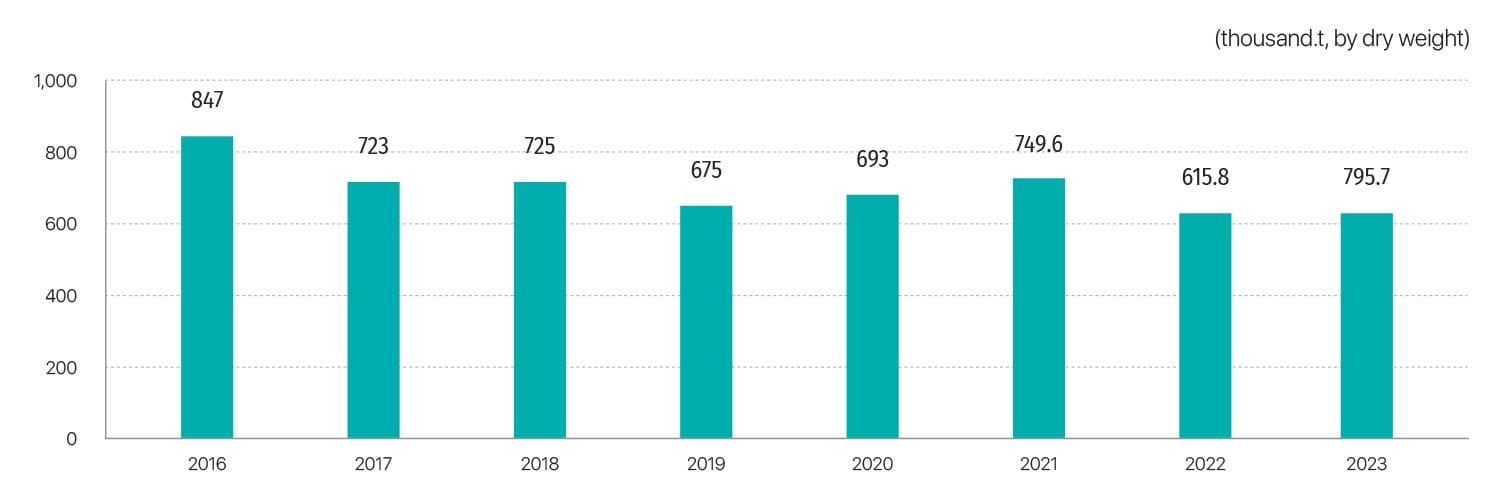

COPPER CATHODES, 99% (IN THOUSAND TONNES)

Mongolia exports 100% of its copper concentrates to the Chinese market via road and rail. The Erdenet plant uses the Erdenet-Zamyn-Uud route while the Oyu Tolgoi plant delivers via the Oyu Tolgoi- Gashuunsukhait road route for exports.

Chinese demand for Mongolian copper concentrate is expected to continue to be strong in the mid and long term.

COPPER EXPORTS ROUTE

| Location | Khan-Bogd, Umnugobi Province, Mongolia |

|---|---|

| Ownership: | Erdenes Oyu Tolgoi LLC - 34% (Government of Mongolia) Rio Tinto - 66% |

| Operations | Active |

| Commencement | Open-pit mine - 2013 Underground mine - 2023 |

| Mineral reserves: | Copper and gold |

| Production Capacity: | 100 kt p/a |

| Total number of employees: | 20,000 (as of 2024) |

| Infrastructure: | Concentrator, open-pit mine, underground mine |

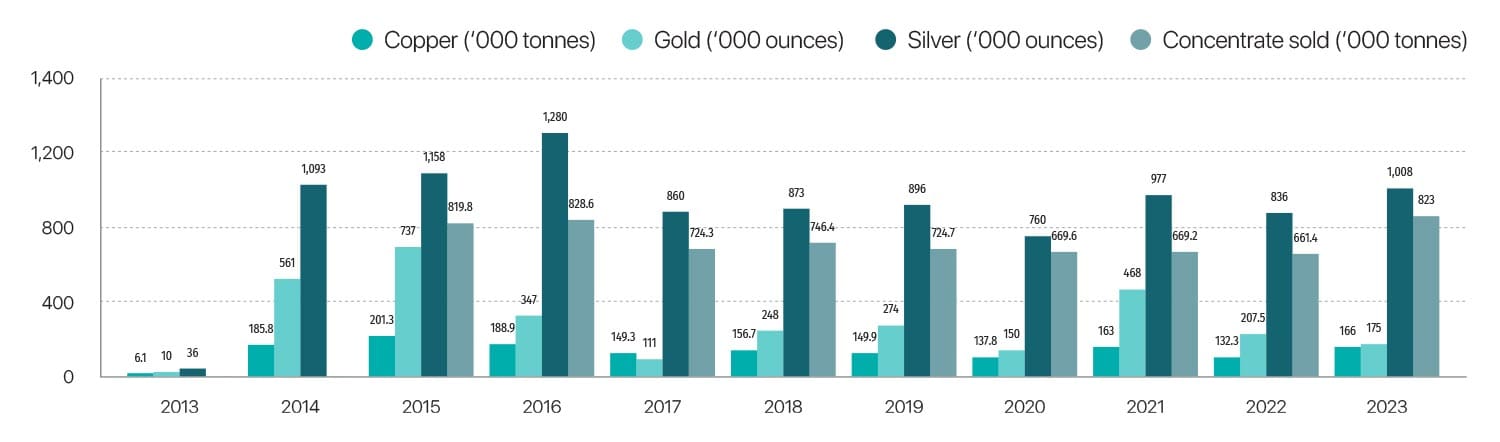

Copper Concentrate production

Copper Concentrate sales

Highlights:

Oyu Tolgoi is known to be one of the largest deposits of copper and gold in the world. The Mongolian government owns a 34% stake in Oyu Tolgoi (OT), while the rest is controlled by Rio Tinto, the second-largest mining company in the world, which operates the mine. In 2022, Rio Tinto invested $3.1 billion and completed the acquisition of 49% of Turquoise Hill Resources, which previously owned 66% of Oyu Tolgoi. Rio Tinto CEO Jakob Stausholm stated that “Oyu Tolgoi is a remarkable asset with talented people that will bring significant long-term value for both Rio Tinto and Mongolia.”

The Oyu Tolgoi project is located approximately 550 kilometres south of Ulaanbaatar, and 80 kilometres north of Mongolia-China border. The property is cut by the Oyu Tolgoi trend, a 12 kilometres north-south oriented corridor which is host to the known deposits, Hugo North, Hugo South, Oyut and Heruga. Open-pit mining operations commenced at Oyut in 2013. The Hugo North depost is currently being developed as an underground operation.

The copper concentrator plant, with related facilities and necessary infrastructure, was originally designed to process approximately 100,000 tonnes of ore per day from the Oyut open pit. However, since 2014, the concentrator has consistently achieved a throughout of over 105,000 tonnes per day due to improvements in operating practices.

“Rio Tinto strongly believes in the long-term success of Oyu Tolgoi and Mongolia”

Jakob Stausholm, CEO of Rio Tinto

With the start of underground mine production in the first quarter of 2023, Oyu Tolgoi has become a comprehensive copper mine.

From 2028 to 2036, the project is expected to have an average production of 500,000 tonnes of copper a year from both open pit and underground operations, compared with 163,000 tonnes in 2021 from open pit operations.

With the commencent of the OT project, large inflows of foreign investment has been come to Mongolia since 2011.

Between 2010 and 2020, the OT project invested $11.6 billion in Mongolia. Rio Tinto and the Government of Mongolia renegotiated the deal several times over the progress of the project due to implementation process and excess cost.

“Rio Tinto strongly believes in the long-term success of Oyu Tolgoi and Mongolia, and delivering for all stakeholders over the long-term. The transaction will simplify the ownership structure, and further strengthen Rio Tinto’s copper portfolio,” Rio Tinto’s Chief Executive Director Jakob Stausholm said in a statement.